Introduction

Transform Corporate Cash Flow Forecasting

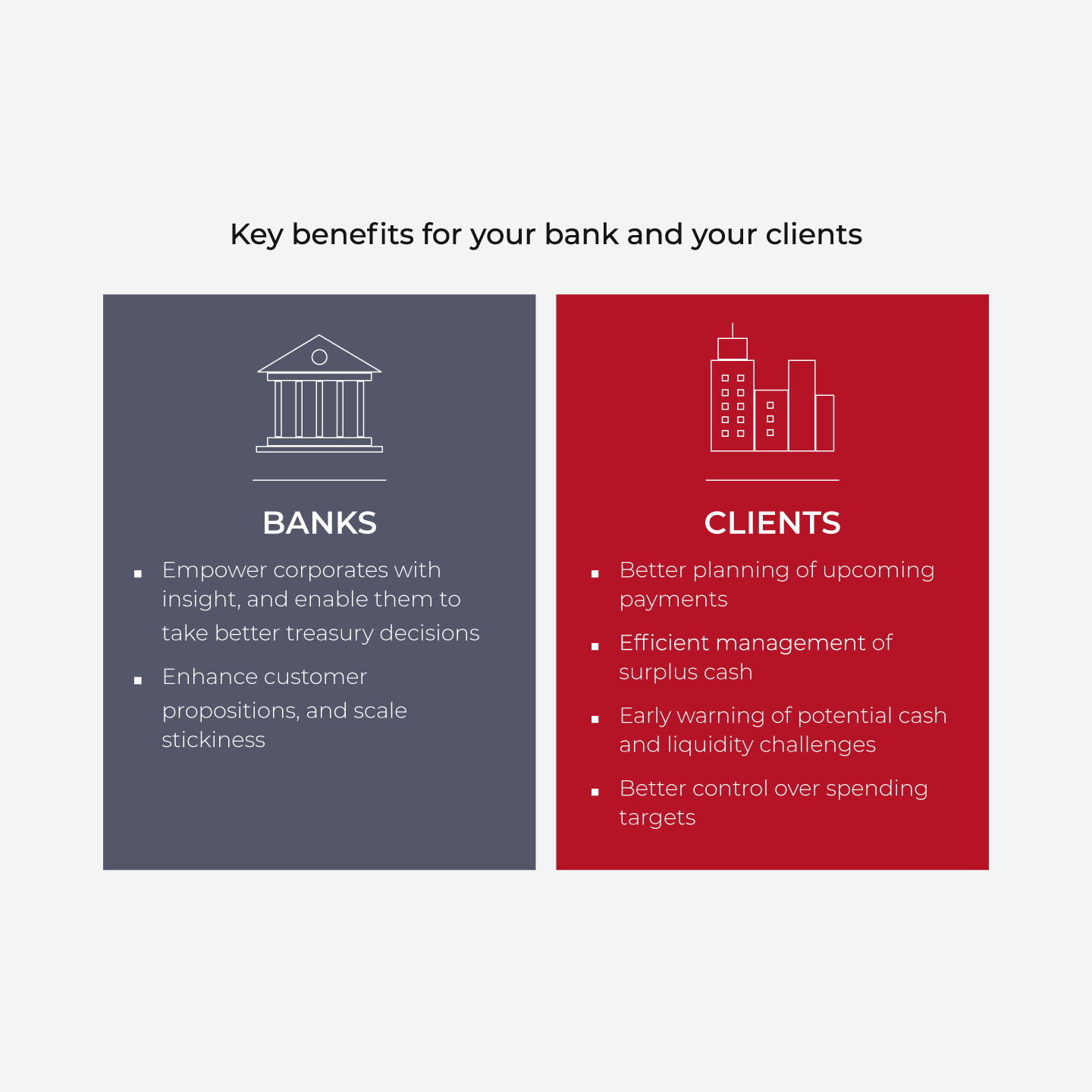

Finacle Cash Flow Forecasting is designed to digitally transform cash forecasting services of corporate banks worldwide. Powered by Finacle Insights, an advanced analytics platform built on a strong AI and ML foundation, the solution delivers granular insights both at account level, as well as for a host of transactions of interest to corporate clients.

