Introduction

Accelerate Your Trade Finance Transformation Journey

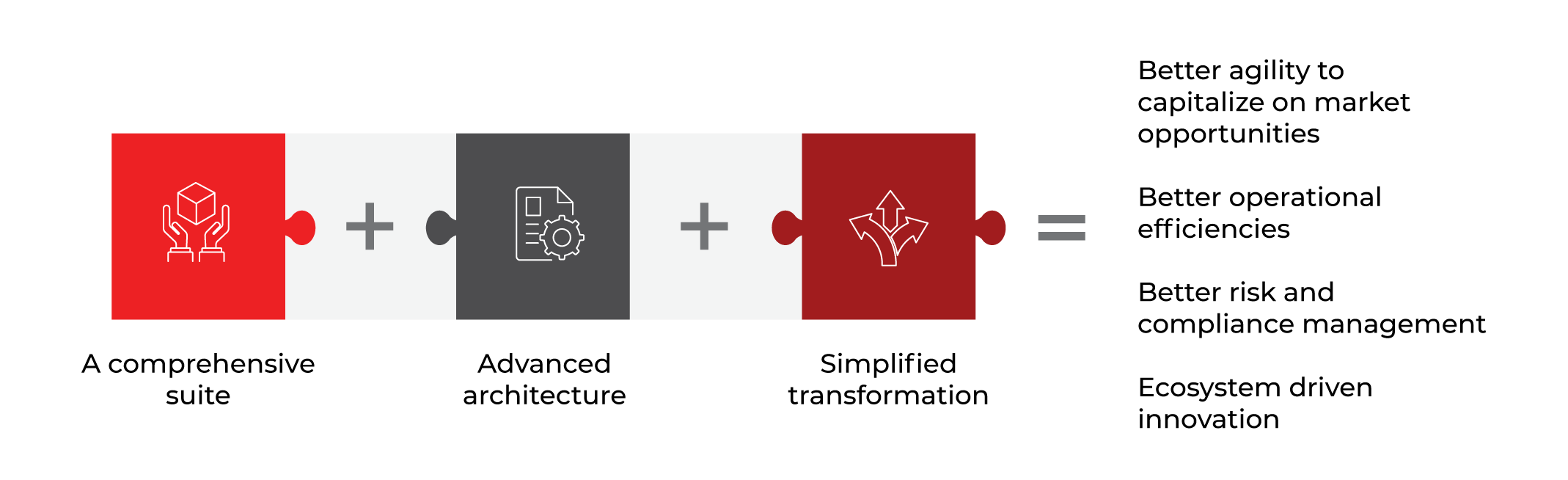

Finacle Trade Finance Solution Suite offers an expansive range of trade and supply chain finance products to enable banks and financial institutions accelerate their digital journeys. Built on an advanced architecture, the comprehensive componentized, multi-entity enabled solution suite is designed to unlock new propositions in trade finance business.

