Overview

Reimagine margin lending for the digital age

Finacle Margin Finance is a cloud-native solution that optimizes margin operations, empowering banks and investors with superior flexibility and efficiency. Future-ready and innovative, the platform enables institutions to serve diverse customer needs with a comprehensive suite of financing models including collateralized and non-collateralized portfolio financing, along with security-backed lending.

The solution seamlessly integrates with your bank's digital ecosystem, ensuring interoperability with core banking, wealth management, and customer engagement platforms to drive operational excellence. With its multi-currency investment capabilities, clients can capitalize on global market opportunities, enabling banks to lead with agility in in an ever-evolving financial landscape.

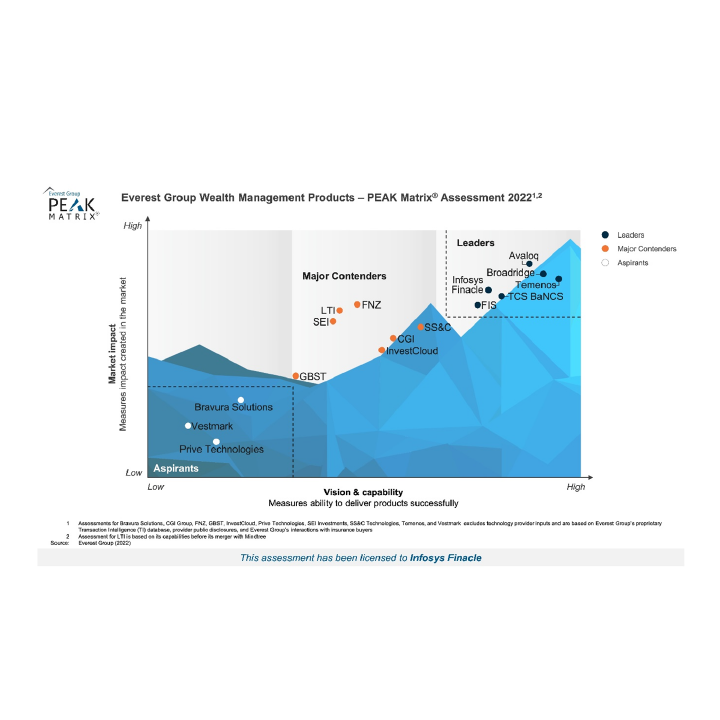

Market Benchmarking

Everest Group PEAK Matrix® for Wealth Management Products Provider 2023

Read this report to learn why Infosys Finacle is rated a Leader among 16 wealth platform providers. Get detailed insights on the capabilities and strengths of the Finacle Wealth Management Solution and why top banks like DBS and Axis Bank trust us to drive their success.

Kriti Gupta, Practice Director, Everest Group – “Dedicated focus on enabling technology capability via detailed dashboards, client portal, analytics processing, and 360-degree view of customers along with well-established presence in Asia and the Middle East, have helped Infosys Finacle secure a positioning as a Leader in Everest Group’s Wealth Management Products PEAK Matrix® Assessment 2023.”

Feature Rich Solution

Simplify financing with intelligent and flexible capabilities

- Smart administration framework

Customizes operational parameters, including customer schemes, fees, security controls, collaterals, and support cross-border lending. - Seamless account management

Offers flexible margin account management with collateral mapping, customization for clients, and account lifecycle management. - Diverse financing models

Provides collateralized financing for liquidity, non-collateralized financing based on portfolio value, and security-level asset-based lending. - Streamlined transaction management

Manages buy and sell transactions with risk simulations, drawing power checks, sell limit checks, and forced sell me

A leading UAE bank, known for its customer-centric approach and digital innovation, implemented security-based lending with Finacle Margin Finance to offer efficient, flexible credit solutions leveraging customer securities.

Next-Gen Architecture

Empowered by a scalable and agile platform

One of Asia’s top bank, leveraged Finacle Margin Finance for centralized margin and collateral management and seamless multi-currency investments across Singapore, Hong Kong, and the US through multiple trading channels.

Unveiling Key Benefits

Accelerate with seamless operations and stronger risk control

- Boost operational efficiency with automated margin calls and simplified collateral management, enabling faster and accurate processes.

- Mitigate risk through proactive collateral monitoring and real-time alerts, reducing exposure to market volatility and ensuring margin compliance.

- Reduce ownership costs with rapid adoption of a cloud-based solution, enhancing scalability and business adaptability.

- Achieve transparency for accurate decision-making by tracking margin calls, required funds and collateral values, supported by comprehensive reporti

One of India’s largest private sector banks leveraged Finacle Margin Finance to transform wealth and margin management across Dubai and Bahrain enabling multicurrency investments, efficient limit monitoring, and faster transaction processing through a superior digital solution for its sales force.