We are living in a time when so many things are changing, so rapidly, all at once. This is giving business leaders their biggest challenge – keeping pace with change so their organizations remain relevant, undisrupted, and ahead of competitors who may be better funded, more innovative, or advantaged in some other way. To succeed, banks need to recompose their legacy business models and technology landscape and lead with transformation initiatives that enable them to fight for a share of “new-age banking”, conducted as digital-first, embedded finance, marketplace banking, BaaS, among others.

Join this panel of industry leaders and learn from their storied transformational journeys.

- Dr. Dennis Khoo, Digital Transformation Expert, Author, and Former Head of UOB TMRW Digital Bank

- Kaspar Situmorang, Head of Digital Banking Development and Operations, Bank BRI

- Miguel Rio Tinto, Group Chief Information Officer, Emirates NBD

- Sopnendu Mohanty, Chief Fintech Officer, Monetary Authority of Singapore

- Sanat Rao, Chief Executive Officer, Infosys Finacle (Moderator)

Recognized for its remarkable transformation journey, DBS has been consistently named “World’s Best Digital Bank” by several global agencies like Euromoney and Global Finance. What has been DBS Bank’s secret sauce to drive the digital transformation at scale? What makes DBS act less like a traditional bank, and more like a startup and a digital-native business? How is the bank recomposing its business model and what does the target business model look like?

Join us in this fireside chat, between Piyush Gupta, Chief Executive Officer, DBS Group, and Mohit Joshi, President, Infosys, as they discuss several of these key topics to unearth insights on what it takes to recompose banking for the future.

- Piyush Gupta, Group Chief Executive Officer, DBS Group

- Mohit Joshi, President, Infosys (Moderator)

A few years ago, cloud conversations in banking circled around adoption challenges related to security, compliance, or skilling issues – concerns, while valid, distracted banks from the urgency of adoption. But things changed dramatically and quickly as the major ecosystem players, including regulators, moved forward in their understanding of cloud; business application players brought their cloud-native solutions, the volume of digital transactions scaled exponentially, and the hyperscalers and regional players spread their data centers around the world to meet data residency requirements. The value proposition since then has become unignorable. It is no longer just a technology lever of efficiency, resilience, and scale but a catalyst of ecosystem innovation, time-to-market, and business value creation.

Join this session to learn from leaders that are unlocking the value of cloud to scale their digital success.

- Darlene Mattiske-Wood, Chief Executive Officer, Australian Military Bank

- Enis Huseyin, Chief Information Officer, Australian Military Bank

- John Wamai, Chief Information Officer, Equity Bank

- Manoranjan Sahu, Chief Information Officer, Übank

- Arun Krishnan, Senior Vice President & Head of Engineering, Infosys Finacle (Moderator)

Digital transformation is a key focus for financial clients who are on their cloud journey, but they are facing various challenges. IBM’s Hybrid Cloud strategy is aimed at helping our clients accelerate their digital transformation.

- Meredith Stowell, Vice President, IBM Z Ecosystem

- Simon Ward, Partner and Global ISV Practice Leader – Core Banking & Payments, IBM Consulting

Business and corporate banking segments are experiencing a digital adoption overdrive, and the shifts are profound and irreversible. For banks to grow interest-based income, amp up fee-based revenues, reduce costs, and innovate into the new with differentiated business models, a truly digital foundation is paramount. How will the ongoing transformation help banks differentiate? What does it take to scale digital success?

Join this session to discuss the topics that matter most in the realm of corporate banking digitization.

- Venkat ES, Managing Director & Head, APAC Treasury Product, Global Transaction Services, Bank of America

- Zoltan Korpadi, Global Head of Core Banking Solutions, ING Wholesale Banking

- Rajashekara V. Maiya, Vice President and Global Head of Business Consulting, Infosys Finacle (Moderator)

Digital transformation has been at the focal point of investments for last several years now, yet few banks can claim success with scaling digital leadership across the board. This is because managing transformation at scale requires a paradigm shift in thinking, designing and executing for change.

In this panel discussion, we will learn from our speakers on what does it take to drive digital at scale? How can an organization be purposeful, surgical and yet ubiquitous with digital transformation?

Join us in this discussion to learn and raise questions that can help you drive your business forward.