Empower Corporate Clients With Dynamic Forecasting Capabilities

The advanced forecasting platform offers flexible options for generating forecasts at various time intervals, allowing corporate clients to create independent projections for cash inflows and outflows, which can be adjusted by region or role-based access, and consolidated for a comprehensive account view.

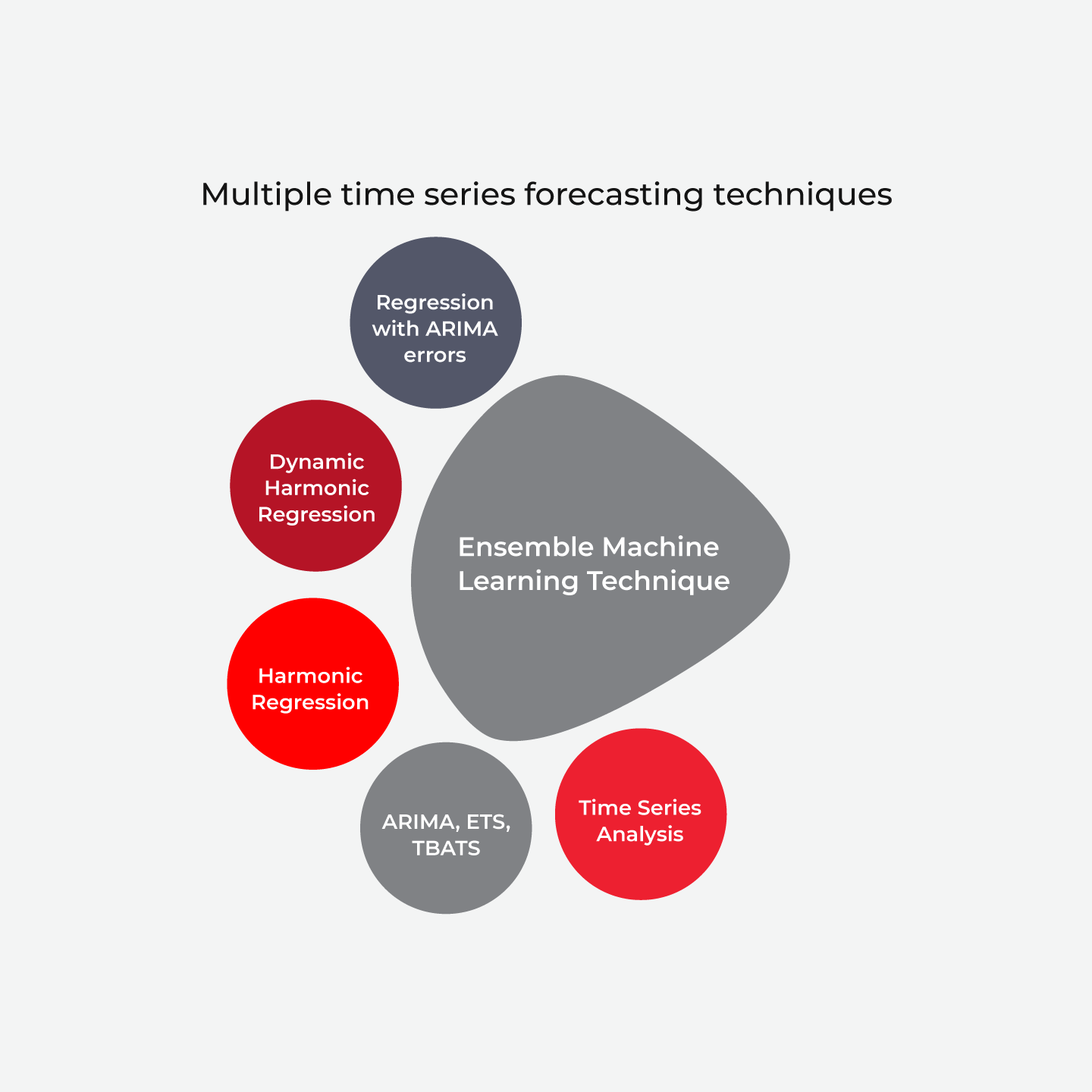

Drive Accurate Forecasts With Cutting-Edge Machine Learning Algorithms

Utilizing advanced analytical algorithms and machine learning, Finacle Cash Flow Forecasting enables precise predictions by leveraging a combination of time series techniques to accommodate various transaction patterns and frequencies. Seamless integration with corporates’ ERP/TMS systems ensures comprehensive capture of payables and receivables information, enhancing both forecast accuracy and model reliability.

