Finacle Conclave 2023

At Finacle Conclave 2023, over 325 participants – global banking leaders, industry influencers and thought leaders, analysts and partners – gathered in Istanbul to discuss and share insights and experiences on banking technology and innovation. The theme of the conference was Recomposing Banking – Leading the Digital Continuum. The topic stimulated conversations on ways in which banks can continuously recompose their customer engagement, operations, technology and overall business models, to adapt, innovate, and stay ahead of fast-evolving digital goalposts. Led by keynotes from Salil Parekh, MD & CEO – Infosys Technologies and Sanat Rao, CEO – Infosys Finacle, the conference featured insightful sessions, engaging breakouts and product innovation showcases. In addition, Finacle Conclave 2023 continued to feature its signature immersive networking experiences, ensuring an exceptionally memorable event for all delegates.

Event Videos

Gallery

Welcome to Finacle Conclave 2023. The conference will explore ways in which banks can continuously recompose their customer engagement, operations, technology, and overall business models, to adapt, innovate, and stay ahead of fast-evolving goalposts in the digital continuum.

Today, banks need to continuously adapt themselves and remain relevant amidst an accelerating pace of change. In this insightful session, renowned advisor and best-selling author, Sangeet Paul Choudary, will delve into the evolution of global banking ecosystems. He will share guidelines that will empower you to identify profound industry shifts that accompany each new wave of technology. Through compelling case studies and proven insights, Sangeet will also unravel crucial capabilities, mindsets, and organisational principles with a comprehensive value migration framework that will guide your bank to stay ahead in this changing landscape.

- Carlos Garcia, Chief Executive Officer, Nave Bank

- Faisal Ameen, Managing Director, Head, Asia Pacific & Japan, Global Transaction Services, Bank of America

- Frank Stockx, Independent Non-executive and Senior Advisor, Bain & Company

- Rajashekara V. Maiya, Global Head of Business Consulting, Infosys Finacle

The banking landscape continues to experience seismic shifts, fueled by rapid technological advancements, ever-changing customer expectations, and dynamic market forces. Thus, continuous transformation across various dimensions of organizational maturity becomes a necessity to remain relevant. How can banks drive continuous transformation amidst this ever-evolving landscape? What unexplored avenues lie ahead after years of relentless efforts? Join us as industry pioneers and thought leaders unveil the elements of recomposing banking, empowering institutions to reinvent themselves continuously. This session uncovers the blueprint for banks to thrive in the digital age by reimagining customer journeys and embracing cutting-edge technologies. Join the dialogue to embrace the future of banking and chart a path to ongoing success.

Join this session to gain insights from Infosys Group CEO and Managing Director. Discover how Infosys’s expertise in digital, cloud, and AI can empower you to navigate your next with confidence.

As technology reshapes industries, mastering the digital continuum has become the key to sustainable growth and competitive advantage. Join us to explore how Finacle suite of solutions, architectural advancements, and transformation approaches are helping banks scale digital transformation, enhance customer experiences, and achieve operational excellence. Through real-world case studies, discover how Finacle’s cloud-native composable offerings can accelerate your journey to becoming a digital leader.

- Jerry Silva, VP – IDC Financial Insights, IDC

- Jeronimo Azevedo, Chief Enterprise Architect and Head – Corporate IT, POST Luxembourg

- Miguel Rio Tinto, Group Chief Digital and Information Officer, Emirates NBD

- Kalambur Venkatraman, Head – Product Architecture, Infosys Finacle

The adoption of cloud technology in the banking industry is no longer a mere consideration but a race toward gaining a substantial business advantage. It has evolved beyond being just a lever for efficiency, resilience, and scalability; it now serves as a catalyst for ecosystem innovation, faster time-to-market, and the creation of business value. Participate in this session to gain insights from industry leaders who are unlocking the potential of the cloud to scale their digital success.

- Don Free, Research Vice President, Gartner

- Enis Huseyin, Chief Information Officer, Australian Military Bank

- Khomotso Molabe, Group CIO – Personal and Private Banking, Standard Bank

- Lefteris Kororos, Group CIO, National Bank of Greece

To fully harness the benefits of their digital investments, banks require a modern core that embodies cloud-native architecture, composability, flexibility, agility, scalability, and openness. This digital foundation enables banks to swiftly adapt to dynamic market conditions, foster continuous innovation, facilitate the creation of novel business models, and unlock fresh revenue opportunities through strategic partnerships. Join us in this session as we delve into the experiences of executives who are prioritizing core modernization, gaining insights on how it accelerates their transformation agendas and positions them for sustained growth in the ever-evolving digital landscape.

- Kelly Pushong, Director – ISV Ecosystem for IBM Z and LinuxONE, IBM

- Monica Sasso, Global Financial Services Digital Transformation Lead, Red Hat

- Rudra Pratap Singh, Deputy General Manager – Department of Information Technology, Union Bank of India

- Kimberly Payton, Head of Alliances & Ecosystem Partnerships, Infosys Finacle

Today’s banking industry is consistently in a state of flux. In addition to a challenging macroeconomic environment, banks face ever-evolving customer behaviors and expectations in an increasingly digital world. At the same time, the continued proliferation of data, heightened compliance, sustainability requirements, and growing security threats continue their impact on the financial services landscape. A hybrid cloud with AI first strategy can accelerate business outcomes and reduce risk. Success requires leveraging existing investments, embracing new technologies and processes, as well as adopting enterprise IT architectures that support fast, secure integration of on-premises workloads with multi-cloud environments.

