-

![]() Quantum Computing: As the Future Awaits, The Strides Are DefinitiveQuantum computing is no longer confined to theory or the edges of experimental science - it is rapidly advancing toward practical impact.Read More

Quantum Computing: As the Future Awaits, The Strides Are DefinitiveQuantum computing is no longer confined to theory or the edges of experimental science - it is rapidly advancing toward practical impact.Read More -

![IDC IDC]() IDC MarketScape: Worldwide Integrated Bank PaymentFinacle Payments is an enterprise payments services system that manages end-to-end payments across instrument types, payment schemes, transaction types, customeRead More

IDC MarketScape: Worldwide Integrated Bank PaymentFinacle Payments is an enterprise payments services system that manages end-to-end payments across instrument types, payment schemes, transaction types, customeRead More -

![]() Supply Chain FinanceToday, as businesses seek to make their ecosystems more resilient, Supply Chain Finance (SCF) has emerged as a powerful lever for banks and financial institutions to support clients, while unlocking new revenue streams.Read More

Supply Chain FinanceToday, as businesses seek to make their ecosystems more resilient, Supply Chain Finance (SCF) has emerged as a powerful lever for banks and financial institutions to support clients, while unlocking new revenue streams.Read More

-

![]() The Future of Core Banking: Business and Technology EvolutionOur point of view paper, “The Future of Core Banking: Business and Technology Evolution”, serves as a candid and forward-looking benchmark of your institution’s readiness—and a strategic playbook for core modernization.Read More

The Future of Core Banking: Business and Technology EvolutionOur point of view paper, “The Future of Core Banking: Business and Technology Evolution”, serves as a candid and forward-looking benchmark of your institution’s readiness—and a strategic playbook for core modernization.Read More -

![The Forrester Wave The Forrester Wave]() Forrester Wave Digital Banking, Q4 2024Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support.Read More

Forrester Wave Digital Banking, Q4 2024Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support.Read More -

![]() Driving Comprehensive Revenue ManagementDiscover why revenue management must evolve into a comprehensive, strategic capability. Decode a blueprint to overcome challenges and unlock sustainable monetization.Read More

Driving Comprehensive Revenue ManagementDiscover why revenue management must evolve into a comprehensive, strategic capability. Decode a blueprint to overcome challenges and unlock sustainable monetization.Read More

-

![]() Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More

Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More -

![]() Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More

Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More -

![]() Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

-

![]() Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More

Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More -

![]() Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

-

![]() Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More

Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More -

![]() A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More

A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More -

![]() Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Overview

RSA Adaptive Authentication Solution is a leading consumer focused, comprehensive risk-based authentication and fraud detection platform. Powered by RSA’s Risk Based Authentication technology, it is designed to measure the risk associated with user’s login and post login activities by evaluating a variety of risk indicators. With RSA’s adaptive authentication, organizations can achieve a right balance of security, while maintaining a positive user experience for their customers across digital channel.

RSA Adaptive Authentication includes an advanced, omnichannel fraud detection hub that provides risk-based, multi-factor user authentication for organizations seeking to protect against fraud across multiple digital channels. Powerful machine learning and fine-grained policy controls work together to deliver a frictionless user experience with fraud detection rates as high as 95%.

