Introduction

Accelerate Cash Management Digitization

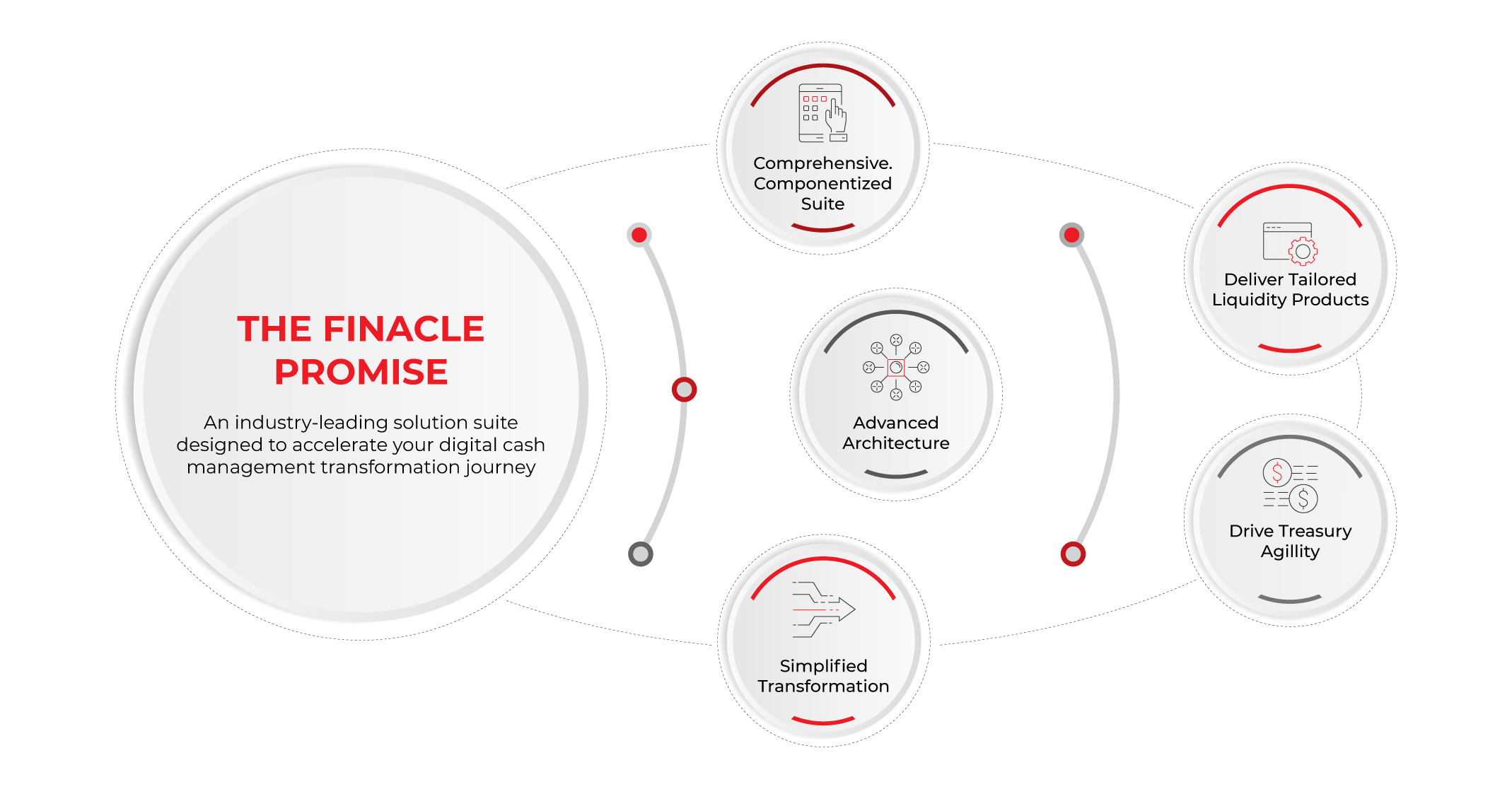

Finacle Cash Management is a comprehensive solution suite built on an advanced architecture. The componentized suite empowers your bank to deliver new propositions in digital cash management. Finacle’s proven digital offering which includes Finacle Liquidity Management Solution, Finacle Virtual Accounts Management, Finacle Payments along with Finacle Corporate Online Banking, Finacle Corporate Mobile Banking and Finacle Digital Engagement Hub will help you accelerate corporate cash management digitization.