Our Promise

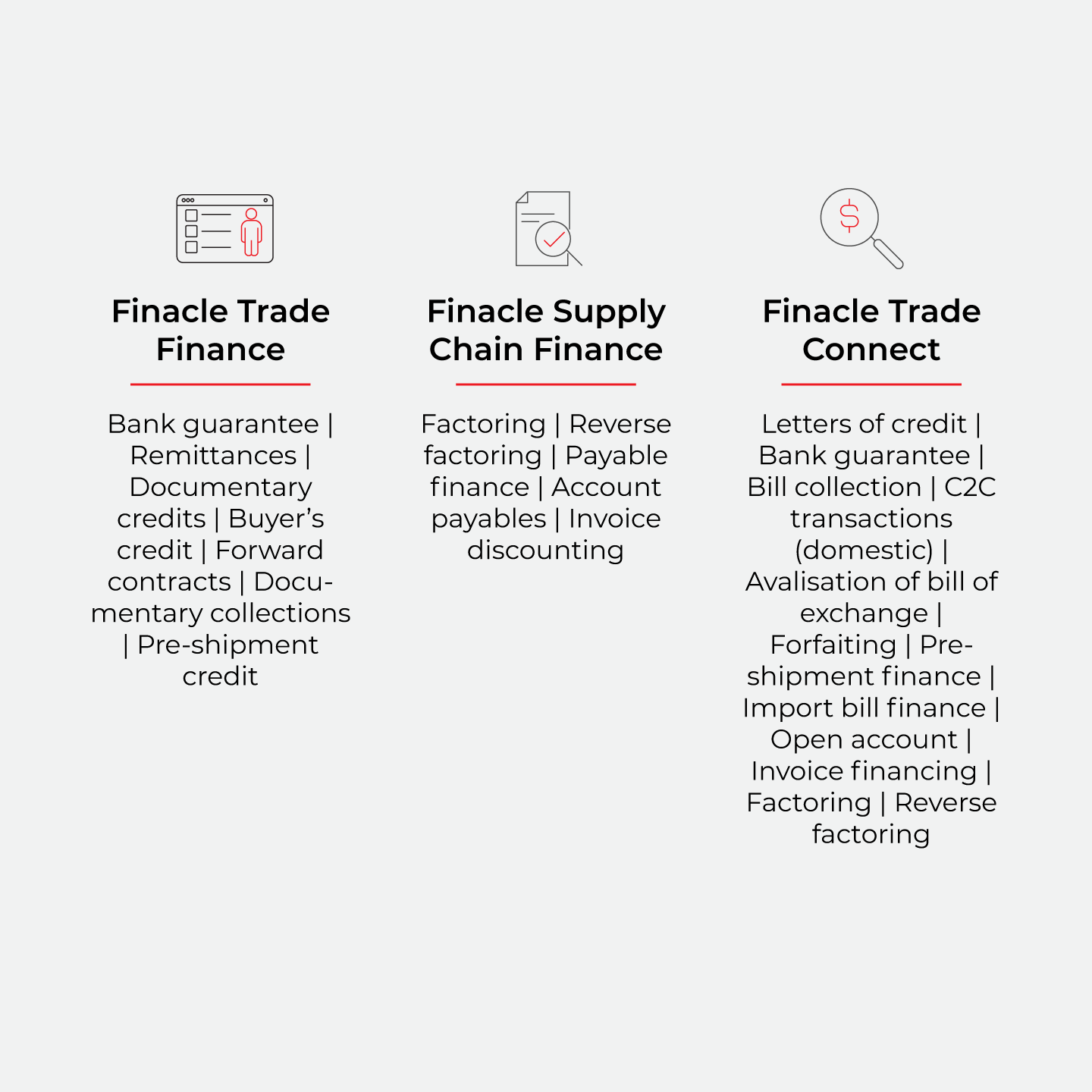

Future-Proof Your Business With a Comprehensive Componentized Suite

Finacle Trade Finance Solution Suite offers a wide array of trade and supply chain finance products along with a host of digital capabilities to automate the end-to-end business lifecycle. The suite also offers a blockchain-based solution to power inter-organization automation and drive ecosystem innovations. The solution offers the freedom to choose tailored products that match your bank’s business priorities, and the flexibility to decide when to deploy or upgrade a particular product.