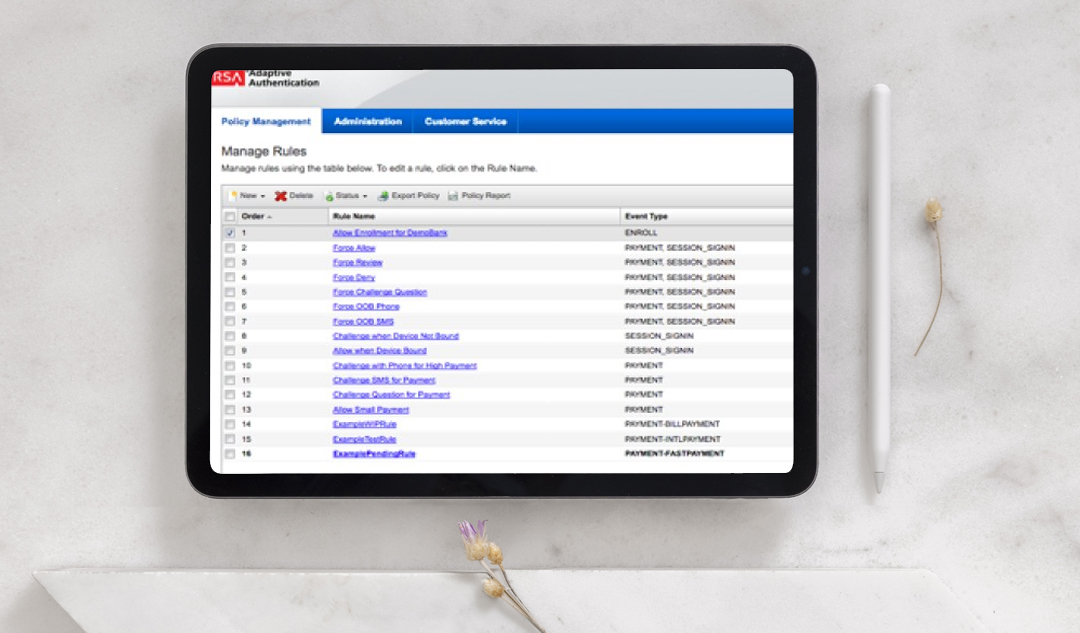

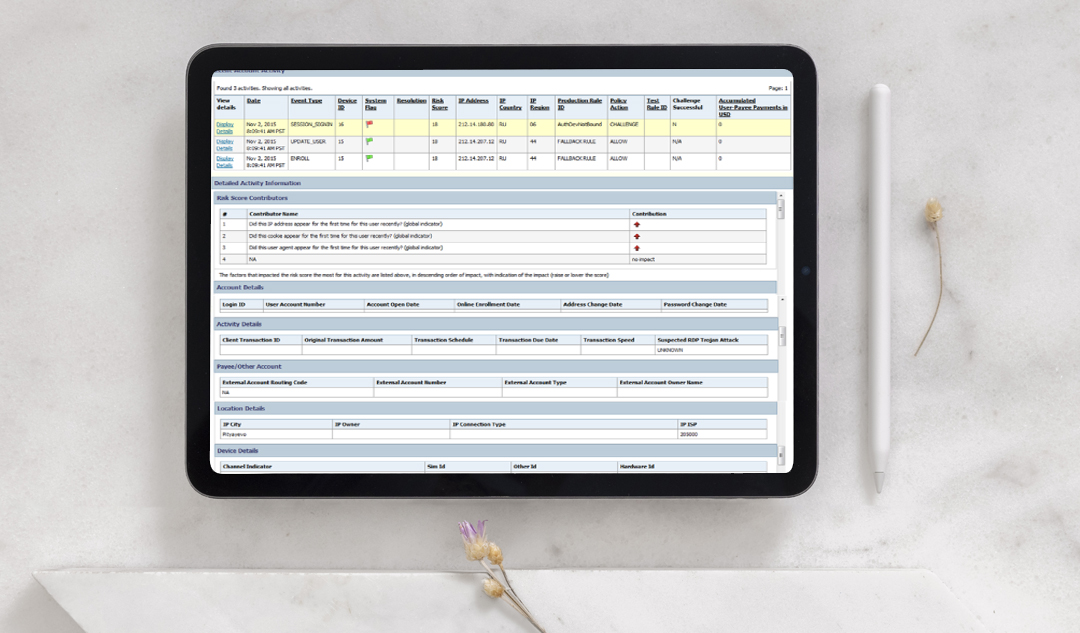

App Screens

Watch & Learn

RSA Fraud & Risk Intelligence Suite: Overview

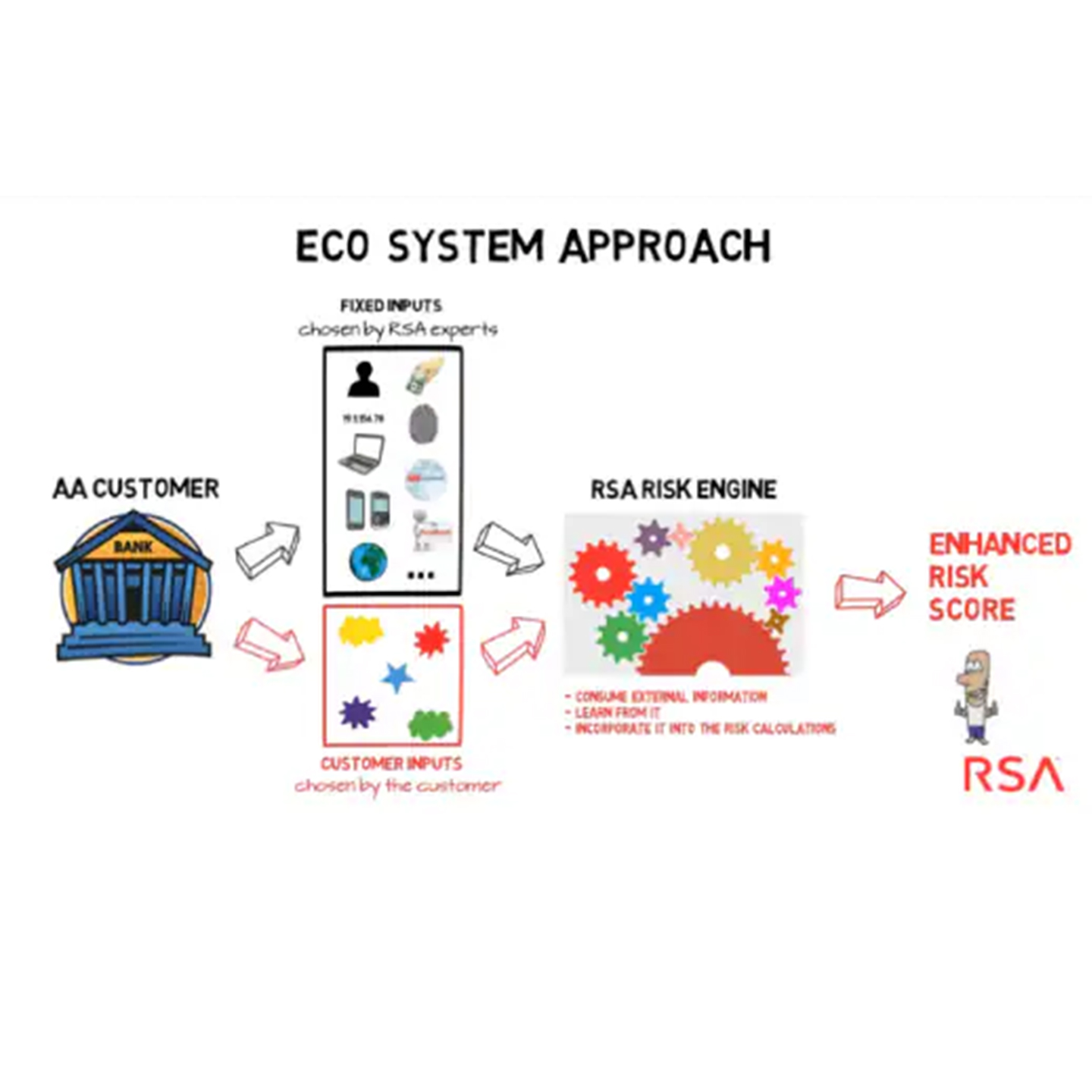

This overview provides a brief description of typical Adaptive Authentication customer, inputs, the risk engine, and the risk score.

Features

Real time digital channels fraud detection and prevention including transaction monitoring and inbuilt step-up authentication

RSA Adaptive Authentication analyses the risk of user activities in the web and/or mobile channel. The RSA Risk Engine builds profiles of users, IPs, devices, statistical patterns of genuine and fraudulent activity. The risk engine provides the statistical likelihood of a given user activity being fraudulent. The policy manager allows building of business rules on top of the risk engine analysis.

Features

Device Profiling

Device profiling analyzes the device from which the user is accessing an organization’s website or mobile application. RSA Adaptive Authentication compares the profile of a given device with previous devices used by the individual in the past. The device profile is used to determine whether the current device is one from which the user typically requests access or if the device has been connected to previous known fraud. Parameters analyzed include IP address and geolocation, operating system version, browser type and other device settings.

Features

Behavioral Profiling

Behavior profiling is a record of typical activity for the user. RSA Adaptive Authentication compares the profile for the activity with the usual behavior to assess risk. The user profile determines if the various activities are typical for that user or if the behavior is indicative of known fraudulent patterns. Parameters examined include frequency, time of day and type of activity. For example, is this payment amount typical for the user and is the payee someone the user usually transfers money too?

