Introduction

Accelerate Truly Digital Corporate Banking

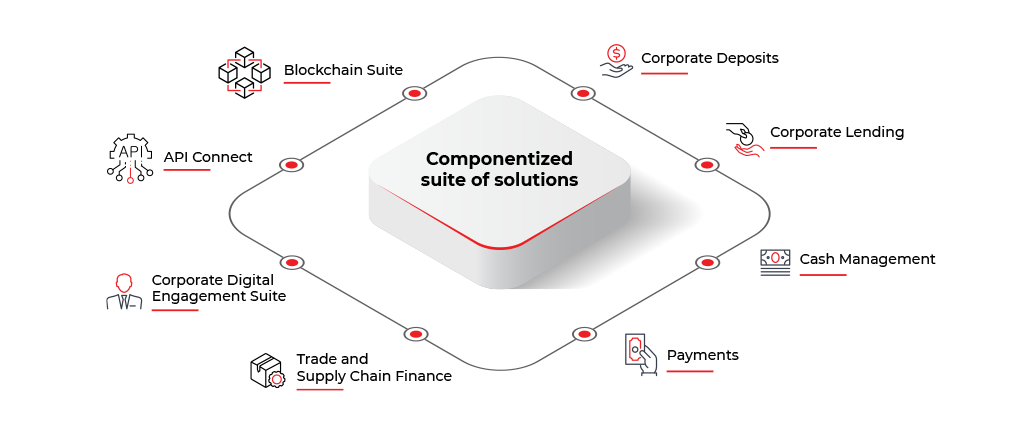

The Finacle Corporate Banking Solution Suite is a comprehensive solution suite built on a cutting-edge architecture. It caters to corporate banks globally, meeting their needs across deposits, lending, cash management, payments, trade and supply chain finance, online banking, and mobile banking. The suite empowers corporate banks to provide tailored services to organizations of varying sizes and scales.

Furthermore, it includes a robust API solution that facilitates the exploration of new business models and expedites innovation within ecosystems. Leveraging contemporary technologies like cloud computing, AI/ML, advanced analytics, open APIs, and blockchain, the suite paves the way for innovative offerings and propositions, transforming the landscape for corporate banks and their clientele in the digital age.

Get End-To-End Corporate Banking Capabilities With Finacle Corporate Banking Solution Suite

Uncover the groundbreaking capabilities of the Finacle Corporate Banking Suite, revolutionizing global corporate banking standards. Delve into the pioneering solutions and cutting-edge technologies of the suite that are shaping the corporate banking landscape. Watch the video below for a comprehensive view of the robust capabilities provided by the Finacle Corporate Banking Suite.

The Finacle Promise

Here’s Introducing the Finacle Corporate Banking Solution Suite

It is an industry leading solution suite and our promise is to accelerate your journey towards truly digital corporate banking. We offer a comprehensive, componentized platform, powered by advanced architecture to help you grow your business in unprecedented ways, while renewing existing systems and processes for higher cost efficiencies and productivity. We offer end-to-end services to help you simplify your transformation journey

And our promise is, with our solution suite

- You will achieve greater agility for continuous innovation and accelerated growth.

- You will also gain a robust platform to support your corporate customers with a more nuanced, contextualized offering they demand, across channels of their choice.

- You will achieve extensive automation, straight through processing for gaining operational excellence.

Future-Proof Your Corporate Banking Business With a Comprehensive Solution Suite

- A comprehensive, componentized platform of corporate banking solutions

- Freedom to choose products that match the bank’s business priorities, and flexibility to decide when to deploy or upgrade a particular component