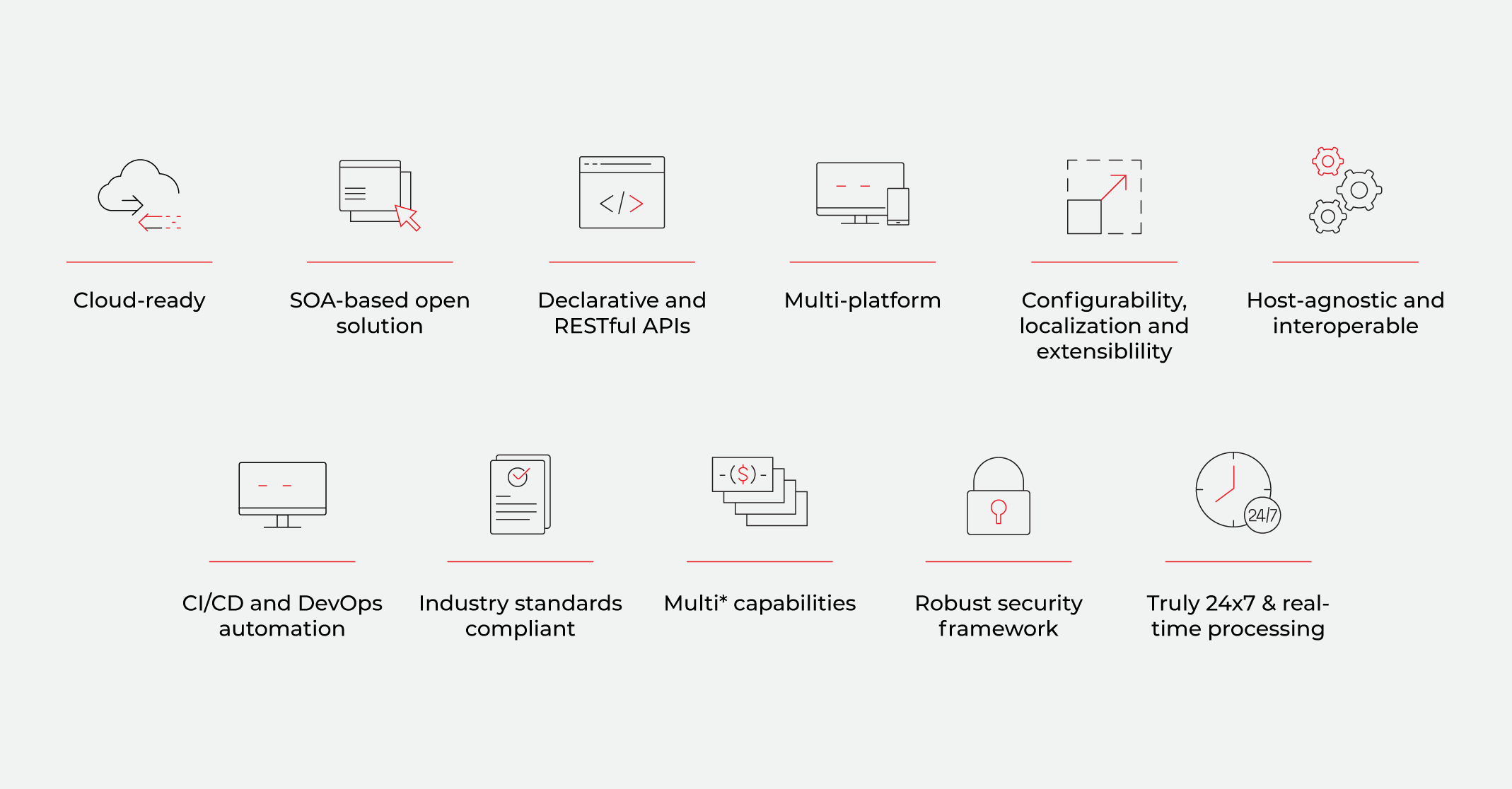

Advanced Architecture

Finacle Trade Finance Solution Suite Is Built on an Advanced Architecture and Enables Banks to Transform Trade Finance Business With Agility and Flexibility.

