Reimagine Custody for the Digital Age

The Finacle Custody Management is a containerized, cloud-ready solution that enables financial institutions to efficiently and securely manage client assets across the entire capital markets.

Supports banks and asset managers with scalable, automated processes for trade processing, clearing and settlement, custody administration, and corporate actions management. With robust functionality and real-time insights, Finacle empowers institutions to securely manage a diverse range of assets including stocks, bonds, mutual funds, and structured products, with precision and compliance.

By streamlining operations and minimizing risks, organizations can deliver superior client service, achieve operational excellence, and focus on strategic growth in a dynamic financial market environment.

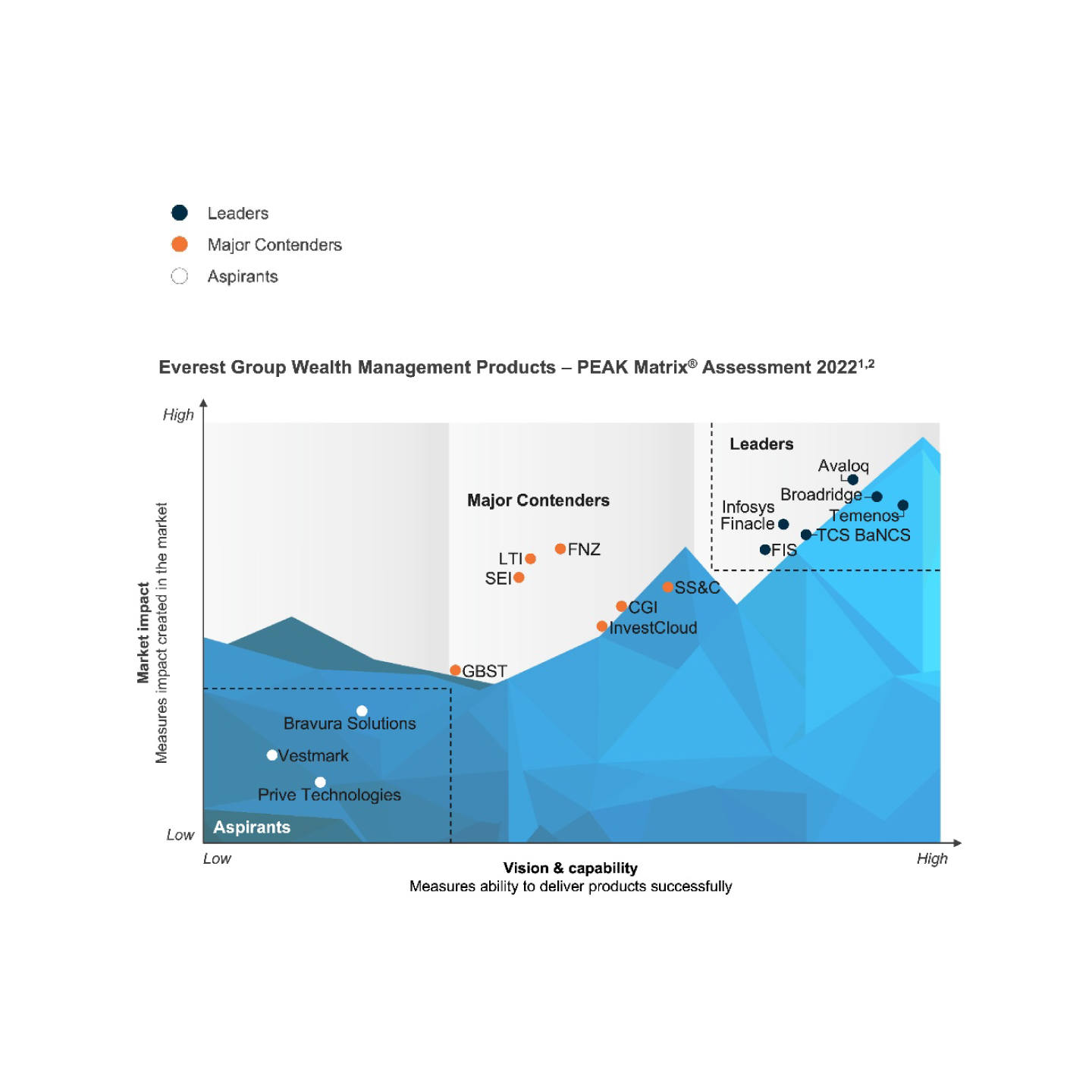

Market Benchmarking

Everest Group Peak Matrix® for Wealth Management Products Provider 2023

Infosys Finacle is rated a Leader among 16 wealth platform providers. Get detailed insights on the capabilities and strengths of the Finacle Wealth Management Solution and why top banks like DBS and Axis Bank trust us to drive their success.

Kriti Gupta, Practice Director, Everest Group – “Dedicated focus on enabling technology capability via detailed dashboards, client portal, analytics processing, and 360-degree view of customers along with well-established presence in Asia and the Middle East, have helped Infosys Finacle secure a positioning as a Leader in Everest Group’s Wealth Management Products PEAK Matrix® Assessment 2023.”

Feature Rich Solution

Advanced capabilities for efficient asset and transaction management

- Seamlessly manage custody accounts with client onboarding, trade processing, corporate actions, reconciliation and reporting.

- Simplify data management with a single source for assets, pricing, clients, transactions, and market entities.

- Automate post-trade capture, clearing, and settlement for accurate, timely, and compliant processing.

- Supports flexible custody fee with AUM-based calculations, customizable billing, rule-based configurations on asset class, and automated invoicing.

- Automate the full corporate actions lifecycle from event setup, notifications, to confirmation, allocation, and settlement.

- Enables reports and automated alerts to support monitoring, decision making, and customer service.

One of the largest banks in Oman, leverages Finacle Wealth Management to efficiently manage its custody operations for trust accounts and funds, with support for multiple fee models and comprehensive asset administration. The platform is expected to enable accurate fund accounting, NAV calculations, investor management, and transparent reporting. With streamlined workflows and flexible revenue models, the bank aims to reduce risks, enhance transparency, and strengthen client servicing.

Next-Gen Architecture

Empowered by a resilient and agile platform

- Scalability with cloud-ready, elastic design for growing business demands.

- Modular flexibility through a componentized, plug-and-play framework.

- Seamless integration with platform-agnostic design across financial systems.

- Multi-capability supporting multi-currency, multi-lingual, cross-border operations.

- 24/7 processing for continuous, real-time global transactions.

One of the oldest commercial banks in Greece, has selected Finacle to transform its wealth, private banking, and custody services through a single, flexible platform. With the advanced RM/Advisor Workbench, relationship managers will be empowered to deliver personalized, compliant advisory services, helping the bank advance its private banking vision in Greece. Furthermore, by leveraging the platform’s Fund Custody capabilities, the bank aims to strengthen its licensed custody business.

Unveiling Key Benefits

Drive growth with streamlined operations and enhanced security

- Boost operational efficiency through streamlined automation and intelligent reconciliation, ensuring faster and accurate processing.

- Enhance client experience with real-time alerts and personalized insights, enabling timely actions and fostering stronger trust.

- Achieve scalability and flexibility with broad asset class coverage and global readiness, allowing banks to expand services while meeting regulatory requirements.

- Strengthen risk mitigation by continuously monitoring and safeguarding client assets to minimize risks of fraud, loss, or errors.

- Improve transparency with real-time reporting, portfolio insights, and transactions to drive smarter decisions and stronger engagement.