Deliver Engaging Customer Experiences

The Finacle Digital Engagement Suite is an advanced omnichannel solution that helps banks – onboard, sell, service and engage – retail, small business and corporate customers. The suite offers a broad range of traditional, modern and emerging channel experiences to every type of user – end customer, bank staff, external partner and trusted third party.

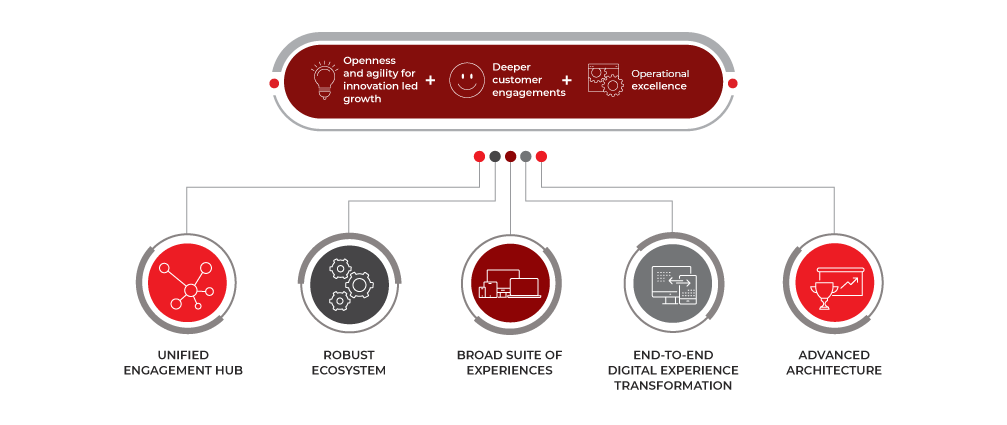

The core promise of the Finacle Digital Engagement Suite is to enable banks to drive deeper customer engagements, openness and agility for innovation-led growth, and digital operational excellence. This is made possible by a unified engagement hub, a broad suite of digital experiences, industry leading architecture, a robust ecosystem and experiences that are transformed from end-to-end.

