About the Event

Smart Banking Summit 2024

Infosys Finacle is a digital transformation partner at the Smart Banking Summit 2024 happening in Hanoi, Vietnam on 9 October. Meet us to learn how you can accelerate your digital transformation journey.

Event website: https://bankingsummit.vn/2024/

ROUNDTABLE: ‘Next-Gen Now: Transforming Banking in Vietnam’

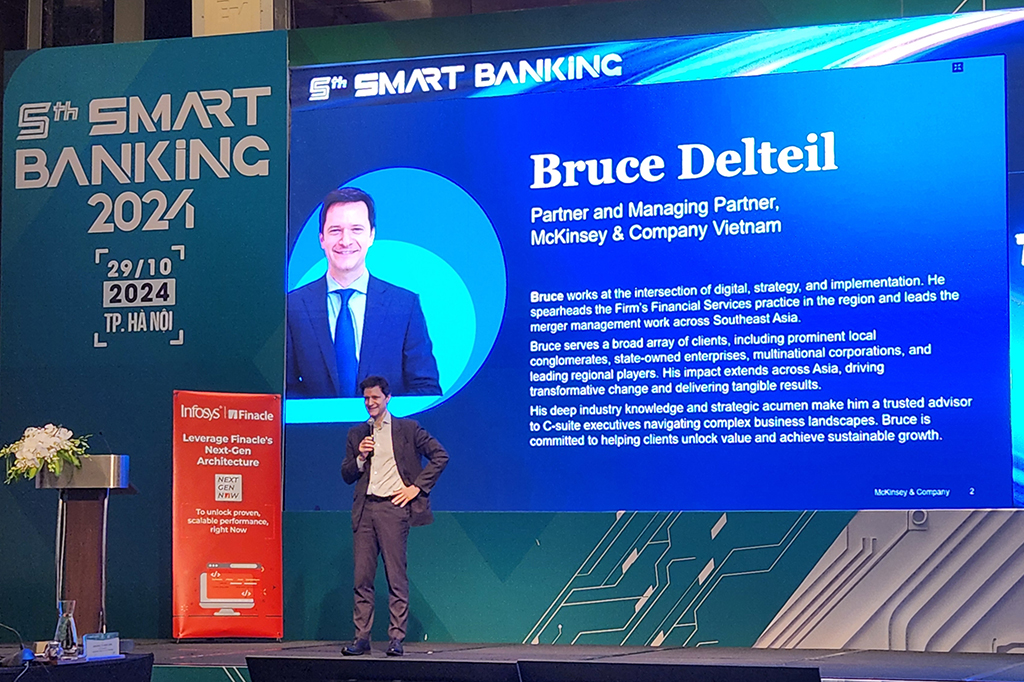

Alongside the event, Finacle will also be hosting an executive roundtable titled – ‘Next-Gen Now: Transforming Banking in Vietnam’, jointly with the State Bank of Vietnam, and co-organized by the Vietnam Bank Association, and IEC Group, on 28th October, between 2:30 PM – 5:00 PM. This invite-only roundtable will have participation from 30 CXOs and banking leaders from the leading banks in Vietnam, along with guest speakers from McKinsey.

The roundtable will facilitate exchange of ideas on key trends, technologies and transformation strategies to stay relevant and thrive in this customer-centric digital era. Gain insights on Next-Gen banking and learn how your bank leverage the power of modern technologies to be more innovative, efficient, and future-ready.

Discussion Topic 1: Next-Gen Now: Core Digitization Simplified

In today’s fast-paced banking environment, legacy core systems are no longer sufficient to meet rising customer needs. To be a progressive bank, one requires a core that is not just resilient and scalable but also agile enough to co-create tailored products with ecosystem partners. Let’s discuss what it takes to be a next-gen bank.

- Limitations with traditional core banking platforms: Which are the biggest limitations of legacy core banking platforms and how does it affect the overall growth for a bank?

- Insights-driven banking, powered by data and AI: How can your bank effectively harness real-time data for delivering personalized customer experiences and assist more informed, timely decision-making?

- Cloud-models: What should be the key considerations while choosing a cloud model, to facilitate scalability and driving cost efficiency

- Migrations: Tips and success factors that make migrations easy, seamless and risk free.

Discussion Topic 2: Recomposing Banking to Achieve Agility & Resilience at Scale

A fully composable digital banking solution gives a bank several advantages, including the flexibility in modernization, ability to leverage best of breed capabilities, and a big boost in speed of innovation across products and services. Let’s discuss how composability can empower your bank.

- Modernization through composability – How to strike the right balance between modernizing legacy systems and integrating composable solutions without disrupting ongoing operations?

- Speed of innovation and time-to-market – Ways to harness the power of composability to reduce time-to-market for innovative products and services? What internal and external factors impact this agility?

- Resilience through modularity – How can composable architectures help banks enhance resilience at scale? What are the potential pitfalls to be away about?

Gallery