- Abdulla Quessem, Chief Operations Officer, Emirates NBD

- Balaji VV, Head, Business Technology Group, ICICI Bank

- Stratos Molyviatis, Group Chief Operating Officer, National Bank of Greece

- John Barber, Vice President and Head of Europe, Infosys Finacle (Moderator)

The first principles approach has led to some of the revolutionary inventions the world has seen and has been used by some of the world’s greatest minds: like Leonardo Da Vinci, Thomas Edison, Steve Jobs, Bill Gates, Henry Ford, and Elon Musk. So how can one apply first principles thinking to innovation? How can technology and innovation combine to create superior outcomes? and how can organizations balance shareholder and societal value creation?

In this session, we will have Sonam Wangchuk, Director of Himalayan Institute of Alternatives & Founder at SECMOL giving us insights and learnings on Recomposing with First Principles Approach.

Sonam Wangchuk, winner of Ramon Magsaysay Award 2018 is India’s most renowned Educationist, Environmentalist and Innovator. He is an Indian engineer from Ladakh, innovator and education reformist.

- Sonam Wangchuk, Director, Himalayan Institute of Alternatives & Founder at SECMOL

With new channels, new embedded services, and new ways of doing banking – delivering personalized omnichannel customer journeys isn’t an easy ask. To respond with agility, banks need a unified engagement hub that can power tailored customer journeys across channels, applications, and devices – at a population scale. The hub must power traditional, modern, and emerging channel experiences while supporting every type of user – end customer, bank staff, and partners.

Join this session to learn how Finacle is partnering with global banks to help them meet and exceed these expectations with a unified digital engagement suite.

- Hemant Verma, Chief General Manager, Punjab National Bank

- Tapas Kumar Mondal, Head of Architecture, RAKBANK

- Siddhant Taneja, Senior Industry Principal – Digital and Analytics Products, Infosys Finacle (Moderator)

The unprecedented pace of change as well as entrance of digital banks is pressuring banks of all sizes to increase agility and accelerate innovation. AWS works with banks of all sizes to structurally lower their cost base, bring new products to market at breakneck pace, and create more a personalized customer experiences – all while meeting stringent security, compliance, and regulatory requirements.

- Felix Thummernicht, APAC Banking Specialist – Worldwide Financial Services Business Development, Amazon Web Services

Join this session to understand how you can complete your hybrid cloud and multi-cloud strategy and transform in place with the cloud that comes with you. The question is no longer “What apps should move to cloud and what should stay on prem?” but, “How can I become more data-first and bring a consistent, modern cloud operating model across all your workloads and data?” The answer is HPE GreenLake. With HPE GreenLake, you can transform in place and modernize your business-critical apps and data that live outside the public cloud in colos, data centers and especially at the edge – the apps and data that run your business – without compromise.

- Shankar Raghavan, Sr. Director, Advisory, Professional Services & Greenlake Cloud Services, Asia Pacific, Hewlett-Packard Enterprise

Blockchain continues to be a technology with immense potential. One that can help recompose banking by automating inter-organization processes at scale. From digital currencies to cross-border payments to trade finance digitization – blockchain is helping reimagine several banking processes. While the number of potential use cases can be boundless, some are gaining greater traction vis-à-vis others. The session will feature some of the most sought-after use cases to help you recompose your inter-organization processes with blockchain.

- Daniel Latimore, Chief Research Officer, Celent

- Sandeep Ubale, Chief General Manager, State Bank of India

- Vivek Jeyaraj, Principal – Product Management Group, Infosys Finacle

- Zennon Kapron, Founder and Director, Kapronasia

- Ravi Venkataratna, Senior Industry Principal – Business Consulting Group, Infosys Finacle (Moderator)

Learn how amazing security and phenomenal client experiences enables you to create digital journeys that matter.

- Bimal Gandhi, Chief Executive Officer, Uniken

This session will highlight feedback from corporate treasurers regarding their experiences with bank’s treasury onboarding processes. It will also discuss bank initiatives and priorities in this space and where they must focus to see greater success.

- Christine Barry, Head of Banking & Payments Insights & Advisory, Aite-Novarica Group

Most organizations want to embark on a modernization journey – either afresh or for continuous improvement. Financial services organizations must continually innovate in order to be relevant and competitive as they forge ahead with a razor-sharp focus on customer acquisition, retention, channel optimization, and digital transformation. In recent years, enterprises have seen what it takes to modernize, but the expectation has now shifted towards cost-effective modernization journeys – through automation, low code/no code initiatives, composition, and configuration versus build from scratch and similar patterns. We welcome you to this session as we share how Red Hat is helping our ecosystem of partners and customers accelerate their modernization initiatives.

