Introduction

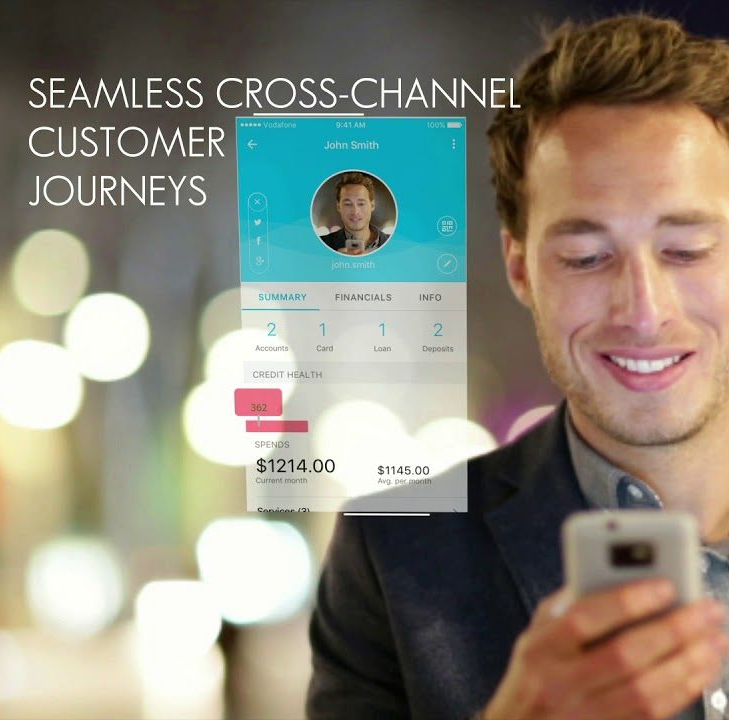

Power Seamless Engagement Across Channels

The Finacle Digital Engagement Hub is a comprehensive system of engagement that delivers insights-driven and personalized customer experiences across applications, devices, and channels. It integrates seamlessly with back-end systems such as core banking, trade finance, and payments, along with channel applications including mobile banking, branch, and chatbots. The hub offers capabilities to design customer-centric processes, ensure consistent cross-channel journeys, and use a robust set of APIs to support tailored experiences.

Compatible with both Finacle and non-Finacle applications, it provides flexibility in IT strategy design. Embedded analytics and a unique engagement architecture enable contextual interactions. Banks can deploy the hub independently or integrate it with other Finacle channel solutions, helping institutions leverage open banking and deliver smarter, seamless omnichannel engagement for accelerated digital transformation.

Comprehensive Features

Comprehensive Capabilities Powering Digital Engagement

Customer-Led Engagement Architecture

Supports contextual experiences, robust cross-sales and nudges for financial well-being. By leveraging customer data, it delivers hyper-personalized, human-centric engagement.

Channel Administration

Centralizes channel rules and processes across assisted and self-serve channels. It allows banks to define controls on features, limits, and authentication for both corporate and retail customers.

Context Manager

Enables a seamless cross-channel experience for customers. By linking users and external systems, it ensures continuity across devices, enabling smooth cross-channel customer journeys.

Preferences and Entitlements

Enables personalization of channel experiences and manages user entitlements. Banks can configure access to accounts, reports, and corporate-specific rules like approvals and divisions.

Transaction and Service Administration

Configures and designs transaction and service experiences across channels. It manages rules for transaction types, payees, network setup, holidays, and supports service requests and approvals.

Open API-driven Design

Enables innovation inside the bank and partner ecosystem. Supported by advanced SOA architecture, it ensures consistent functionality across channels.

Next-Gen Technology

Next-Gen Technology for Future Ready Banking

Banks need a firm foundation of open platform and modern technology stack to take full advantage of evolving digital technologies. The Digital Engagement Hub helps banks keep pace with technological change as well as future-proof investments with easy and componentized upgrades.

Cloud-Native

Open API-Led Innovation

Integration Capabilities, Host Agnostic

Low Code / No Code

Decoupled UI Interactions

Reusable Custom Components

Metadata Driven Design

Massive Scalability

Extensive Security Considerations

Success Stories

Delivering Meaningful Impact For Clients Worldwide

A leading Canadian financial institute harnesses data-led insights to deliver frictionless, personalized experiences, boosting customer satisfaction and retention.

A large banking group in ANZ leverages Finacle Digital Engagement Hub to process over a billion NZD business and enables insights-driven personalized customer experiences.

One of the market leaders in Ireland transforms its digital customer engagement for retail and SME customers.

RAKBANK leverages Finacle to drive seamless and consistent cross-channel interactions and enable API-led innovations.

