Introduction

Build New Propositions in Digital Cash Management

Finacle Virtual Accounts Management is an industry-leading solution designed to digitally transform cash management services of corporate banks worldwide. Leveraging the solution, banks can empower corporates to transform their treasury operations, streamline payments and receivables, and reimagine in-house banking dynamics, while lowering costs. With a broad range of account virtualization capabilities and a digital self serve model, the solution enables corporates manage their global, multi-bank cash and liquidity positions with enhanced levels of visibility and controls.

Drive New Possibilities With Virtual Accounts

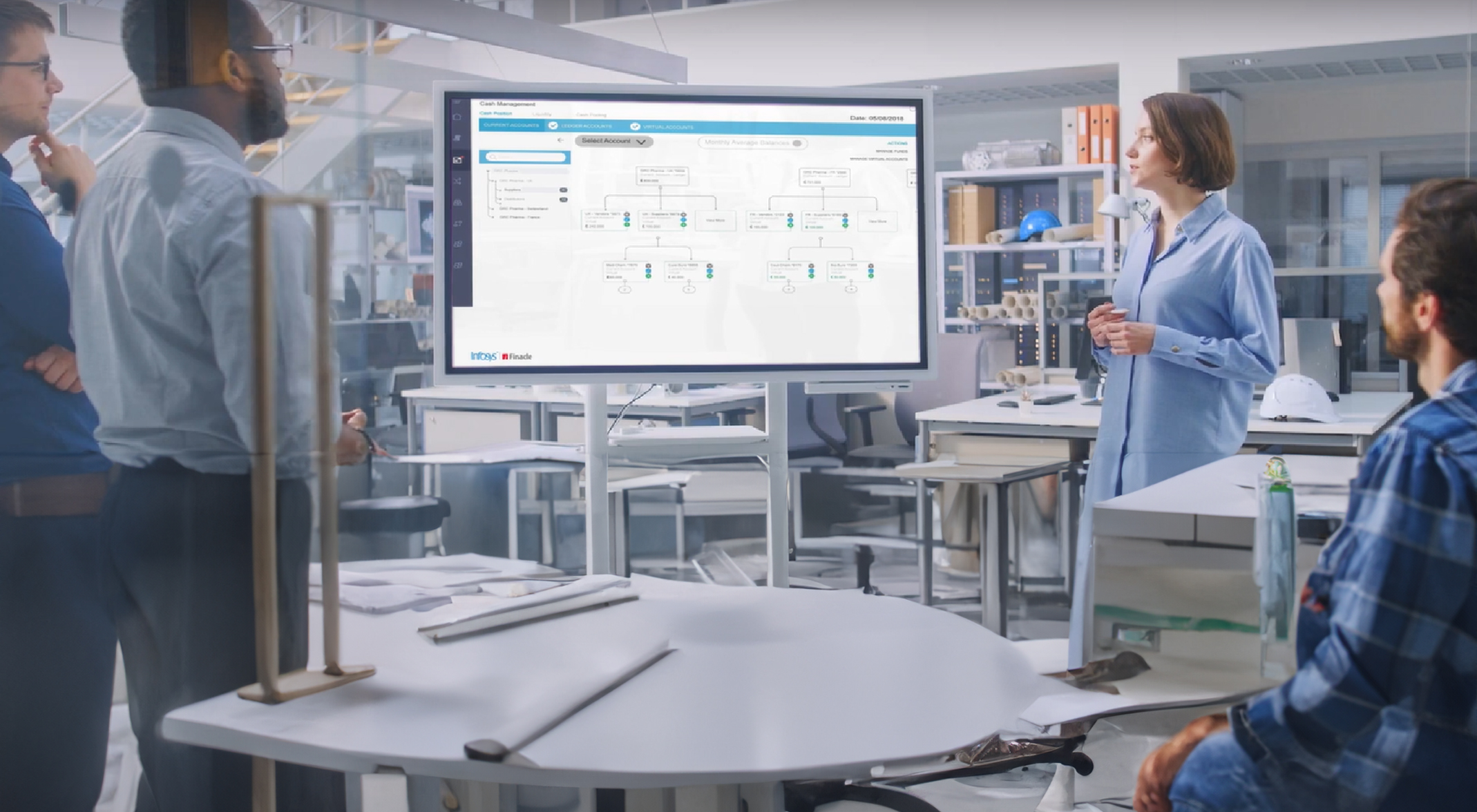

Watch This Video to Discover More

The Finacle Promise

Future-Proof Your Cash Management Strategies With a Comprehensive Solution

Finacle Virtual Accounts Management provides banks with robust capabilities to create and offer state-of-the-art virtual account products, empowering them to revolutionize their cash management processes, attract new clients, and sustain their competitive edge in the dynamic banking sector.

A leading Spanish bank leverages virtual accounts to streamline treasury operations and enhance global payment propositions

Advanced Architecture

Finacle Virtual Accounts Management Solution Is Built on an Advanced Architecture and Enables Banks to Transform Cash Management Business With Agility and Flexibility.

Infosys Finacle’s compelling vision and value proposition build on a strong track record in emerging technologies. Its comprehensive roadmap focuses on AI, blockchain, and green computing, and has achievable timelines… Infosys Finacle offers superior API capabilities and supports diverse banking services for retail, small and medium-size business (SMB), and corporate clients… It excels in real-time and event-driven architecture, leveraging robust technologies for data consistency, resilience, and security… Finacle’s Enterprise-Class Customer Data Hub delivers a unified view of the customer and feeds a comprehensive AI platform for training and deploying models with more than 40 use cases, including generative AI (genAI) bots… Customers consistently rate Finacle highly, praising its responsiveness, implementation support, and ability to understand and act on their business needs… they overwhelmingly emphasized the vendor’s strengths in functionality, performance, and support… Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support

– The Forrester Wave™: Digital Banking Processing Platforms, Q4 2024

Simplified Transformation