- Transform at one go, or in a progressive, phased manner

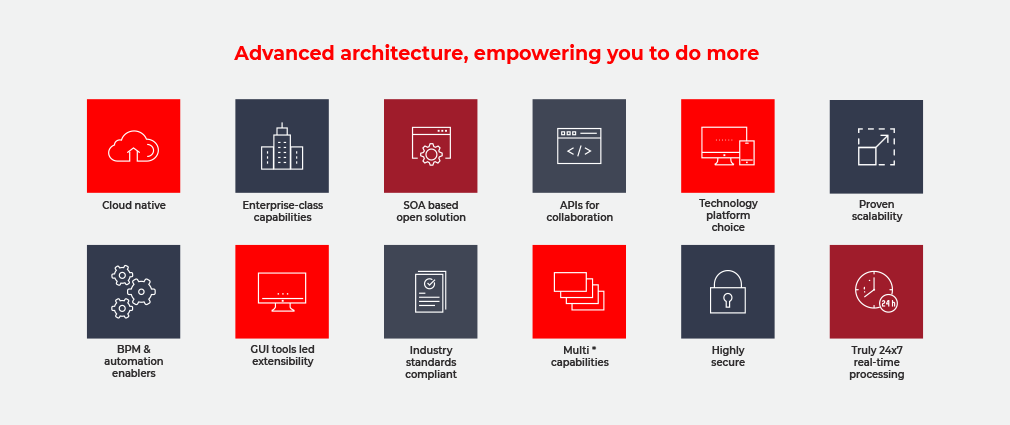

Harness the Power of Cutting-Edge Technologies With an Advanced Architecture

The Finacle corporate banking suite of offerings is built on industry’s most advanced architecture. It provides you the build-agility, deployment flexibility and scalability

Infosys Finacle’s compelling vision and value proposition build on a strong track record in emerging technologies. Its comprehensive roadmap focuses on AI, blockchain, and green computing, and has achievable timelines… Infosys Finacle offers superior API capabilities and supports diverse banking services for retail, small and medium-size business (SMB), and corporate clients… It excels in real-time and event-driven architecture, leveraging robust technologies for data consistency, resilience, and security… Finacle’s Enterprise-Class Customer Data Hub delivers a unified view of the customer and feeds a comprehensive AI platform for training and deploying models with more than 40 use cases, including generative AI (genAI) bots… Customers consistently rate Finacle highly, praising its responsiveness, implementation support, and ability to understand and act on their business needs… they overwhelmingly emphasized the vendor’s strengths in functionality, performance, and support… Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support

– The Forrester Wave™: Digital Banking Processing Platforms, Q4 2024

Experience Simplified and Risk-Mitigated Transformation

Whether It Is a Big Bang Switchover, Progressive Deployment, or Complete Overhaul, Finacle Helps Your Bank Transform at Its Own Pace by Simplifying Transformation and Minimizing Risks.

- Reference bank model enabling coverage for local products – parameterization for geo-specific practices.

- Phased transformation approach with end-to-end transformation services and flexible modernization milestones.

- SAFe agile delivery model enabling progressive launches.

"Learn how a global top 5 bank leverages Finacle to modernize payments across markets."

Driving Agility for Innovation, Growth, and Profitability

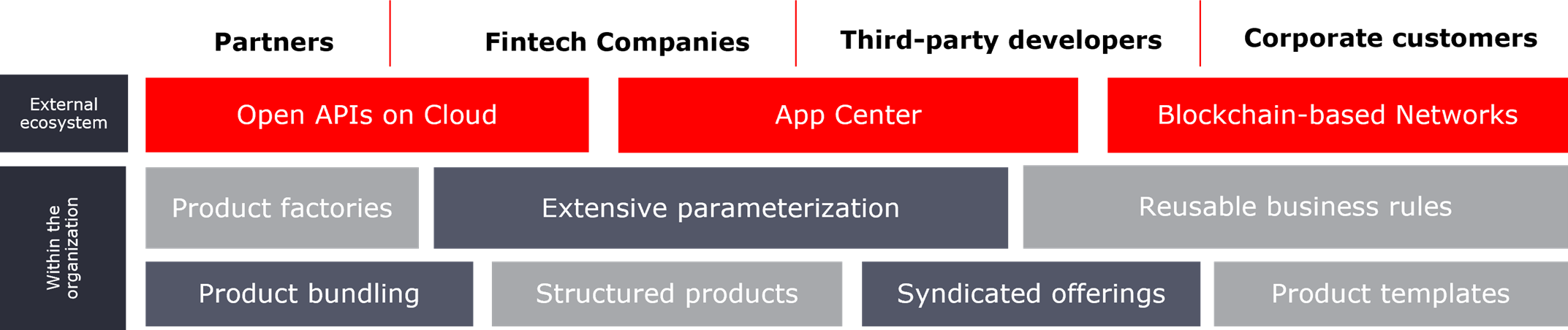

Making Corporate Banks Ready for Delivering New Value Propositions Through Innovative Business Models

- Build a platform business by tapping new and diverse partner networks within a larger ecosystem

- Become a marketplace operator for financial and non-financial offerings recommending contextual offerings to corporates

- Leverage third party channels on par with the banks’ own channels

Discover how Goldman Sachs disrupted the transaction banking space.

