The Rise of Embedded Financial Infrastructure: 2026 as a Structural Break

In 2026 and beyond, embedded banking will continue to evolve beyond its payments roots to become a primary distribution engine across products, redefining how financial services reach retail, SME, and corporate customers.

A decade ago, Infosys Finacle forecast that banking would evolve into a “gang of four” construct—where telcos supply the networks and cloud infrastructure, retailers excel at distribution, technology providers like us power innovation, and banks anchor the system through domain leadership, product expertise, and risk stewardship. That prediction is now unfolding at scale across markets, as customers gravitate to the platforms they already rely on including marketplaces, vertical SaaS, logistics and mobility platforms, and modern enterprise systems. The transition is structural given AI-driven underwriting, tokenization, mandatory open data, ecosystem consolidation, and distribution power shifts.

Over the next five years, these ecosystems will increasingly shape product adoption, influence credit origination, and determine where value creation occurs. Embedded finance is a step-change opportunity for banks to expand distribution, deepen risk intelligence, monetise capabilities, and position themselves at the heart of digital value creation.

Author - Rajashekara V. Maiya

Vice President and Global Head - Business Consulting, Infosys Finacle

Digital Adoption: The Catalyst for Bank–Platform Convergence

The engine powering this shift is the unprecedented level of digital adoption. India’s UPI, which grew at a 147% CAGR between FY18 and FY23, illustrates the scale unlocked when financial interactions are woven into daily flows. Globally, curated marketplaces now drive 35% of online commerce, creating natural launchpads for embedded payments, instalment financing, insurance, and contextual credit.

Vertical SaaS systems have become the operating backbone of SMEs, and increasingly, of mid-market and enterprise segments. Customers will continue to demand seamless, native, integrated experiences. Thus in the expanding phase of digital proliferation, embedded banking continues to open up an entirely new distribution frontier for banks. Instead of competing for traffic, banks can meet customers where they already operate, embedded inside trusted digital environments, expanding reach and reducing acquisition cost while enhancing service intensity.

Case in Point: Kasikorn Line, Thailand, a joint venture between Kasikorn Bank and Line, launched a range of banking services that are offered via messaging app LINE BK | Acquired 1 million customers in less than 2 months, provided unsecured loans to over 300,000 customers – 30% of whom don’t get loans from other FIs

Lending: The Next Wave of Embedded Disruption

Embedded lending is poised to reshape credit distribution more profoundly than embedded payments reshaped checkout. Platforms such as Shopify Capital and Mercado Crédito exemplify the power of underwriting based on real-time signals such as sales velocity, fulfilment reliability, dispute patterns, and inventory turnover areas. This shift is enabling cheaper credit, faster disbursements, and lower ticket-size loans. The model is also catalyzing a broader ecosystem. Marketplaces, payment processors, logistics platforms, and ERP providers are converging into credit-origination hubs, where credit becomes a native service. However, this shift also demands open data frameworks to prevent fragmented credit ecosystems and ensure borrowers build portable credit profiles across platforms.

As the industry gears up for a tokenized future, with tokenized invoices, tokenized receivables, and programmable settlement flows, embedded lenders will need to integrate with digital-asset-ready infrastructures. Also, embedded credit will expand access for the unbanked population. As regulatory frameworks mandate open data and consent-led portability, banks are uniquely positioned to lead this next chapter. Their advantages lie in regulated balance sheets, risk governance, access to diversified capital, and trust. Combined with platform data, banks can build more precise, inclusive, and dynamic credit models.

Case in Point: Bank Raya is focusing on the gig economy in Indonesia by providing embedded lending solutions to gig workers. This involves integrating loan application and approval processes directly into platforms used by gig workers

The SME Segment: A Strategic Growth Corridor for Banks

SMEs represent the largest whitespace and the most competitive segment. According to BCG, 59% of SMEs in the US use vertical SaaS platforms as operational systems. Embedded payments already account for 36% of SME acquiring revenues, projected to rise to 45% by 2028. Yet embedded credit, insurance, cash-flow tools, and expense solutions remain considerably underpenetrated.

For banks, this creates an immediate opportunity to integrate via API-first partnerships with vertical SaaS and marketplace providers. By accessing platform telemetry, banks can originate contextual financial products, from merchant cash advances and invoice financing to usage-based insurance and dynamic working-capital solutions. These partnerships improve acquisition economics, deepen product penetration, and position banks as enablers of SME growth, not merely providers of discrete financial products.

Case in Point: Goldman Sachs powers Amazon’s small business credit line with Amazon’s business financing options extended to eligible sellers with application process 100% digital. Small businesses who sell on the platform can avail revolving credit lines from Amazon, powered by the bank.

