About the Event

Annual Convention of Thrift Banks Philippines 2025

Date: 15 July, 2025

Time: 08:00 – 17:00

Venue: Dusit Thani Manila, Makati City

Booth: 22

Infosys Finacle will be participating as the Gold Sponsor at the Annual Convention of Thrift Banks Philippines 2025.

The event is an annual gathering organized by The Chamber of Thrift Banks (CTB), the umbrella organization of the country’s 36 thrift banks which collectively have over 2,500 branches across the country. Over 200 senior leaders, including Bank Owners, Board of Directors, CEOs, COOs of its member banks are expected to attend this annual event, apart from dignitaries from the Central Bank. This year’s convention theme is – Resilience in Hybrid Banking

Meet the Finacle team at Booth #22, to explore the Finacle as a Service for Philippines, tailored for Filipino Thrift and Rural Banks.

Explore the Finacle as a Service for Philippines Platform

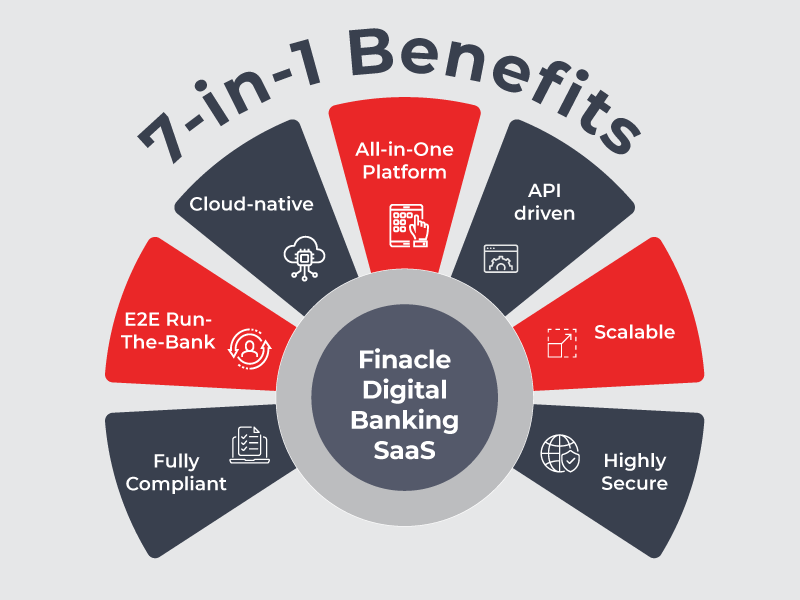

Finacle as a Service for Philippines is a cloud-native, API-driven platform designed to help Philippines banks accelerate their digital transformation. With a comprehensive, bundled offering that’s fully compliant and secure, Finacle enables rapid deployment—go live in just 3 months using the proven Reference Bank model tailored for local needs. Backed by end-to-end support and built for scale, the solution empowers banks to innovate with confidence. Join a global community of over 150 thrift banks already thriving with Finacle. Key benefits: Expand reach, increase customer stickiness, and collaborate to innovate in a fast-evolving digital banking landscape.

Gallery