-

![]() ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More

ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More -

![Everest Group PEAK Matri Everest Group PEAK Matri]() Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More

Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More -

![]() Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

-

![]() Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More

Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More -

![]() Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More

Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More -

![]() Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

-

![]() Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More

Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More -

![]() Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More

Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More -

![]() Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

-

![]() Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More

Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More -

![]() Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

-

![]() Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More

Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More -

![]() A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More

A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More -

![]() Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Automation-First Design

Finacle Digital Banking Platform Is Built for Scaling Process Excellence

Smarter Processes Hold the Secret to Bank Profitability

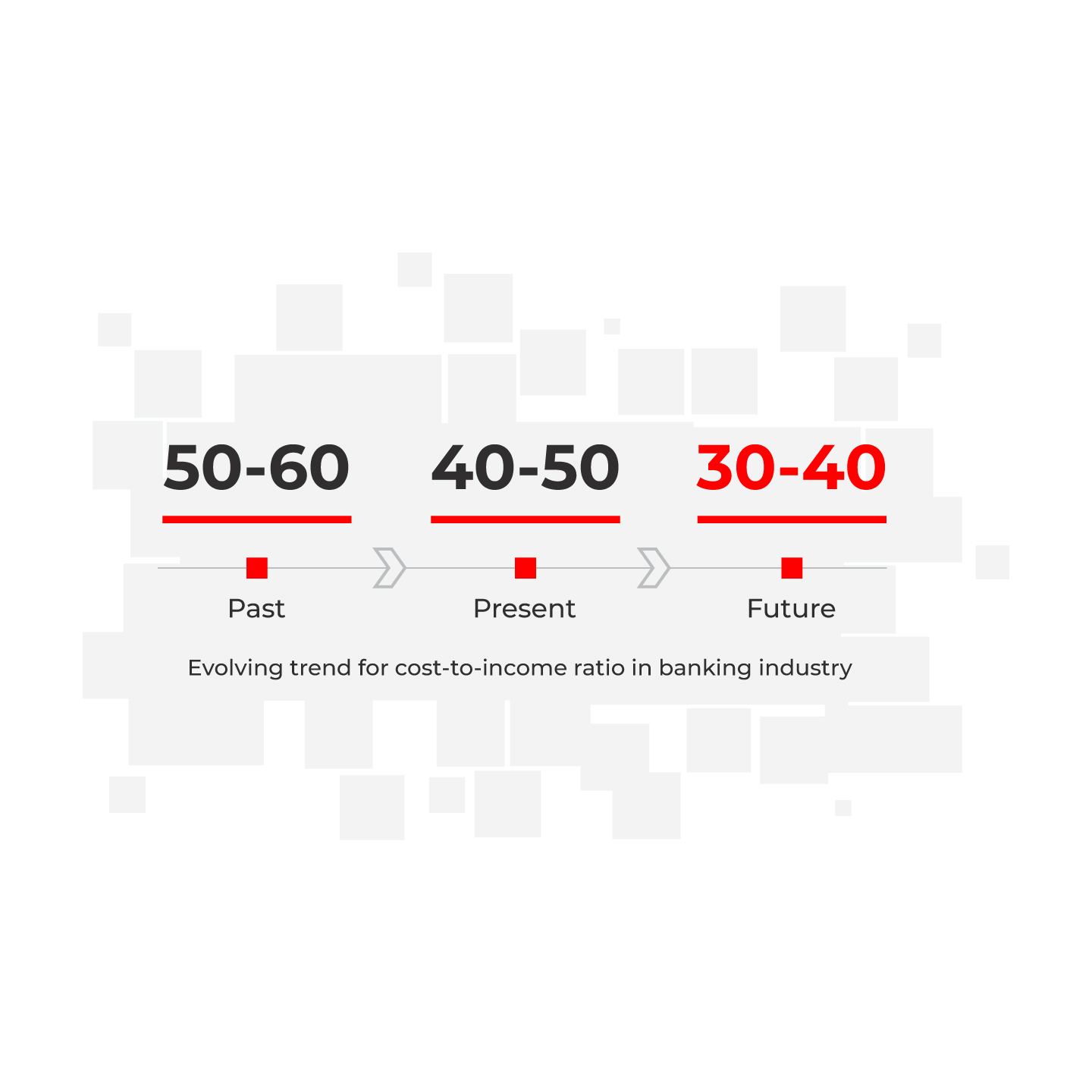

Digital challengers are resetting the operational efficiency norms in banking. The key to driving down cost-to-income ratio lies in optimizing business processes, reducing cost overheads and baking customer-centric design into banking operations. Winning banks are stepping-up their AI and automation game and rethinking processes for the next-gen.

An Assessment of the Top 1000 Global Banks Confirms That Institutions Powered by Finacle Have a 3.9 Percentage Point Lower Cost-To-Income Ratio Than Their Peers.

Scale Process Digitization and

Automation with Finacle

Streamline your operations with Finacle Digital Banking Platform. Driving real-time straight-through processing, our platform automates workflows using rules, APIs, events, and integrated RPA and AI enablers. Our flow builder ensures automation through service composition and API/events orchestration. Our in-house RPA (AssistEdge) and AI platforms enable true process automation, while blockchain-powered capabilities elevate efficiency in inter organizational processes. Our API-first, event-driven approach gives you enhanced agility, efficiency, and adaptability.

- RPA at Nations Trust Bank delivered as much as 90% reduction in operational costs in select processes.

- With Finacle, Discover Financial Services improved quality of customer service with most common customer requests requiring 40% fewer clicks.

- Finacle Trade Connect – a blockchain-based network of 18 banks, enabled reduction in letter of Credit processing cycle time by 75%.

©2025 -Edgeverve Systems Limited | All rights reserved