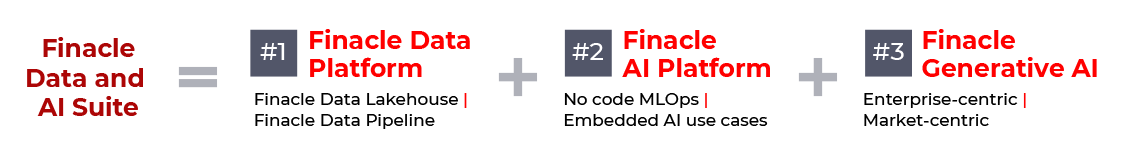

Empowering Next-Gen Banking with Data and AI

The banking industry has long underutilized its vast customer data, but the urgency for change is clear. Achieving digital success at scale demands real-time data access, advanced analytics, and the transformative power of AI. By ensuring data readiness and balancing generative AI pilots with classical AI approaches, banks can streamline operations, make smarter decisions, and elevate customer experiences to meet the demands of the digital age.

Unlock Data Composability with Finacle

Crafted on the pillars of layered OLTP and OLAP architecture, real-time data processing, and embedded insight principles, the Finacle Digital Banking Platform lays a robust groundwork. It empowers banks to seamlessly handle, sustain, and disseminate data at scale—a vital element for propelling cutting-edge banking innovations.

It’s time to elevate your banking operations and engagements with data foundations built for the future.

Accelerate Data Readiness with Finacle Data Platform

Unlock the full potential of your data and accelerate your AI readiness with the Finacle Data Platform. This powerful platform, driven by a robust data pipeline, efficiently captures, extracts, curates, and delivers high-quality data for diverse applications, including analytics, reporting, and AI. The platform's advanced data stores balance velocity, veracity, volume, and variety, providing a unified data estate. It uses a tiered structure aligned with Finacle’s CQRS pattern, separating OLTP and OLAP workloads. Data seamlessly flows from OLTP systems to OLAP data stores and the Finacle Data Lakehouse through event streaming and asynchronous interfaces. With sophisticated low-code configuration options, integration from various data sources is simplified, and data cleansing and transformation are expedited. Built-in data security, observability, and governance features ensure that banks can confidently future-proof their data strategies.

Bian Inspired Data Model, Designed with Domain-Based Data Marts

Elegantly designed, the Finacle Data lakehouse employs domain-based data marts for expansive datasets. Decentralizing data ownership through these domain-oriented marts fosters a self-serve infrastructure, ensuring efficient handling of diverse data within specific domains. This model promotes agility and autonomy, enabling teams to seamlessly access, manage, and derive insights from their datasets.

Transform AI Initiatives with Finacle AI Platform

Finacle AI Platform empowers your bank to build, train, deploy, monitor, and optimize AI solutions from a unified interface. It features a wide range of pre-trained models and ML techniques, combined with a no-code, generative AI-driven approach, allowing both technical and business users to rapidly create explainable AI solutions. The platform’s extensive library of pre-built use cases facilitates seamless AI integration into various business processes and user journeys. Features such as model comparators, what-if simulations and pattern analysis, help refine and elevate modelling sophistication. The platform promotes responsible AI practices with capabilities for detecting biases and drifts and includes a patent-pending synthetic data generation feature to safeguard data privacy during training.

Step up the AI Momentum with Finacle Generative AI

Finacle Generative AI Offerings encompass a diverse range of AI assistants designed for both enterprise and customer-centric applications, including the Finacle Knowledge AI Assistant, designed to facilitate NLP-based information extraction from document repositories, and the Finacle Support AI Assistant, which enhances ticket resolution for support teams. Additionally, generative AI technology plays a foundational role in Finacle AI Platform, empowering users with an interactive interface to select and build the right models for their AI use cases.