- Arvind Swami, Director, Financial Services, Asia Pacific, Red Hat

Geopolitical and economic waves have shocked markets around the world. In a period of disrupted supply chains, accelerating inflation, and rising interest rates, companies of all sizes face challenging times ahead. More than ever, they will turn to their banks as trusted advisors to help them weather the storm, but they will also be more selective in their bank relationships. In response, leading banks will seek to deepen client relationships by optimizing customer engagement, delivering innovative, intelligent treasury solutions, leveraging data and analytics, and accelerating payments capabilities. Patty will provide an on update Celent’s key technology trends for Corporate Banking in 2023.

- Patricia Hines, Head of Corporate Banking, Celent

Embedded finance is that rare opportunity that creates wins all around – for customers, who can avail banking services seamlessly to consummate any transaction without making an extra effort; for merchants and brands, who can attract customers with financing options like Buy Now Pay Later, or earn commissions on the sale of financial products; and for banks who can expand their business by embedding their services within other consumption journeys. Powered by the growing maturity of Banking as a Service (BaaS) offerings, the embedded finance is a big opportunity for this decade.

Join us, as we discuss how banks can accelerate their success with the Finacle API Connect Suite.

- Amit Varma, Group Chief Platform Officer, Emirates NBD

- Sidharth Rath, Managing Director and Chief Executive Officer, SBM Bank India

- Puneet Chhahira, Head, Product Management and Marketing, Infosys Finacle (Moderator)

Payments business is truly converging towards real-time propositions. Consequently, to keep pace with the changing dynamics, progressive banks are redrawing their technology strategies. They are consolidating multiple payment engines with a unified enterprise payments hub to transform operations and experience for end customers. Few are co-creating blockchain based payment networks to expedite cross-border payments. Clearly, the pace of change demands complete renovation of legacy processes. This session will put spotlight on banking leaders transforming their payments infrastructure to drive payments innovation at scale.

- Marc Daniel, Director & Program Manager, Global Banking & Markets, Asia Pacific, Bank of America

- Siva Subramaniam, Senior Industry Principal, Infosys Finacle

As interest rates climb, the role of digital in corporate cash management is fast evolving, and for the better. Corporations are choosing to closely monitor and manage liquidity positions and working capital in real-time. They want to manage all accounts from a single dashboard, move money automatically to minimize expenses, maximize yield, and make accurate forecasts. Treasurers also want to send and receive money instantaneously, manage working capital with ease, and stay on top of payables and receivables. At the same time, API-powered innovations are heralding new opportunities in bank-to-corporate connectivity.

Join this session to learn how leading banks around the world are shoring up investments, and building a modern cash management platform for the future.

- Emmanuel Narciso, Executive Vice President – Transaction Banking, Rizal Commercial Banking Corporation (RCBC)

- Rahul Wadhavkar, AVP and Head of Product Management, North America, Infosys Finacle (Moderator)

Importance of application-led digital transformation in BFSI is paramount. However, attracting and retaining customers through new digital services like mobile deposits, or simplifying the customer experience with easy-to- use banking apps attract complexities around technology adoption. Attend this session to learn how AppDynamics full-stack observability simplifies this challenge by providing complete visibility relative to business context deep into the application/IT environment and empowers banking and financial services teams to make decisions based on business impact. Also hear a customer success story covering the implementation of FinAssure Powered by Cisco AppDynamics to minimize system disruptions & elevate CX.

- Pruthviraj Patil, Global Alliance Director, Global Systems Integrators, Cisco AppDynamics

As analytics and AI technologies mature, they offer unprecedented opportunities to automate processes, elevate customer experiences and manage risks. Listen to industry leaders discuss contemporary use cases of AI implementation in banking, trending innovations, and what all this means for the future of banking.

- Cyrus Daruwala, Managing Director, Global Financial Services, IDC

- Sankarson Banerjee, Chief Information Officer, RBL Bank

- Soumya Ghoshal, Partner & Associate Director, Singapore, Boston Consulting Group

- Kimberly Payton, Global Vice President, Head of Alliances & Ecosystem Partners, Infosys Finacle (Moderator)

Digital Transformation, customized service delivery, operational efficiencies, Regulatory compliance & IT security might appear at first glance to be unrelated matters. But for financial institutions, they are connected by a common thread: Each depends on the quality, speed and reliability of data management. As banks strive to keep pace with changes in technology trends, customer expectations and competition , they must become adept at unlocking the value of their data assets.

Find out how partnering with Hitachi and end-to-end solutions we deliver helps create an IT ecosystem that functions as the backbone of business and revenue growth.

