Building a Digital- Only Bank

Finacle for digital-only banks is a comprehensive, front to back digital banking solution suite built on advanced architecture. The solution helps address all the business banking application requirements of digital-only propositions – across core banking, customer onboarding, product origination, payments, digital engagement, and omnichannel digital experiences. The solution enables banks onboard, sell, service and engage – retail, small business and corporate customers on a range of digital channels – mobile, online, or RESTful APIs.

Over a dozen digital-only banks globally rely on Finacle to drive their innovation and growth aspirations.

Leading Digital-Only Banks Rely on Finacle

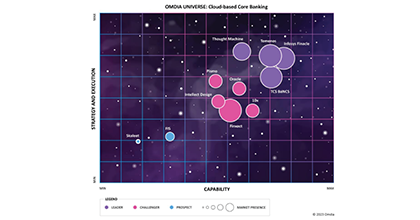

The Forrester Wave™: Digital Banking Processing Platforms, Q4 2024

Infosys Finacle Positioned as a Leader

Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support.

Infosys Finacle’s compelling vision and value proposition build on a strong track record in emerging technologies. Its comprehensive roadmap focuses on AI, blockchain, and green computing, and has achievable timelines.

The Finacle Promise

"Finacle Digital Engagement Suite provides a strong digital banking platform that caters to the needs banks in the digital economy and supports the delivery of next-generation services, while providing broad omnichannel capabilities..."

Daniel Mayo

Ex-Chief Analyst, Ovum and Matthew Heaslip, Associate Consultant, Ovum

Driving Engagement Across the Customer Relationship Lifecycle

- Digitize the customer onboarding process delivering a frictionless experience for your customers

- Enabling self-service with contextual and timely financial nudges for savings and investments

- Leverage Finacle’s comprehensive capabilities to serve retail, business and corporate customers

Digibank by DBS acquires 2 million customers within 18 months with frictionless customer on-boarding

Enhancing Customer Engagement With Ecosystem Propositions

- Participate in emerging digital ecosystem to drive granular and contextual engagements leveraging Finacle’s extensive Open and RESTful APIs

- Drive rapid and continuous innovation within the bank and with your partner ecosystem with Finacle App Center, a marketplace of partner solutions

- Enable touch, chat, voice-based interactions across devices and applications

“Ubankis one of the first digital neo banks by VP Bank, One of the largest Private sector bank and FECREDIT, a market leader in consumer lending in Vietnam. Übank aims to become the leading technological bank in providing basic banking & financial solutions solely through a digital platform. The innovation journey is achieved by the state-of-the-art Finacle platform from Infosys. The Finacle-as-a-Service (FaaS) has not only helped in launching the core banking platform in a short span of 6 months, but also played a critical role in interfacing with all the partners and payment platforms through the readily available APIs & Microservices. Definitely Übank is on top gear in achieving 5 million accounts by 2025.”

Manoranjan Sahu

Chief Technology Officer, Ubank

Deepening Customer Engagement Across Interactions

- Anticipate customers’ needs and offer actionable insights with the unique customer-led engagement engine

- Elevate customer experiences through personalized content and human- centric experiences

- Enhance cross-sell and up-sell success through contextual channel-specific propositions and content

"With the presence of Pinang, Bank BRI Group is able to reach more volumes of customers in Indonesia at high speed (from application to disbursement in less than 10 minutes without a face to face meeting). Pinang is BRI’s radical innovation catering to ultra-micro customers creating a seamless and economical on-boarding process.

The reimagined process provides a faster, cheaper and safer digital lending in Indonesia. With the persistent support of the Infosys management and the robust Infosys Finacle digital banking suite, BRI’s vision of accelerating Indonesia financial inclusion is one step closer."

Kaspar Situmorang

Executive Vice President, Digital Banking Development and Operation, Bank Rakyat Indonesia

Driving Operational Excellence Through Intelligent Automation

- Optimize cross channel interactions by simplifying, automating, and streamlining customer facing processes

- Offer a full suite of digital experiences, with lower cost of ownership and ongoing cost of maintenance due to technology harmonization

- Centralized capabilities to launch experiences and offerings anywhere with the Finacle Digital Engagement Hub

"Discover’s adoption of the Finacle solution is part of our continuous commitment to improve our customer experience. As our direct banking business grows, the Finacle platform will help us scale and optimize internal processes so that they keep pace with evolving consumer demands and market trends."

Carlos Minetti

Ex – President of Consumer Banking at Discover Financial Services

Leveraging Cloud to Accelerate Speed of Business Innovation

- Cloud native suite supports Kubernetes for deploying and operating cloud of your choice

- Run Finacle on a private or public cloud or subscribe to Software-as-a-service offering (SaaS)

- Subscribe to Finacle SaaS for complete solution suite or select components

- Manage cost and focus resources towards business growth leveraging the consumption based pricing model