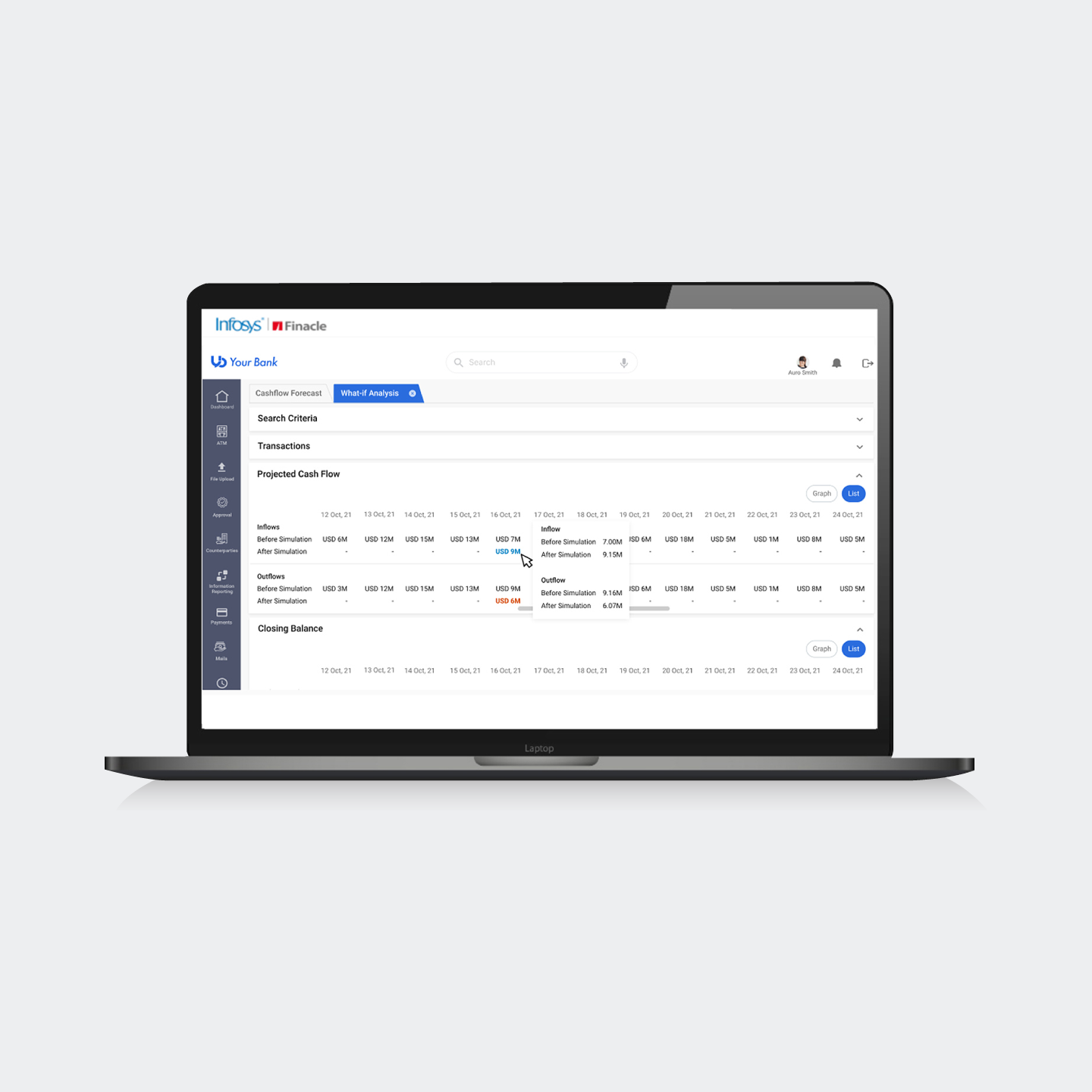

Enhance Your Customers’ Cash Operations With a Host of Configurable What-if Scenarios

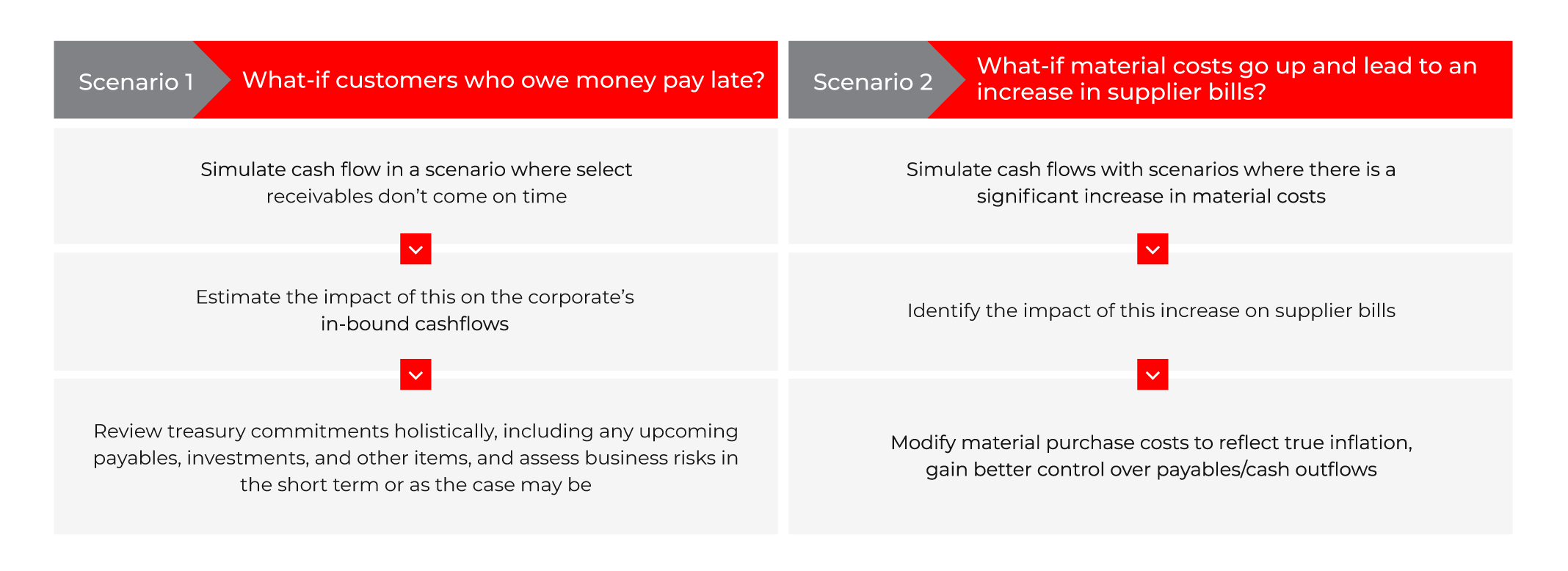

Finacle Cash Flow Forecasting empowers corporates with an integrated what-if analysis tool, enabling the simulation of forecasts for specific events and transactions. This versatile tool allows the creation of stress scenarios, facilitating in-depth analysis of their impact on cash flows and supporting effective treasury planning, providing data-driven insights for risk management and confident decision-making in a volatile market.

