Scale Digital Transformation

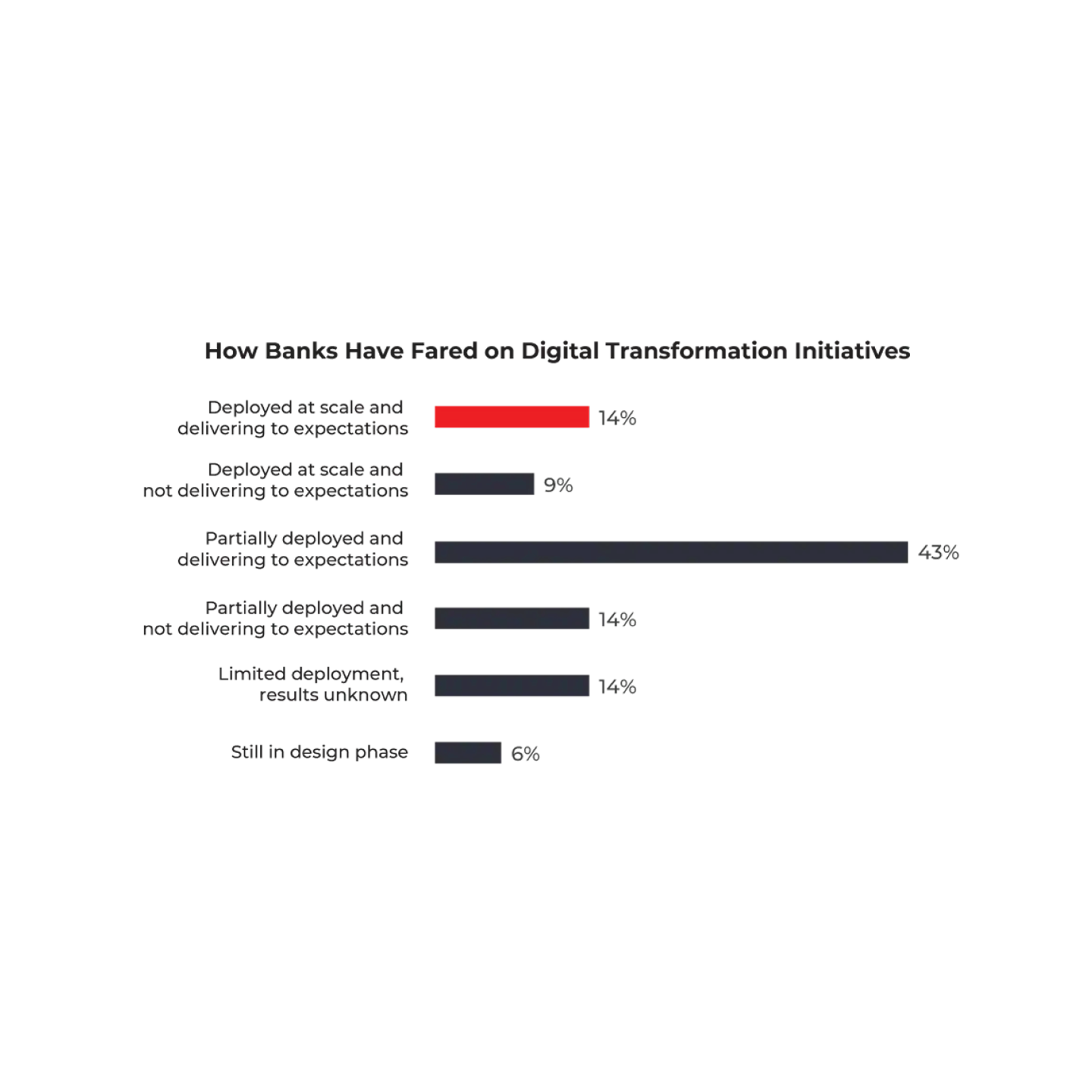

As change spirals upwards and outwards in the industry, staying relevant is the biggest concern of bank leaders today. Consequently, banks are in a state of continual transformation – an ongoing pursuit of ways to create, deliver, and capture value. The reported success, however, is quite underwhelming.

In our research, only 14 percent of bankers said they had deployed digital transformation at scale and reaped the desired results. In many cases, the digital transformation is yet to cover the back-end core transformation. Consequently, the transformation programs are not unlocking desired benefits. At its heart, a successful transformation is about managing change better. It is an outcome of three things – clarity of vision and target operating model, change competencies – people, process, technology and data readiness required to support change, and robust governance. And, we help banks across these areas.

Transform With Confidence

Finacle helps banks to transform better so that they can stay relevant to evolving market dynamics. With a componentized digital suite, flexible deployment options, and a pre-configured reference bank approach, we empower banks to mitigate risk and transform and upgrade in a phased manner. Our DevOps toolchain helps banks to build, test, deploy, and monitor new capabilities with speed to stay ahead of the competition.