- Chris Drieberg, Global Director and CTO, Collaborative Solutions, Hitachi Vantara

As the banking industry treads through the current complex and uncertain times, the strategic importance of treasury management has never been more profound. The expectations are sky high from the treasury function – be it managing and delivering financial prudence, mitigating risks across trading and banking books, or maximizing net-interest income through sound investment and balance-sheet optimization strategies. Needless to mention, all of this and more is possible when treasurers truly embrace the potential of technology and imbibe digital propositions across the front-to-back office treasury stack.

Leading banks are driving digital treasury operations powered by Finacle’s Treasury platform. Join this session to learn from their experiences.

- Rajesh Nair, Senior Vice President & Group Head, Information Technology, Axis Bank

- Milind Kolhatkar, Product Business Manager, Infosys Finacle

Digitization has fundamentally changed the banking landscape. To unlock the true potential of their digital investments, banks need a resilient digital core that is composable, cloud-native, agile, scalable, and open. One that can swiftly respond to changing market dynamics, power continuous innovation, help build new business models and unlock new partnerships and revenue opportunities.

Join this session to learn from industry leaders about how they are maximizing digital success with a digital core.

- Abhijit Singh, Chief Technology & Digital Officer, HDFC Ltd

- Avinash Raghavendra, President & Chief Information Officer, Axis Bank

- Sajit Vijayakumar, Senior Vice President and Chief Operating Officer, Infosys Finacle (Moderator)

A Fully Carbon Neutral Event

At #FinacleConclave 2022, a conference that saw banking industry leaders from all over the world, converging on Singapore, we worked hard to neutralize all the conference related carbon emissions. It is a matter of immense pride for us that the entire #FinacleConclave 2022 conference was completely Carbon Neutral and every delegate’s carbon footprint at the conference, was effectively by zero.

How did we achieve Carbon Neutrality for #FinacleConclave 2022?

- The total emissions for the conference, with additional buffers, were meticulously calculated with the help of experts, as per global standards

- This included elements such as delegate air travel, hotel, accommodation, food, commute, energy usage, material usage, fuel consumption, and much more

- Avoidable emissions were offset using sustainable methods and materials, wherever possible

- For all unavoidable conference-related emissions, Infosys invested in commensurate certified Gold Standard carbon offsets

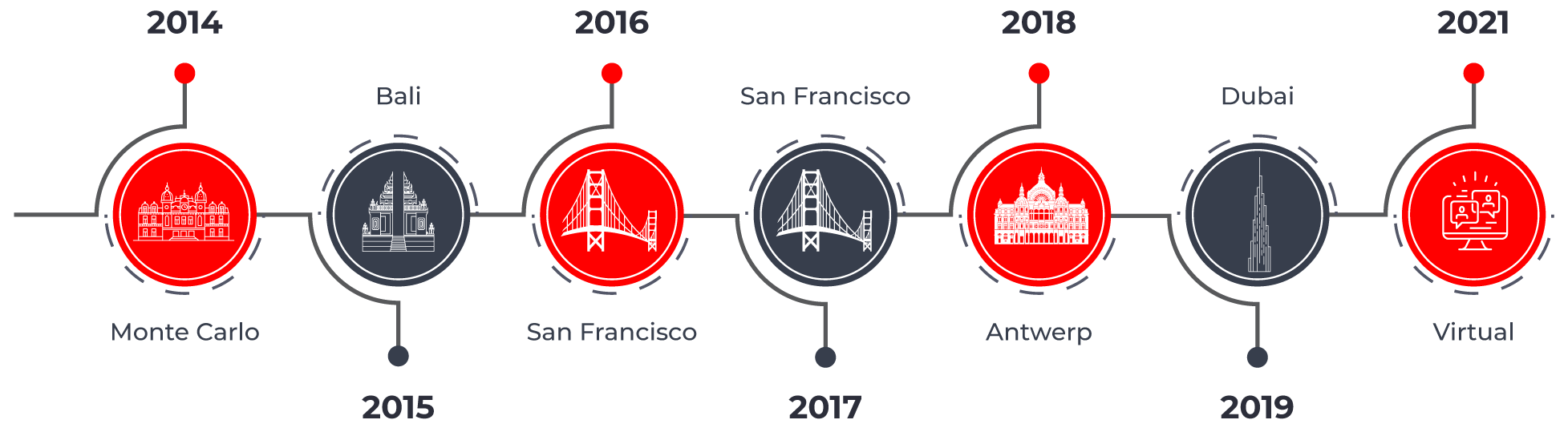

Past Finacle Conclave Events