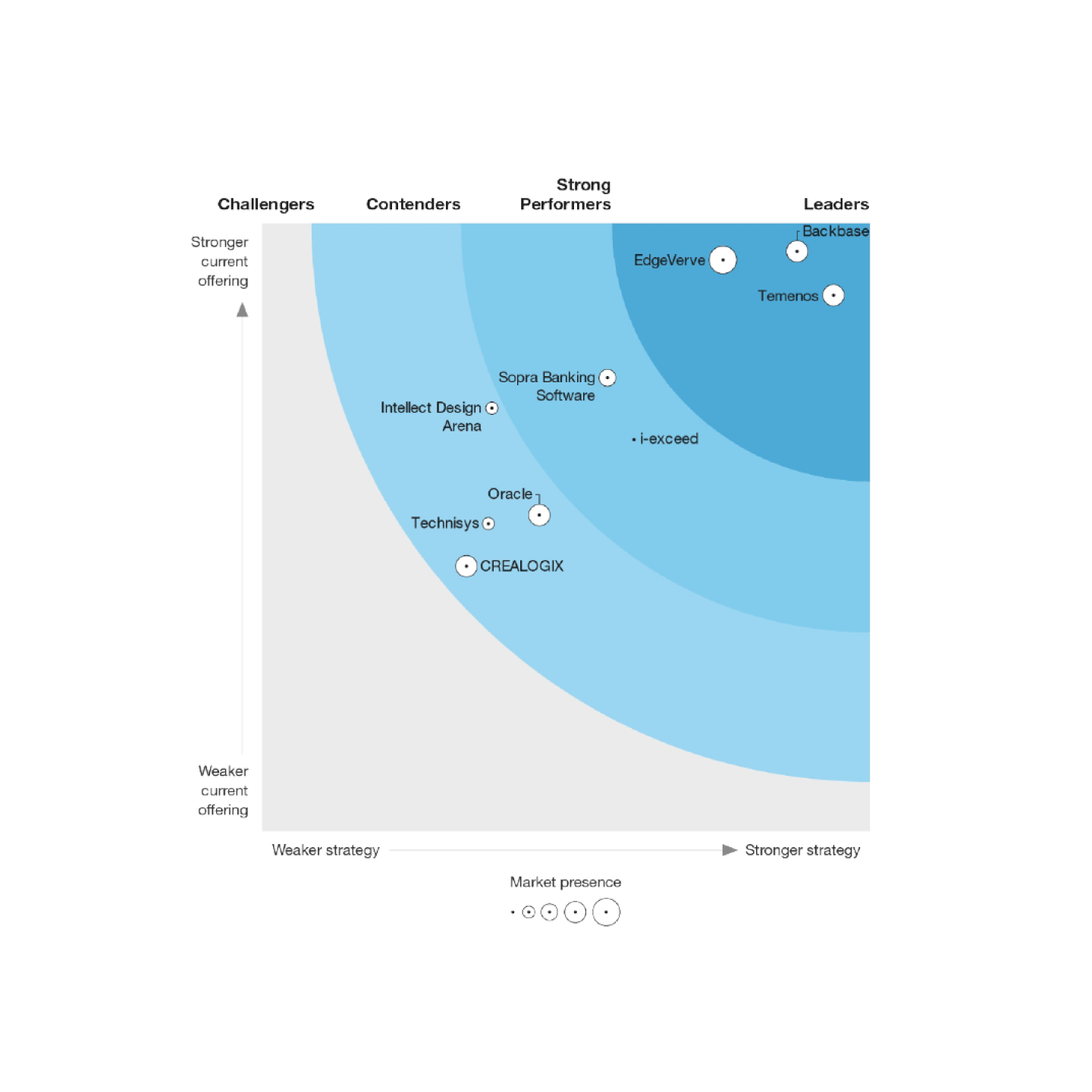

The Forrester Wave™: Digital Banking Engagement Hubs, Q3 2021

Learn Why Forrester Named Finacle a Leader

“EdgeVerve excels with engagement infrastructure on a well-designed architecture… The solution comes with strong API management, offers broad and rich retail, business, and corporate banking services, and excels with its top-tier engagement infrastructure… EdgeVerve is a good fit for banks with a preference for custom-built apps seeking an advanced solution that can be melted into their existing infrastructure"

– Jost Hoppermann, Ex - VP and Principal Analyst, Forrester

Unified Engagement Hub

Powering Contextual and Personalized Interactions

- An enterprise-class system of engagement that powers insights-driven personalized customer experiences across channels, applications and devices

- Works seamlessly with all back-end applications such as core banking and payments, as well as channel applications such as mobile banking, branch solutions, and chat bots

- Offers extensive capabilities to design customer-centric processes leading to consistent cross-channel journeys

“With Infosys Finacle, we now have a strong digital suite that enables the bank to drive growth while providing an exceptional banking experience to our growing retail, SME, institutional and corporate customers”

– Kennedy Uzoka, Group Managing Director, UBA Group.

Robust Capabilities and Ecosystem

Empowering You to Innovate Rapidly and Continuously

- A comprehensive set of capabilities help banks onboard, sell, service and engage customers across channels and applications

- Finacle App Center, a marketplace of partner solutions, compliments the suite’s native capabilities to drive rapid and continuous innovation

- Open APIs driven design enables innovation both inside the bank and in the partner ecosystem

Learn how Australian Military Bank has leveraged Finacle Digital Banking Suite to power their digital transformation program

Broad Suite of Experiences

Let Customers Experience Your Services Everywhere

- Support for broad range of traditional and emerging self-service and assisted channels

- Cover internal users, such as bank staff as well as external users, such as agents and partners

- Enable touch, chat, voice-based solutions across devices and applications

Learn how RAKBANK is leveraging Finacle Digital Suite to advance its digital journey

End-To-End Digital Experience Transformation

Assuring Agile, Risk Mitigated Outcomes and Success

- Craft tailored customer journeys using solution configuration and customer experience best practices

- Progressively transform across customer touch points with Agile delivery approach

- Accelerate your transformation journey with flexible cloud offering

Learn how AGD Bank provides a differentiated omnichannel experience to customers using Finacle Digital Engagement Suite

Advanced Architecture

Future Proof Your Investments

- Componentized, micro-services based architecture

- Cloud native suite available on leading cloud platforms such as AWS and Azure

- Extensive RESTful APIs to enable co-innovation with the external ecosystem

- Proven scalability and performance in both simulated and live client environments

- Decoupled UI interaction architecture to power persona-based interfaces

- Technology platform agnostic suite – runs on all major stacks

- Multi-entity, multi-currency, multi-lingual, multi-time zone capabilities to power multi-national operations

Openness and Agility for Innovation Led Growth

Win, Serve, Engage and Retain Customers With Improved and New Customer Value

- Unified digital engagement hub to accelerate innovation and time-to-market with new digital offerings

- Extensive parameterization enables services and interaction design to suit diverse business requirements

- Engage and innovate with external ecosystem by offering a large suite of open APIs

Deeper Customer Engagements

Powered by Customer Led Engagement Architecture

- Anticipate customers’ needs and offer actionable insights with the unique engagement engine

- Elevate customer experience through personalized content and delivery

- Advance financial well-being through educational nudges

- Enhance cross-sell and up-sell success through contextual propositions

“Using Finacle solutions, Santander will provide our corporate customers a single point of access to better manage their global commercial cash ow conveniently and securely. It represents a significant part of GTB UK’s channel strategy, helping to prepare the bank for its shift towards serving digital enabled corporate clients”

– Bart Timmermans, Head of Global Transaction Banking (GTB), Santander UK.

Digital Operational Excellence

Redefining Operational Indexes for the Digital World

- Optimize cross channel interactions by digitizing, automating, and streamlining processes

- Adopt technology harmonization with a full digital suite of experiences, thus lower total cost of ownership and ongoing cost of maintenance

- Leverage multi-dimensional capabilities to create global or regional digital hubs

“We are a progressive bank with the interest of our customers at the heart of everything we do. Transforming to effectively serve, continuously delight and digitally engage the smart consumer of today is a key strategic priority for the bank. In Finacle, we saw the promise of an agile digital engagement solution that could help us make banking easy, secure and intuitive for our customers”

– Somnath Menon, Group Chief Operating Officer, Al Ahli Bank of Kuwait.