Our versatile solution suite, local expertise, and a team of in-house and partner experts are enabling truly- digital transformation of financial institutions of all types – established or emerging, global or regional, omnichannel or digital-only.

- Well-established financial institutions that seek comprehensive digitization across front-to-back enterprise systems, such as DBS, Emirates NBD, ICICI Bank, ING, Santander, Standard Bank, and State Bank of India

- Digital-only banks that seek to integrate into their customers’ digital lives, such as Digibank by DBS, Discover Financial Services, Liv. by Emirates NBD, Marcus by Goldman Sachs, and Nequi by Bancolombia

- Financial technology organizations (FinTech) transforming financial services through emerging technology, such as Paytm, and Resimac

- Non-financial companies, such as telcos, insurers, and retailers, who are leveraging connectivity to help customers manage their finances such as India Post, and Manulife

Unlock Agility and Resilience of Cloud

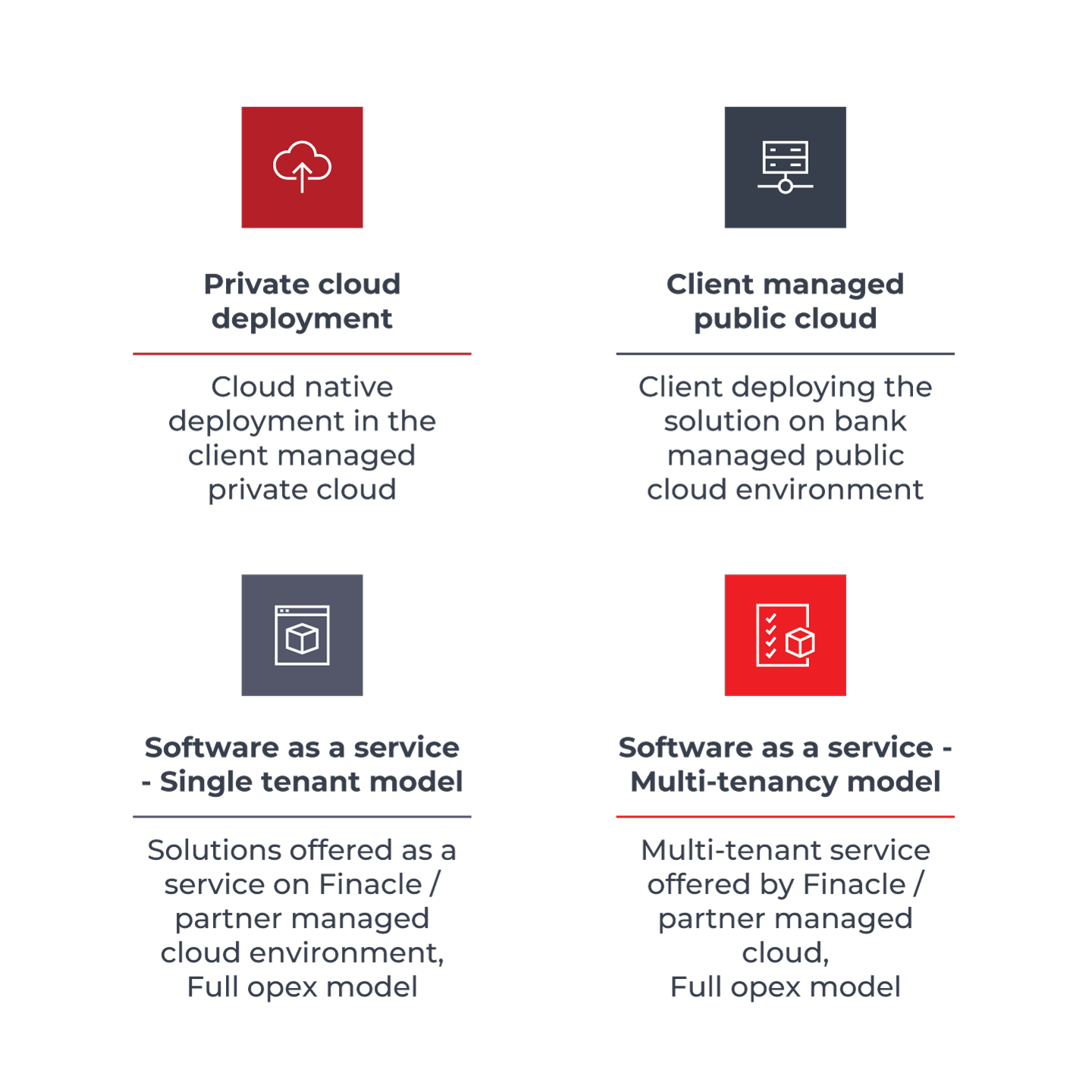

Finacle’s cloud-native, cloud-agnostic digital banking suite can be deployed flexibly – on a private, public, or hybrid cloud.