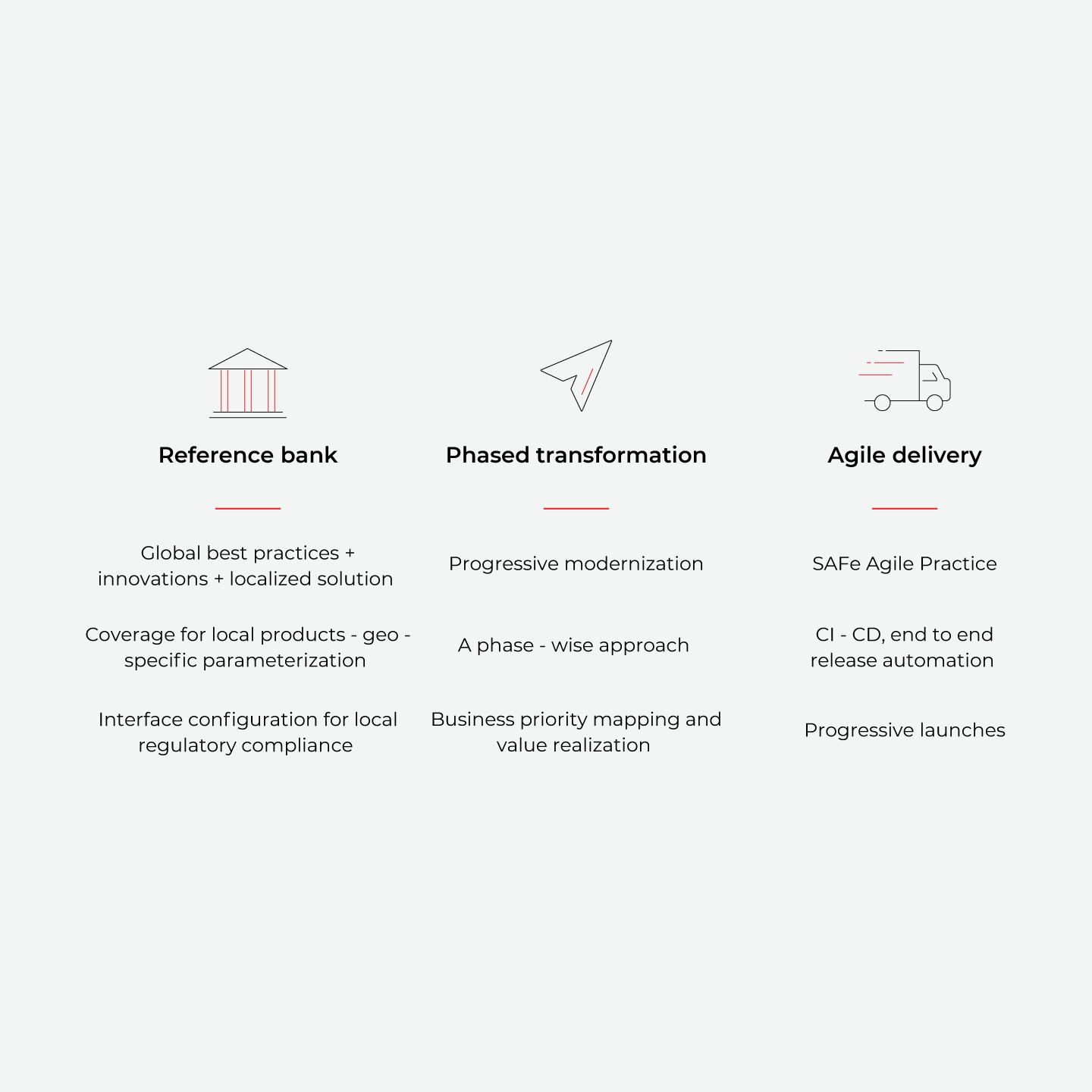

Simplified Transformation

Experience Agile, Risk-Mitigated Modernization

Whether it is a big bang switchover, progressive deployment, or complete overhaul, Finacle helps your bank transform at its own pace by simplifying transformation and minimizing risks.

Agility to Drive Excellence

Capitalize on Market Opportunities

- Expansive out-of-the-box product coverage to support emerging documentary and working capital finance opportunities

- Extensive parameterization and business user-driven customization to create fit-for-purpose products with minimal effort

- Finacle Scripting Studio – an extensibility toolkit to customize business rules, UI, processes, and reports

- Access to global innovation – best practices from trade finance implementations in over 65 countries, along with localization components

Better Operations

Drive Enhanced Efficiencies

- Enablers such as standardized text templates, unified instrument views, auto-parsing and data extraction capabilities to augment key processes

- End-to-end automation of funding and invoice realization processes – from request initiation to financing

- Full-stack, unified processing capabilities to manage a range of requirements such as margin, fees, and interest computations

- Integrated, secure, and scalable reporting engine for out-of-the-box standard reports, as well as custom reports

- Open APIs for ease of collaboration with partners, Fintech companies, corporate clients, and the extended developer ecosystem

Better Risk Management

Circumvent the Market Uncertainty

- Mitigate operational risks with extensive capabilities – audit trails, deal versioning, exception management, automated AML/CFT/KYC checks, 4 eye check, maker checker and more

- Rule based asset management and sophisticated limits management for adequate credit risk coverage

- Holistic compliance with global trade and payment standards to enable better interoperability between geographies, facilitate faster transactions