Finacle has helped corporate banks around the world reimagine their cash management service offerings with digital technologies to drive new revenue streams.

Drive New Propositions in Corporate Cash Management With Finacle Cash Management Suite

Comprehensive, Componentized Suite

Modernize at Your Pace

- A comprehensive, componentized suite of cash management solutions with rich business functionality delivered on all channels

- Freedom to choose products that match your bank’s business priorities

- Flexibility to decide when to deploy or upgrade a particular component

We are excited to announce this collaboration with Infosys Finacle, the market-leading provider of banking technology. The right technology investment for corporate banking customers is of great importance to ABN AMRO as smarter cash management is evolving as a key priority for our customers, pushing the need for driving resilience in treasury operations. Together with Infosys Finacle, we will further enable ABN AMRO to propel with its liquidity management business transformation.

Xander van Heeringen,

Director of Transaction Banking,

ABN AMRO

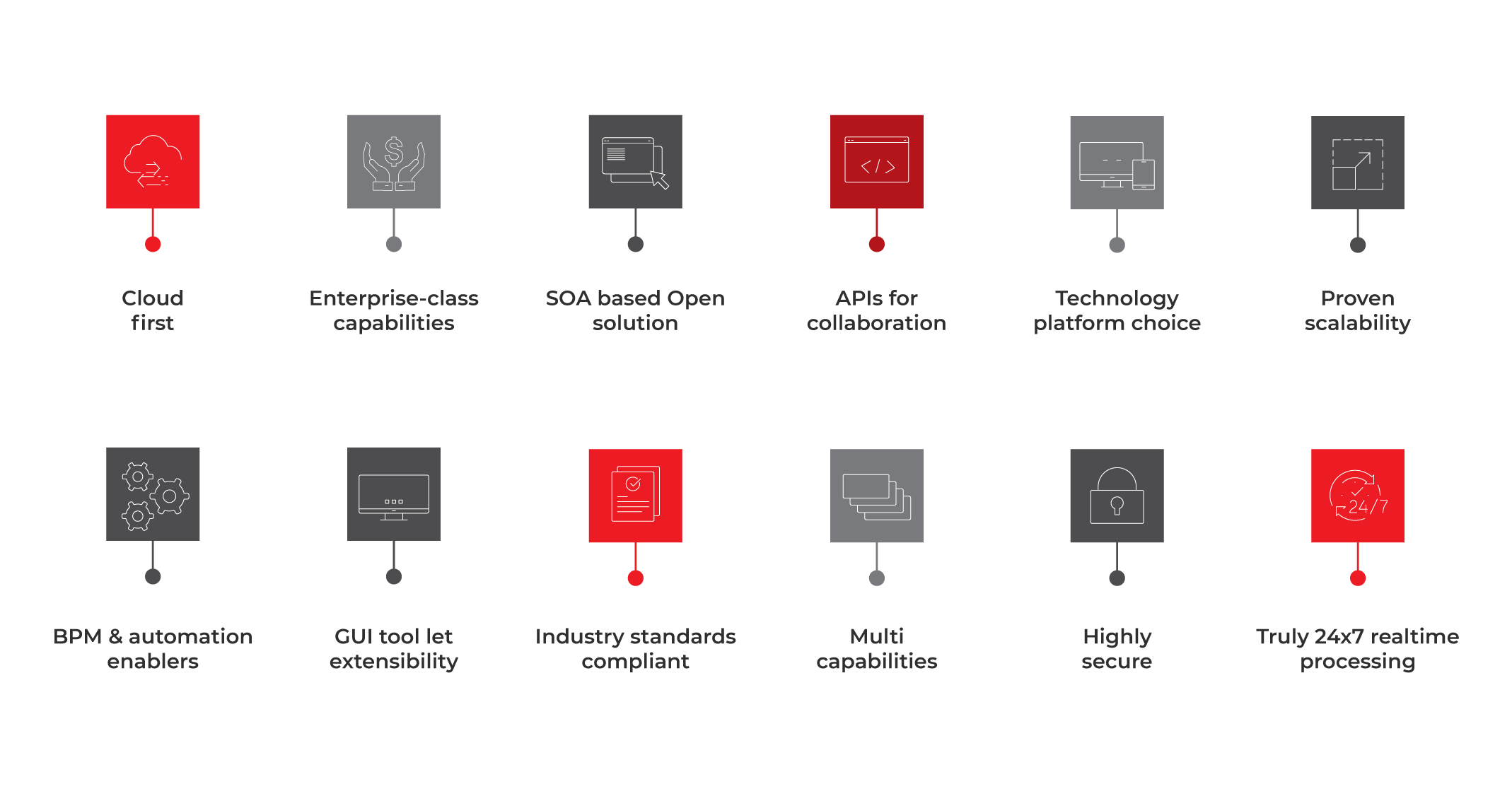

Advanced Architecture

Future Proof Your Business With a Modern Platform That Is Agile, Flexible and Scalable

Industry’s most advanced architecture empowers you to do more

Infosys Finacle’s compelling vision and value proposition build on a strong track record in emerging technologies. Its comprehensive roadmap focuses on AI, blockchain, and green computing, and has achievable timelines… Infosys Finacle offers superior API capabilities and supports diverse banking services for retail, small and medium-size business (SMB), and corporate clients… It excels in real-time and event-driven architecture, leveraging robust technologies for data consistency, resilience, and security… Finacle’s Enterprise-Class Customer Data Hub delivers a unified view of the customer and feeds a comprehensive AI platform for training and deploying models with more than 40 use cases, including generative AI (genAI) bots… Customers consistently rate Finacle highly, praising its responsiveness, implementation support, and ability to understand and act on their business needs… they overwhelmingly emphasized the vendor’s strengths in functionality, performance, and support… Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support