Finacle solutions run in a containerized environment orchestrated by Kubernetes, which is supported in all cloud environments. We have partnerships with major global and regional cloud providers, including AWS, Microsoft Azure, Google Cloud, IBM, Redhat, and Oracle.

Whether your bank is looking to transition entirely to the cloud or do it progressively in phases, Finacle provides the necessary flexibility and support. Finacle’s componentized structure allows you to choose any combination of solutions matching your bank’s specific business priorities and modernization strategy.

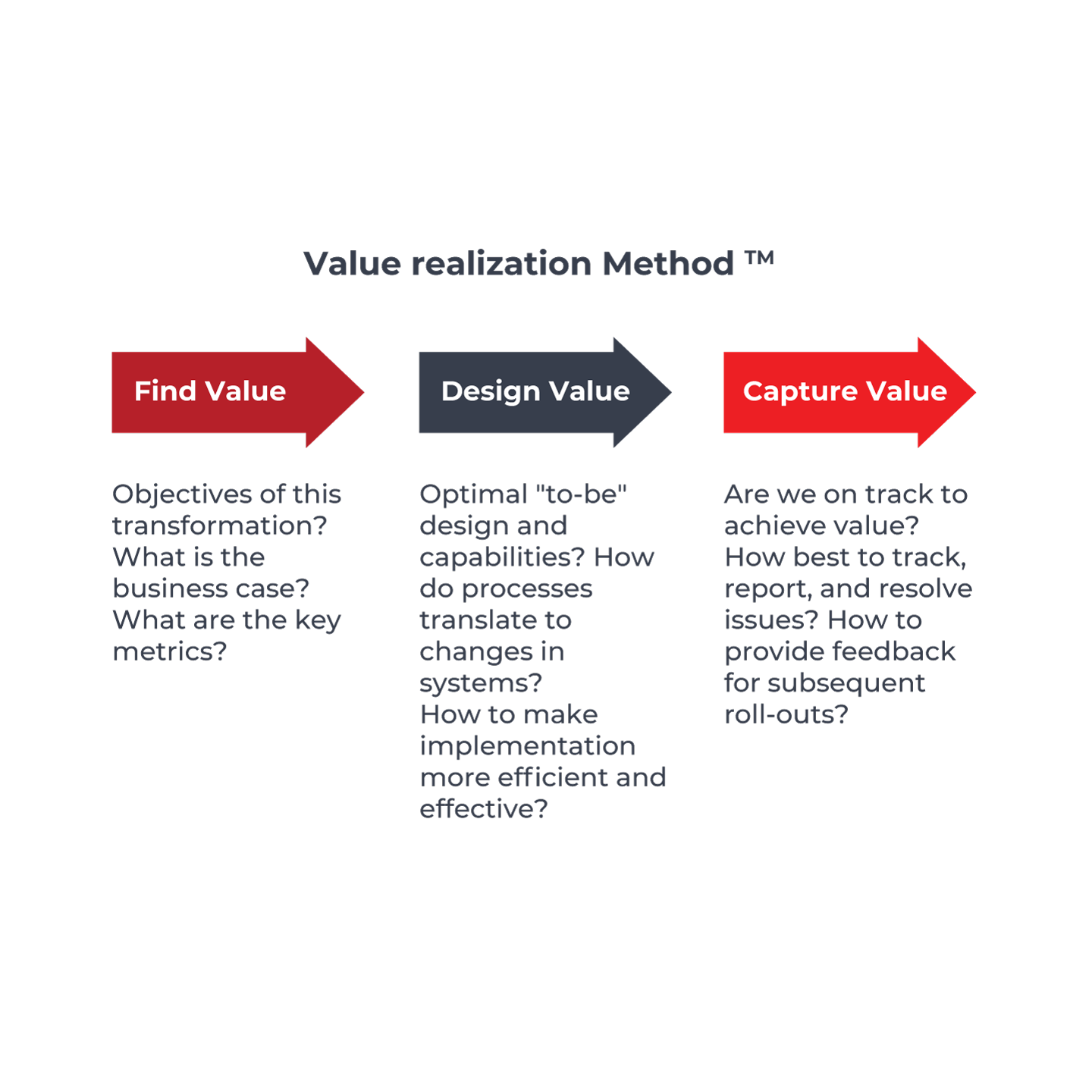

Putting Value at the Heart of Each Transformation

Our unique Value Realization Method™ (VRM) is at the core of each transformation we drive. The approach helps ensure that transformation programs are not only on time and on-budget, but also on-value. Our client’s success is a testimony of the value our solutions and transformation approach delivers for financial institutions globally. Banks running on Finacle