Benefits

Risk Engine

- RSA RISK ENGINE: The RSA Risk Engine is a self-learning, statistical machine learning technology that utilizes over 100 indicators to evaluate the risk of an activity in real time. Datasheet with title “RSA AAOP RiskEngine” attached for reference

- MACHINE LEARNING METHOD: The RSA Risk Engine uses a Naive Bayesian statistical approach to calculating the risk score. A Bayesian approach looks at the conditional probability of an event being fraudulent given the known facts or predictors.

- RSA ECOSYSTEM APPROACH: Leverage existing investments and utilize your own business insights: In addition to proven, predefined risk indicators, the RSA Risk Engine provides organizations the option to ingest their own third party risk indicators to both further enhance fraud detection and augment their existing, current set of Anti-Fraud...

- RSA EFRAUDNETWORK: Cross-institutional, confirmed fraudulent indicators increase your fraud detection (Large percent of fraudulent transactions in RSA Adaptive Authentication have an entry in the RSA eFraudNetwork) Datasheet with title “RSA eFraudNetwork Datasheet” attached for reference

- Omnichannel protection: Protect consumers across channels through a centralized Anti-Fraud hub

- Case management API: Leverage the built-in case management tool or integrate your preferred case management application

RSA Adaptive Authentication was able to individually profile each of our users’ behavior and to actually continuously learn their new behaviors. We were convinced that the system was able to achieve a high rate of detection and minimize the rate of false positives

©2026 -Edgeverve Systems Limited | All rights reserved