A leading bank in Thailand becomes a next-generation consumer digital bank with Finacle, offering personalized experiences and smooth cross-channel engagement.

State Bank of India enhances customer experience with a new mobile app delivered in a record time of 2.5 months.

Reimagine Banking With a Unified Engagement Hub

The core promise of the Finacle Digital Engagement Hub is to enable banks to drive deeper customer engagements, openness and agility for innovation-led growth, and digital operational excellence.

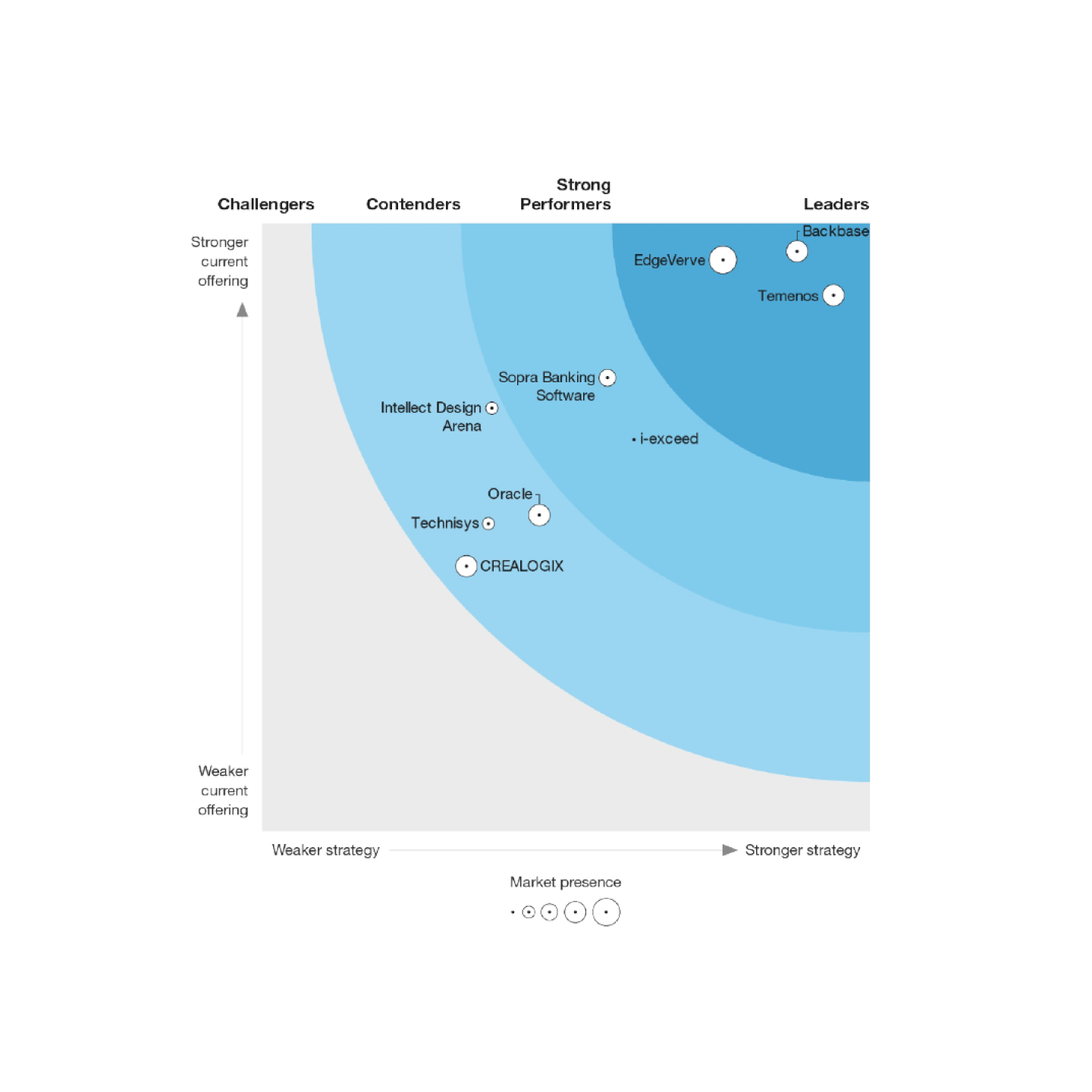

The Forrester Wave™: Digital Banking Engagement Hubs, Q3 2021

Learn Why Forrester Named Finacle a Leader

“EdgeVerve excels with engagement infrastructure on a well-designed architecture… The solution comes with strong API management, offers broad and rich retail, business, and corporate banking services, and excels with its top-tier engagement infrastructure… EdgeVerve is a good fit for banks with a preference for custom-built apps seeking an advanced solution that can be melted into their existing infrastructure"

– Jost Hoppermann, Ex - VP and Principal Analyst