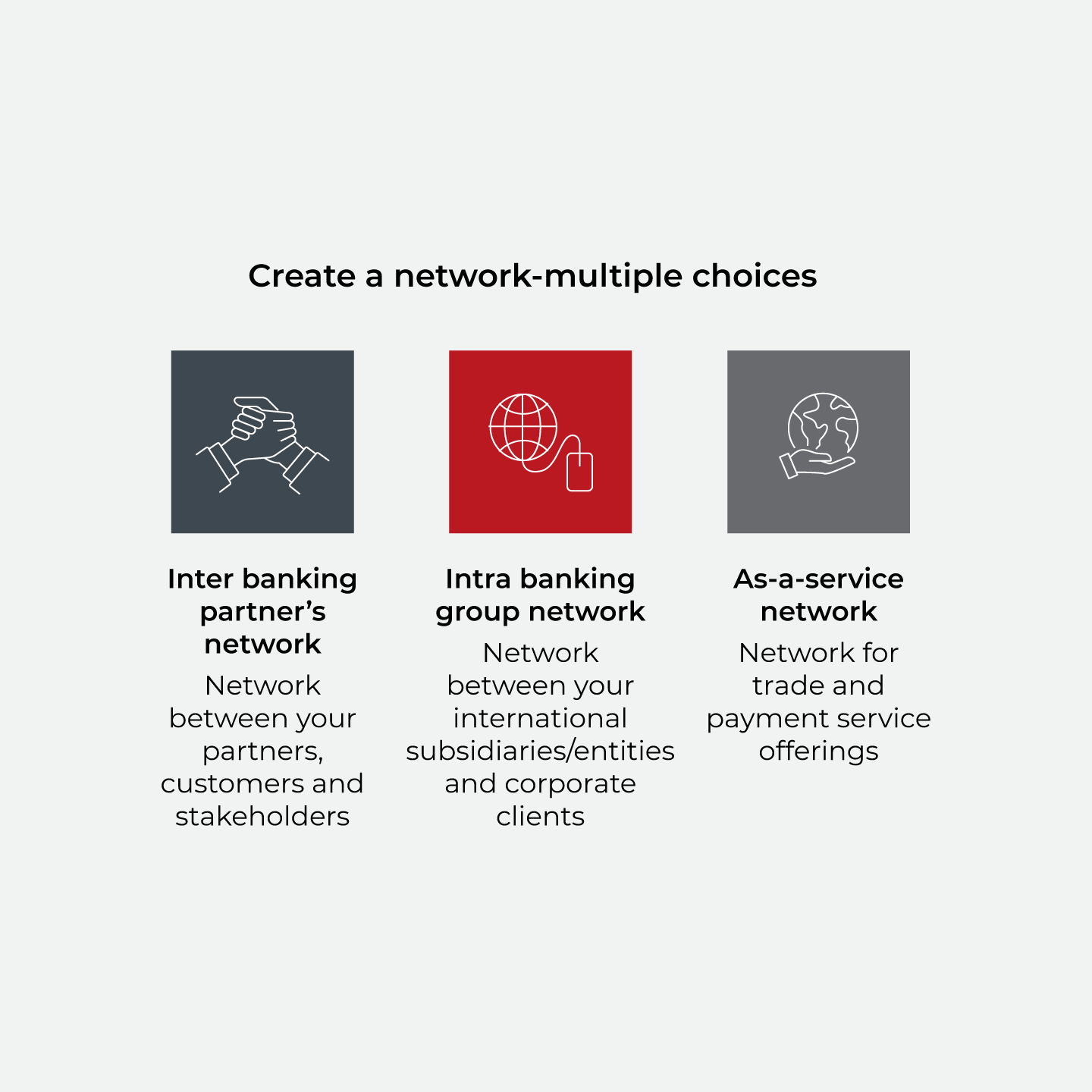

Ecosystem Driven Innovation

Power New Trade Finance Propositions With Blockchain

- Curate an inter-bank network to drive unprecedented efficiency and customer value

- Build an intra-group network to reduce cost, maximize speed, and gain operational efficiencies

- Drive a platform strategy and open new revenue streams with an as-a-service network

Infosys Finacle’s compelling vision and value proposition build on a strong track record in emerging technologies. Its comprehensive roadmap focuses on AI, blockchain, and green computing, and has achievable timelines… Infosys Finacle offers superior API capabilities and supports diverse banking services for retail, small and medium-size business (SMB), and corporate clients… It excels in real-time and event-driven architecture, leveraging robust technologies for data consistency, resilience, and security… Finacle’s Enterprise-Class Customer Data Hub delivers a unified view of the customer and feeds a comprehensive AI platform for training and deploying models with more than 40 use cases, including generative AI (genAI) bots… Customers consistently rate Finacle highly, praising its responsiveness, implementation support, and ability to understand and act on their business needs… they overwhelmingly emphasized the vendor’s strengths in functionality, performance, and support… Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support

– The Forrester Wave™: Digital Banking Processing Platforms, Q4 2024