Corporate Banking: Elevating Banks as Embedded Treasury and Liquidity Hubs

For corporate banking, embedded finance is catalyzing a seismic shift in distribution models. Deloitte notes that Fortune 500 firms are prioritizing platform modernization, creating opportunities for banks to embed treasury, payments, and credit solutions directly into enterprise workflows. Success will hinge on adopting SaaS principles, covering agility, subscription-based pricing, and API-driven integration to deliver scalable, white-label solutions. Banks that fail to pivot risk losing relevance as clients migrate to digital ecosystems offering superior user experiences and operational efficiency.

Further reading: Report ‘Digital Business Ecosystems are reshaping Commercial Banking’ by Infosys Finacle and 11:FS

Market Outlook: Structural Growth That Expands Opportunity for Banks

Across studies, the numbers signal a historic redistribution of value. Gartner forecasts that by 2026, more than half of all consumer financial transactions will be initiated on third-party digital platforms, highlighting a redistribution of customer engagement away from traditional bank interfaces. Research and Markets projects that the embedded finance market will expand at a CAGR of 36.41%, rising from US$146.17 billion in 2025 to US$690.39 billion by 2030.

Deloitte believes revenue pools are shifting accordingly, with embedded banking expected to generate $45 billion by 2030, more than doubling from 2024 levels as lending margins, working-capital flows, and API commercialisation scale. Transaction volumes are expanding in parallel: Deloitte anticipates global financial flows rising to $20.8 trillion by 2030, with $13 trillion attributable to B2B activity, segments where embedded treasury, receivables, and supply chain financing are already gaining traction. BCG and Adyen estimate that in North America and Europe, the total addressable market (TAM) for embedded finance in the SME segment across four key products of payments, capital solutions, accounts, and card issuing stands at approximately $185 billion, compared to a current penetration of just $32 billion.

Banks can reposition themselves as essential infrastructure partners powering these expanding value pools. The institutions that modernise, partner, and commercialise their capabilities will command an outsized share of this growth.

Success Requires a Comprehensive Approach

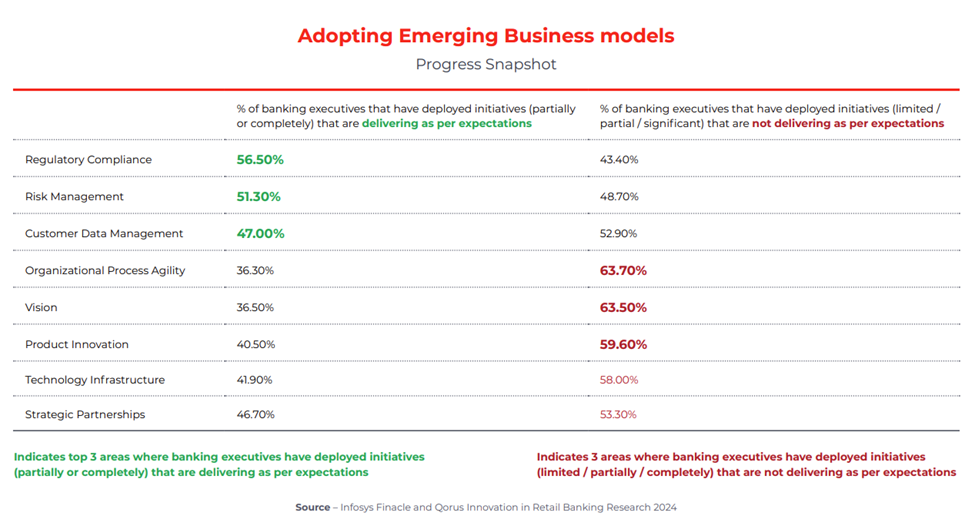

To thrive in an embedded finance ecosystem, banks need a holistic strategy that seamlessly aligns their vision, technology, and organizational agility. Banking executives globally agree that several key factors contribute to success in this transformation. In the survey with Infosys Finacle and Qorus, we asked banking executives to rate their success across each of these parameters which is indicated in the table below.

To make meaningful progress, banks must prioritize aligning their vision with emerging opportunities, cultivate an innovative culture, enhance agility in their processes, and ensure their technology infrastructure is composable and futureproof. Only then can they fully capitalize on the opportunities in the market.

The Road Ahead: Banks as Platform-Native Orchestrators

Every signal suggests that embedded banking will become one of the primary delivery model for financial services from 2026 onwards. But this evolution potentially positions banks at the centre of a broader, more interconnected financial ecosystem.

The banks that will lead are those that transform into platform-native orchestrators: institutions that commercialise capabilities through enterprise-grade APIs, build data-sharing arrangements rooted in trust and regulatory compliance, adopt consent-led portability frameworks, and modernise their technology stacks to deliver real-time, event-driven services across partner ecosystems.

The strategic imperative is now clear: by continuing to embrace embedded banking as a foundational distribution pillar, banks can elevate their role in a rapidly evolving ecosystem and secure a leadership position in the trillion-dollar value migration underway across global financial services.

References

- www.fintechfutures.com

- www.jpmorgan.com

- www.bcg.com

- www.coforge.com

- www.deloitte.com

- Infosys Finacle and Qorus Innovation in Retail Banking Research 2025