– The Forrester Wave™: Digital Banking Processing Platforms, Q4 2024

Simplified Transformation

Experience Agile, Risk-Mitigated Modernization

Whether it is a big bang switchover, progressive deployment or complete overhaul, Finacle helps your bank transform at its own pace. The following tenets simplify transformation as well as minimize its risks:

- Finacle reference liquidity products for cutting complexity and time

- Phased transformation for maximizing business outcomes

- Agile delivery for progressive launches

Tailored Liquidity Products

Transform Cash Management for Innovation and Growth

- Build digital product engines to host products tailored for your corporate customers’ unique industry segments

- Become a marketplace operator and complement your offerings with cash management products sourced from partner ecosystem

- Leverage third party channels on par with your bank’s own channels

Learn how A Leading US Bank Transforms Cash Management with Finacle Virtual Accounts on Cloud

Treasury On-the-go

Enable Digital Experiences in Cash Management

- Leverage Finacle Digital Engagement Hub for seamless access to corporate cash management services across channels and devices

- Empower your corporate customers with comprehensive digital self-service models to set up their preferred sweep structures, and virtual account hierarchies

- Enable enterprise-level dashboards to provide corporates with graphical views of liquidity positions on-the-go, cash flow forecasting and liquidity management structuring options

- Enhance automation and reconciliation outcomes leveraging Open APIs for flexible ERP integrations

Transforming Cash Management Offerings: A Definitive Guide

Driving New Propositions With a Continuum-Led Journey

Read the full report to get a rich understanding of

- Challenges your corporate customers face in managing their cash

- How can you as a bank enable better outcomes in cash management

- A step-by-step view of how you can approach your cash management transformation

- How Finacle can enable you in your transformation journey