Introduction

Finacle Online Banking is an advanced, cloud-native internet banking solution that helps banks onboard, sell, service and engage better. It offers comprehensive functionality and a tailored User Interface to retail, SME and corporate customers. The architecture promotes openness and collaboration through a number of APIs. Banks can leverage the application’s data and insights to deepen customer engagement.

Globally, banks are leveraging Finacle Online Banking to drive growth by acquiring customers, improving operational efficiencies, accelerating product rollout, and optimizing distribution and service costs.

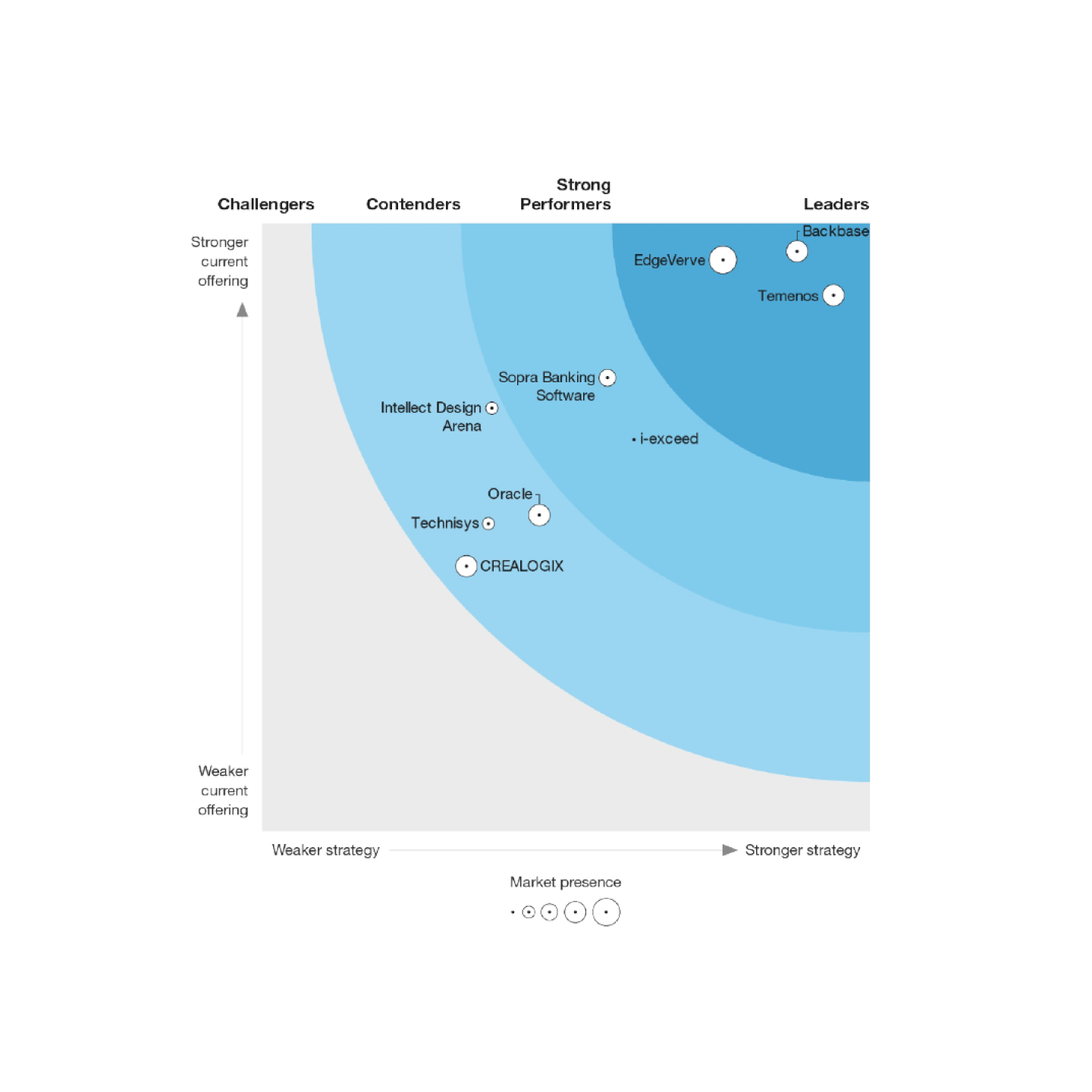

The Forrester Wave™: Digital Banking Engagement Hubs, Q3 2021

Learn Why Forrester Named

Finacle a Leader

“EdgeVerve excels with engagement infrastructure on a well-designed architecture… The solution comes with strong API management, offers broad and rich retail, business, and corporate banking services, and excels with its top-tier engagement infrastructure… EdgeVerve is a good fit for banks with a preference for custom-built apps seeking an advanced solution that can be melted into their existing infrastructure"

– Jost Hoppermann, Ex - VP and Principal Analyst, Forrester

A Great Experience For Every Customer

The world’s leading banks choose Finacle Online Banking to offer more than 350 features to their customers. Retail customers can transact safely and manage their finances online, while SMEs and corporates can do even more, such as manage liquidity and workflows.

With Infosys Finacle, we now have a strong digital suite that enables the bank to drive growth while providing an exceptional banking experience to our growing retail, SME, institutional and corporate customers... " – Kennedy Uzoka, Group Managing Director, UBA Group

Deeper Customer Engagement

Finacle Online Banking enhances digital engagement based on transaction data and insights, which banks may use to offer timely and contextual recommendations. It also helps banks to be more proactive while helping customers manage their finances.

Finacle’s digital banking suite of solutions have not only helped us improve the time to market for new products and services, but we have also seen about a 10% increase in loan origination over a period of 3 months... "– Somnath Menon, Ex- Group COO Al Ahil Bank of Kuwait"

Empower Digital Teams

Finacle Online Banking helps banks innovate faster by enabling their digital teams to efficiently manage their products, content, users and user entitlements. The solution supports centralized designing of customer journeys to accelerate rollout across touch points.

Learn how Sacombank, a leading headquartered in Vietnam, has leveraged the architectural strengths and rich suite of functional capabilities of Finacle to accelerate the launch of new products. With Finacle Online Banking, they were able to launch more than a dozen major functionalities in a short time.

In recognition, the bank has received many awards, including ‘Best Use of Online Banking’ and ‘Vietnam’s Favorite E-bank’.

Built on an Advanced Architecture

Finacle Online Banking is built on an advanced architecture. It is microservices powered, cloud-native and extensible, and integrates seamlessly with the existing applications of financial institutions. Finacle’s architecture promotes openness and collaboration through a vast catalog of APIs that banks can use to create new workflows and features and to co-innovate with external entities.

Learn how RBL bank has efficiently leveraged Finacle’s architecture to drive open API – led growth to become a preferred partner to many FinTech.

Keen on tapping new opportunities, the bank leveraged Finacle’s robust architecture to achieve 80% reduction in the time to onboard a new customer and 90% reduction in costs across digital channels.

Contextual Banking Experiences to Elevate CX

The ability to understand context and intent is critical while curating customer experience. With the help of Finacle Online Banking and embedded analytics, banks can contextualize their

Leading analyst firm, Ovum, compared ten Digital Banking solutions on sixteen criteria covering Market Impact, Technology and Execution. The Finacle Digital Engagement Suite emerged as a clear leader in this assessment. Finacle scored the highest among all vendors in Customer Experience, Security, End-User Adaptability, and Maturity & Scalability.