Introduction

Keep Your Customer Updated With Notifications and Alerts

Finacle Alerts is a comprehensive solution that enables banks to send real-time notifications to their customers, keeping them informed about their account activities. The solution offers a wide range of customizable alerts that can be sent through multiple channels, including SMS, email, and mobile notifications.

With Finacle Alerts, banks can provide their customers with a personalized and proactive banking experience, enhancing customer satisfaction and loyalty. The solution also helps banks reduce the risk of fraud and improve their operational efficiency by automating the alert process. Finacle Alerts is a powerful tool that helps banks stay ahead of the competition by delivering exceptional customer service.

Finacle Promise

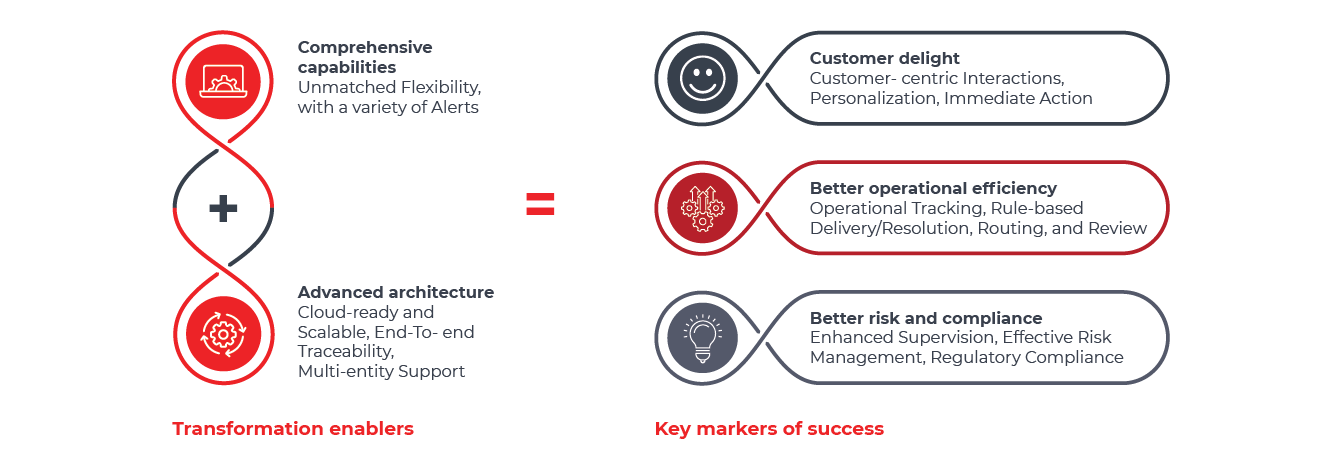

Comprehensive Capabilities

Empowering You to Do More.

The solution empowers banks to provide multi-channel alerts to customers about transactions and events recorded by the bank’s diverse business systems. It can provide alerts for the bank’s internal users as well.

The key features of the solution are –

Advanced Architecture

Built on the Principles of Interoperability and Openness for Collaboration.

Enhanced Customer Delight

- Improved customer experience for ease of banking such as – rent alerts, bill payment, suspicious activity alerts

- Customers desired personalization for various events like Do Not Disturb (DND) set up no alerts

- Actionable alerts for timely action by the customer like Insurance premium, trade finance approvals, credit card payments

Increased Process Efficiencies and Collaboration

- Helps collaborate seamlessly with the bank’s many business engines, optimizing process time and responsiveness to customer imperatives

- Provides flexibility to assign priority to events, channels, and modes of execution

- Track failures such as undelivered alerts and reroute notifications through alternate modes for uninterrupted service

Better Risk and Compliance

- Control center view to perform inquiries on exceptional activities like suspicious transactions, abnormal spending

- Effective risk management by notifying users of customer data risk alerts like KYC compliance, transaction monitoring

- Enable banks to comply with diverse customer-related regulatory requirements, including opt-in/opt-out consent and data privacy