have experienced an average –

- 19% improvement in their NPS scores

- 20% improvement in ecosystem innovation

- 16% uplift in digital sales

- 18% improvement in ability to offer personalized products

- 20% improvement in omnichannel service delivery

- 19% improvement in straight-through processing rates

Experience That Speaks

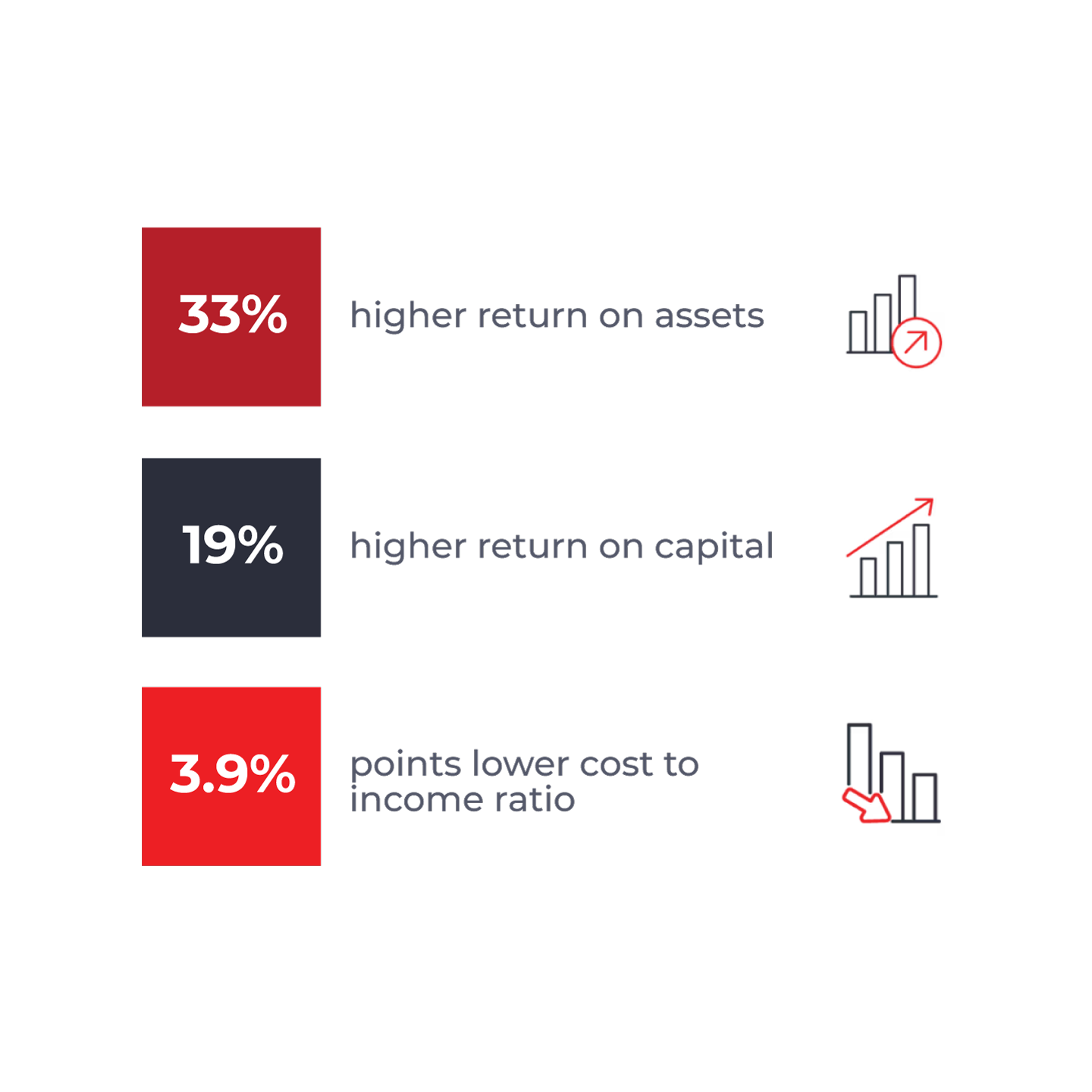

The industry-leading performance of our clients reflects our promise of inspiring better. An assessment of the top 1000 banks globally revealed that institutions powered by Finacle enjoy

- 33% higher returns on assets than others, with average returns on assets at 1.2% and top-performing client at 4.7%

- 19% higher returns on capital than others, with average returns on capital at 15.6% and top-performing client at 33%

- 3.9 % points lesser cost to income ratio than others, with the average ratio at 47.2% and top-performing client at 16%