-

![]() ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More

ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More -

![Everest Group PEAK Matri Everest Group PEAK Matri]() Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More

Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More -

![]() Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

-

![]() Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More

Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More -

![]() Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More

Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More -

![]() Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

-

![]() Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More

Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More -

![]() Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More

Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More -

![]() Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

-

![]() Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More

Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More -

![]() Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

-

![]() Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More

Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More -

![]() A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More

A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More -

![]() Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Research Report:

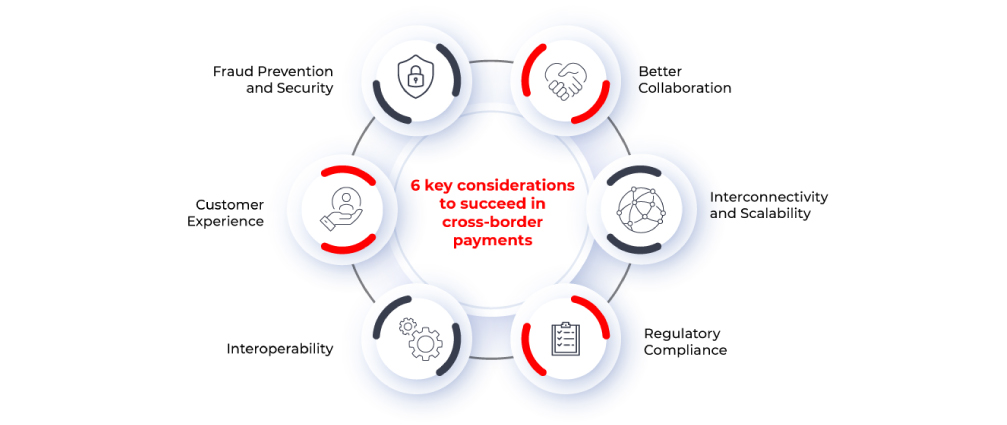

Cross-Border Payments - A Primer. The Report Delves Deep Into the Cross-Border Payments Landscape, Revealing the Immense Opportunity Awaiting Banks, Addressing

The Opportunity

The surging demand for swift, transparent cross-border transactions isn’t merely driven by ecommerce and retail remittances; it’s also fueled by corporations seeking efficient fund movements. Forbes projects the cross-border payments market to skyrocket to $250 trillion by 2027, propelled by robust trade, burgeoning travel and tourism, and steadfast G20 commitments.

- Cross-border e-comm will surpass $3.3 trillion by 2028 – Juniper

- 75% SMEs are planning to expand their international operations – Mastercard

- Cost of a $200 remittance is targeted to reach 3-5% – G20 commitment

- By 2030, the B2B cross-border payments market could reach $56.1 trillion – FXC

Seen together, these numbers paint a vivid picture of the opportunity for banks to become key players in this space.

Top 3 Issues Plaguing the Cross-Border Payments Industry

- High Cost - At 11.48%, banks are the priciest service providers

- Long Settlement Times - Anywhere between real-time to upto a few days

- Transparency - Swift surveyed 7000 consumers and small businesses and identified transparency as a crucial factor for low-value international payments

Outside of solving for these challenges, banks also need to stave off competition from fintechs, card networks, money transfer providers. Find out how

Real-Time Payments Proving Pivotal

Real-time payments (RTP) could prove to be the silver bullet that banks could embrace to succeed.

2 primary models that bear critical significance

Bi-lateral cross-border payments

- Several countries are linking their RTP systems through bilateral agreements.

- Linking national fast-payment systems to reduce intermediaries and lower money transfer costs.

- APAC leading the market.

Multi-lateral cross-border payments

- A multilateral platform spans multiple jurisdictions as a cross-border payment system.

- Complement or replace traditional correspondent banking relationships.

Finacle Payments

The cross-border payments offering from Finacle Payments is a cloud native, microservices driven, highly available and scalable platform; and supports all models of cross-border RTP and has been developed inhouse. We have wide experience assisting banks in their cross-border payments journey.

- Successfully helped banks complete their cross-border payments through SWIFT on CBPR+ MX journey.

- As part of the bi-lateral cross-border payments infrastructure; Finacle Payments is live on rails such as Hong Kong cross-border and is ready for Australia NPP cross-border payment.

- Supports infrastructure for other bi-lateral models such as UPI-PayNow, PromptPay-DuitNow etc.

- Multilateral cross-border networks like SEPA Credit Transfers, SEPA Direct Debits, SEPA Instant, Target 2, TIPS implemented for clients.

- Infrastructure can support cross-border frameworks such as GCC BUNA, BIS Nexus, Visa B2B, Visa Direct, Mastercard Send, Partior, Ripple etc.

©2025 -Edgeverve Systems Limited | All rights reserved