Experience Agile, Risk-Mitigated Modernization

Whether it is a big bang switchover, progressive deployment, or complete overhaul, Finacle helps your bank transform at its own pace by simplifying transformation and minimizing risks.

A Leading US Bank Transforms Cash Management with Finacle Virtual Accounts on Cloud

Drive Agility and Deliver Enhanced Propositions in Virtual Account Management

Power innovation and growth with unparalleled flexibility

With this solution, you can effortlessly establish and operate virtual accounts, enhancing the agility of your cash management operations.

- Comprehensive rule definition module for powerful rules on currencies, limits, transaction reflection, and more

- Product-centric approach empowering configuration of common parameters such as interest rates, fees, exchange rates, taxes, and other charges

- Set up parameters and rules for multiple virtual accounts flexibly

- Seamlessly visualize hierarchy of virtual accounts with included feature

- Robust processing engine for direct transactions and replication based on references

- Potent reconciliation module for manual or automated handling of exceptions

Transforming transaction banking experiences for the new age customers

Additionally, You Can Enhance Cash Management Services for Digitally Empowered Corporate and Sme Clients

Fostering Flexibility to Fuel Innovation and Expansion.

- Facilitate seamless integration with current enterprise systems through industry-standard integration adaptors.

- Empower corporate clients with digital self-service capabilities for managing virtual accounts through digital channel engagements.

- Offer a wide range of APIs that allow banks to empower corporate clients to optimize treasury operations throughout the corporate accounting lifecycle.

The Scenarios E-book:

Unlock True Power of Virtual Accounts

Embrace 7 key industry use cases to leap forward

- Progressive financial institutions are investing in scaling their virtual accounts offerings to provide businesses with efficient payables and receivables management, improved cashflow control, and increased customer value and loyalty.

- Discover the power of virtual accounts in driving efficient payables and receivables management, and gain enhanced control over cashflows. Download the e-book to explore seven key use cases that are gaining significant traction.

- Unlock the potential of virtual accounts to optimize your business’s payables and receivables management while gaining a competitive edge. Download the e-book now to delve into seven compelling use cases that are revolutionizing the industry.