-

![]() Quantum Computing: As the Future Awaits, The Strides Are DefinitiveQuantum computing is no longer confined to theory or the edges of experimental science - it is rapidly advancing toward practical impact.Read More

Quantum Computing: As the Future Awaits, The Strides Are DefinitiveQuantum computing is no longer confined to theory or the edges of experimental science - it is rapidly advancing toward practical impact.Read More -

![IDC IDC]() IDC MarketScape: Worldwide Integrated Bank PaymentFinacle Payments is an enterprise payments services system that manages end-to-end payments across instrument types, payment schemes, transaction types, customeRead More

IDC MarketScape: Worldwide Integrated Bank PaymentFinacle Payments is an enterprise payments services system that manages end-to-end payments across instrument types, payment schemes, transaction types, customeRead More -

![]() Supply Chain FinanceToday, as businesses seek to make their ecosystems more resilient, Supply Chain Finance (SCF) has emerged as a powerful lever for banks and financial institutions to support clients, while unlocking new revenue streams.Read More

Supply Chain FinanceToday, as businesses seek to make their ecosystems more resilient, Supply Chain Finance (SCF) has emerged as a powerful lever for banks and financial institutions to support clients, while unlocking new revenue streams.Read More

-

![]() The Future of Core Banking: Business and Technology EvolutionOur point of view paper, “The Future of Core Banking: Business and Technology Evolution”, serves as a candid and forward-looking benchmark of your institution’s readiness—and a strategic playbook for core modernization.Read More

The Future of Core Banking: Business and Technology EvolutionOur point of view paper, “The Future of Core Banking: Business and Technology Evolution”, serves as a candid and forward-looking benchmark of your institution’s readiness—and a strategic playbook for core modernization.Read More -

![The Forrester Wave The Forrester Wave]() Forrester Wave Digital Banking, Q4 2024Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support.Read More

Forrester Wave Digital Banking, Q4 2024Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support.Read More -

![]() Driving Comprehensive Revenue ManagementDiscover why revenue management must evolve into a comprehensive, strategic capability. Decode a blueprint to overcome challenges and unlock sustainable monetization.Read More

Driving Comprehensive Revenue ManagementDiscover why revenue management must evolve into a comprehensive, strategic capability. Decode a blueprint to overcome challenges and unlock sustainable monetization.Read More

-

![]() Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More

Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More -

![]() Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More

Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More -

![]() Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

-

![]() Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More

Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More -

![]() Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

-

![]() Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More

Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More -

![]() A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More

A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More -

![]() Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

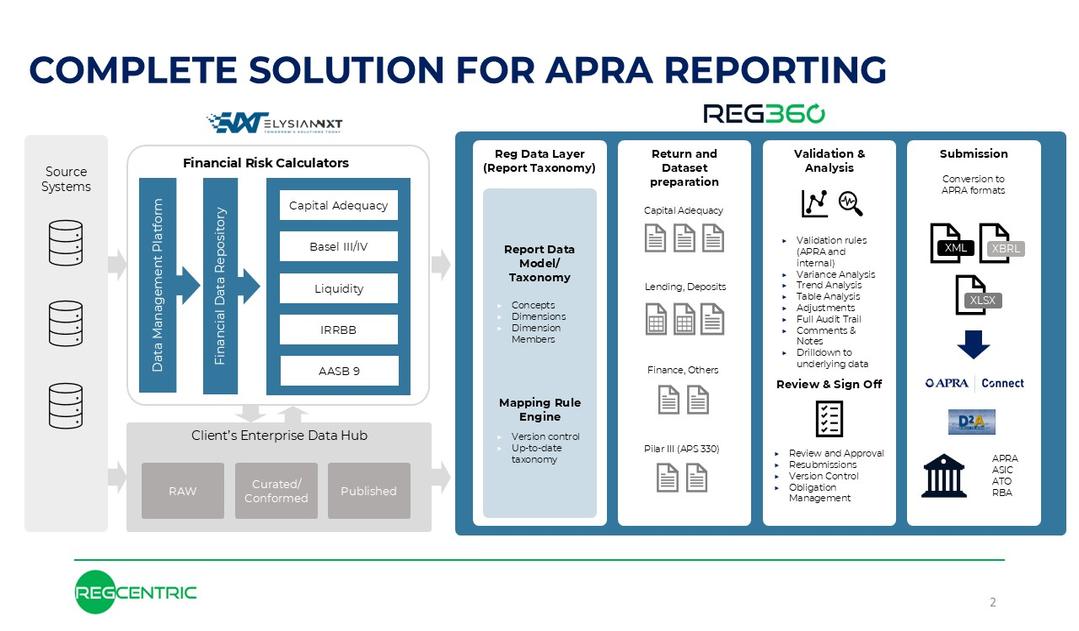

Overview

Reg360 simplifies regulatory reporting with seamless collaboration, automation, and governance. Designed for the big data era, it integrates enterprise datasets, reduces costs, streamline processes, and enables efficient data analysis.

App Screens

Features

Simplified reporting

Our reporting engine uses taxonomies and a data allocation tool to streamline data transformation and aggregation. This design reduces report configuration and production time by up to 90% compared to traditional methods.

Streamlines reports for any financial institution

Reg360 supports any structured report. Used by banks, wealth funds, and insurers in Australia, it leverages XBRL for global reuse and consistency. It also supports BCBS Pillar 3 disclosures, making it suitable for BIS-regulated entities.

Integrated collaboration and control features

Reg360 includes collaboration, workflow, and control (e.g., commentary, documentation, data lineage, review, and sign-off), enhancing transparency and improving governance and control over data and regulatory submissions.

Benefits

Simplifies reg reporting with real-time solutions.

Cut reporting time by 80-90%, reducing regulatory burden.

Reg360 improves efficiency with collaborative workflows.

Clients reduce project implementation time by 60-70%.

Built-in tools provide quick insights beyond compliance.

Reg360 detect anomalies, improving report accuracy.

Reg360 provides best in class governance and controls.

Related Apps

Loxon IFRS Provision Calculation Engine

A comprehensive solution for automatic calculation of impairment, Expected Credit Loss as per IFRS 9 regulations and country specifics, and the related risk (PD, LGD, etc.) and accounting (amortised cost, fair value, effective interest rate) figures.

Read More

©2026 -Edgeverve Systems Limited | All rights reserved