Illustrative What-if Analysis Scenarios

Enable Corporates Simulate Changing Business Conditions and Drive Cash Flow Predictability.

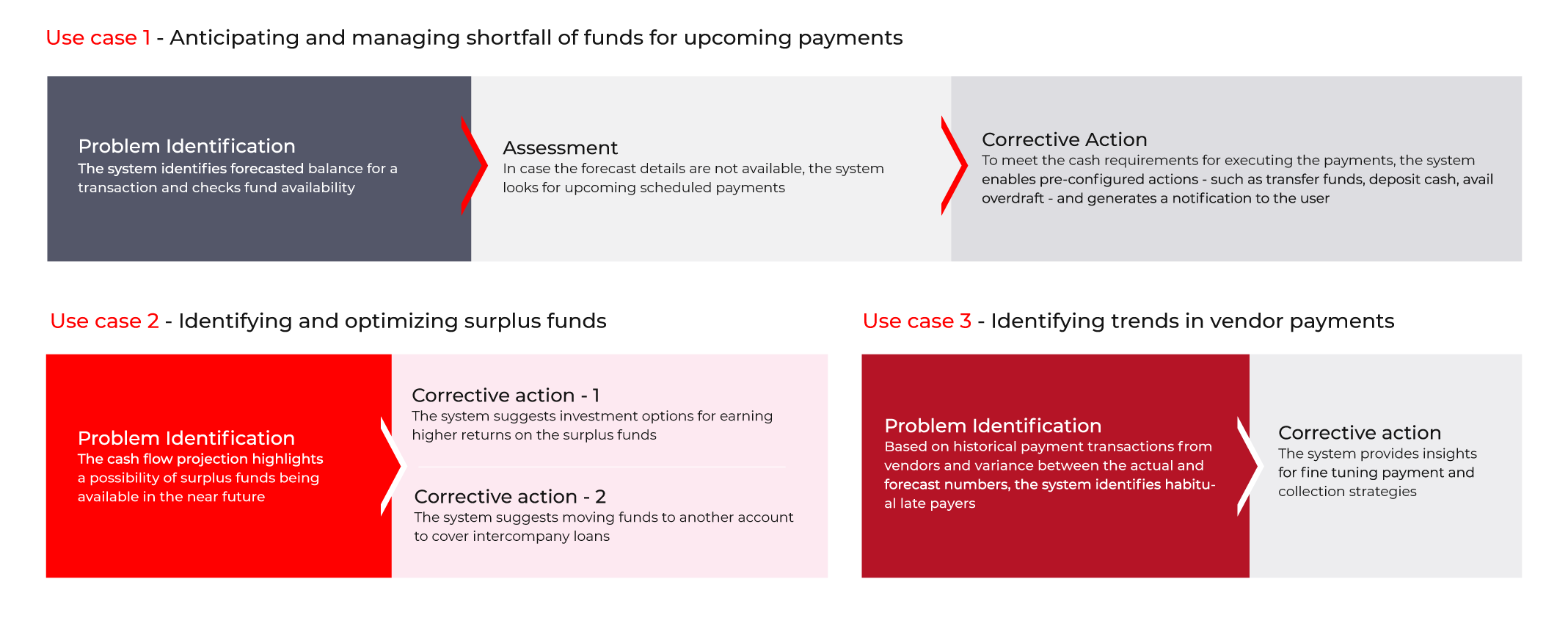

Cashflow Forecasting in Action

Identify, Analyze, and Optimize Cash and Liquidity