Customer-Centric Propositions

Consumer Banking Like Digital Experiences for Your Corporate Customers

- Finacle digital engagement hub gives clients seamless access to corporate services across channels and devices

- The enterprise level dashboards provide graphical views of liquidity positions on-the-go, cash flow forecasting and liquidity management structuring options

- Build new operating models to deliver products and services across channels in a cost effective way and fulfill new customer needs through innovation

- Leverage data-led insights to understand your corporate customers better, identify business opportunities, reduce costs and craft tailored solutions

Discover how a large Dutch bank transforms corporate cash management with Finacle SaaS.

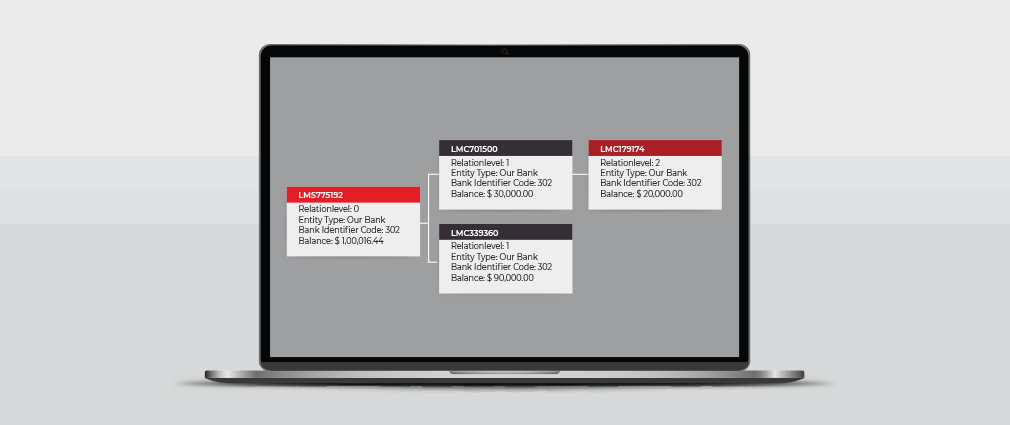

View sweep structure in tree visual and amend and delete accounts and linkages

Drive Operational Excellence and Better Risk Mitigation

Redefining Operational Indices for the Digital World

- Adopt new business models built on the latest digital tools, such as automation, big data, AI, and blockchain

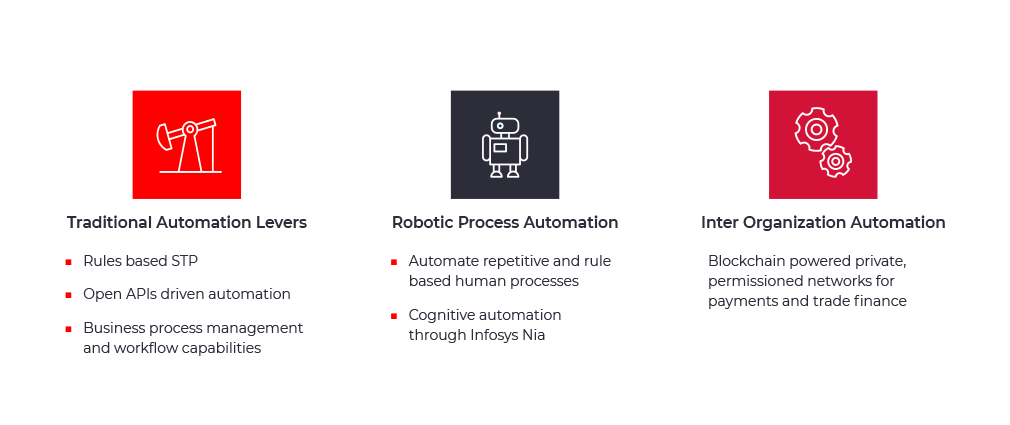

- Leverage a host of automation enablers to help you transform with agile processes, higher efficiencies, leading to better customer experiences

- Build comprehensive risk management capabilities across the core for unified real-time view of exposures, enabling effective risk mitigation strategies

Digital Business Ecosystems Are Reshaping Commercial Banking

How to Thrive With Better Business Models

In this constantly evolving terrain, digital business ecosystems are actively reshaping the commercial banking industry, offering a dual spectrum of challenges and opportunities for industry participants. The key to success for banks and fintechs lies in collaboration within these digital ecosystems to create, deliver, and realize value for customers.

Download this report by 11:FS in association with Infosys Finacle to discover:

- How disruptive digital businesses are reshaping the industry, offering real-time, automated, and embedded solutions for businesses

- The transformation of commercial banking’s value chains and the need for new business models

- A blueprint to iterate relentlessly by adopting new business models to thrive in the digital business ecosystems

- Insights from interviews with 14 leaders at leading commercial banks and Fintechs

Industry's Most Awarded Solution