Join us as we discuss how banks can accelerate their digital future with Finacle Core Banking and IBM technology

- Monica Sasso, Global Financial Services Digital Transformation Lead, Red Hat

Charting your Flight Path to sustainable, controlled digital transformation to outperform your competition in a digital first world

- Dr. Henry Shevlin, Leverhulme Centre for the Future of Intelligence (CFI), University of Cambridge

- Sanat Rao, Chief Executive Officer, Infosys Finacle

Artificial intelligence has been rapidly changing the nature of labour. This talk cuts through the hype to provide a brief history of recent advances in AI, an overview of the capabilities of current models, and what lies ahead, with an emphasis on the practical realities for finance and the global economy.

- Anand Venkataraman, Head – Technology Management Group, ICICI Bank

- Boe Hartman, Co-founder and Chief Technology Officer, Nomi Health

- Paul Hennessy, Chief Executive Officer, Emirates Digital Wallet

- Puneet Chhahira, Head, Product Management and Marketing, Infosys Finacle

As the financial landscape rapidly evolves, traditional boundaries are being redefined, enabling seamless integration of financial services into various non-financial ecosystems. Join us for this immersive session and discover how Embedded Finance and BaaS hold the key to shaping the financial services landscape of tomorrow. Through real-world case studies, and thought-provoking Q&A sessions, the session will explore the capabilities banks must mature to integrate financial services into everyday activities, from e-commerce to enterprise apps, transforming industries and empowering end-customers.

- Angela Iglesias, Head of Cash & Lending Products, GTB Europe, Santander

- Christine Barry, Head of Banking & Payments – Insights & Advisory, Datos Insights

- Justin Silsbury, Lead Product Manager, Infosys Finacle

As interest rates soar and organizations navigate supply chain disruptions and geopolitical uncertainties, the role of digital in corporate cash management is rapidly evolving, and for the better. Corporates are now choosing to attentively monitor and manage their cash positions and working capital in real-time. Also, the surge of API-powered innovations heralds an era of untapped opportunities in bank-to-corporate connectivity, empowering real-time visibility and optimizing cash management strategies. Join this session to learn how leading banks around the world are making strategic investments and building a modern cash management platform for the future.

- Debdeep Sengupta, Global President and CRO, Cloud4C

- Sankarson Banerjee, Thought leader, BFSI and Ex-CIO, RBL Bank

- Venkatramana Gosavi, Global Head of Sales, Infosys Finacle

You have to constantly innovate not only to grow but just to survive and retain your market share & market position. Getting it right the first time and every time is difficult especially in the financial services sector where there are so many moving elements, not to mention the evolving consumer and their demands. Even if you fail, you need to fail fast so that you are still in the race with grace. We bring you this fireside chat to discuss various winning transformation models that worked for many and what to do & what not to do while embracing new age technologies such as AI, Data, Analytics, Advanced Security and more.

- Arun Krishnan, Head of Engineering, Infosys Finacle

As banks seek to reinvent their business models with unprecedented agility, composable solution design has emerged as a pivotal enabler. Built on cloud-native, API and microservices-led foundations, coupled with domain-driven design principles, composability empowers banks to unlock the essential flexibility, agility, and resilience required to navigate the dynamic market landscape successfully. Join us in this session to delve into the diverse dimensions of composable banking architecture. Discover how banks can harness their full potential to adapt, innovate, and thrive in the face of new market realities.

- Kavitha Palanisamy, Head of Digital Channels – Transaction Banking, Santander UK

- Siddhant Taneja, Senior Industry Principal, Digital Products, Infosys Finacle

In today’s rapidly evolving banking landscape, delivering personalized omnichannel customer journeys has become a complex challenge. With the advent of new channels, embedded services, and innovative banking approaches, banks must respond with agility to meet customer expectations. Join us in this session to discover how Finacle’s Digital Engagement Suite empowers banks to onboard and deliver tailored omnichannel customer journeys. Learn how the suite is unlocking the power of a low-code no-code platform to accelerate user experience design and development to drive agility in business.

- Wiley Battle, Global Head, Partner Development, AWS

With a commitment to security, resilience, and operational excellence, AWS stands out as the trusted cloud partner for banking transformations worldwide. Join this session to learn the nuances of migrating core banking operations to the cloud and why AWS continues to be the partner of choice for forward-thinking banks globally.

- Oliver Northern, Head International Real Time Payments, Bank of America

- Siva Subramaniam, Senior Industry Principal, Infosys Finacle

The payments industry is experiencing continuous transformation fueled by the emergence of new payment rails, and soaring payment volumes, amid dynamic regulatory and customer expectations. In this session, we will focus on how banks can leverage Finacle’s composable payments platform to craft agile, incremental modernization approaches across multiple payment imperatives. We will also explore how banks can achieve scale, resilience, and enhanced throughput, to navigate the challenge posed by exponential growth in digital payments volumes.

- Mustafa Maqativ, Director and Head of Core Banking, Housing Bank of Trade and Finance

- Daniel Mayo, Senior Analyst, Celent

- Manish Patni, Lead Product Manager, Infosys Finacle

Join this session to discover how Finacle’s proven Origination Solution empowers financial institutions to streamline and optimize their lending processes, from application to approval. With a customer-centric approach and advanced automation, this solution enables banks to deliver faster, more efficient lending experiences while minimizing risks and maintaining compliance. Learn from expert insights on how organizations can leverage Finacle’s Origination Solution to drive growth, enhance operational efficiency, and stay ahead in a competitive market.

Yasar Yilmaz, Director, Global Industry Advisor, FSI WW, Microsoft

From personalized customer experiences and dynamic product creation, to risk assessment models and automated marketing campaigns, Generative AI is reshaping the way banks operate and engage. This session explores the numerous possibilities Generative AI brings to banking.

- Rajesh Kumar Bhaskaran, Executive Director – Head of Core Technology Platforms, Emirates NBD

- Saket Saith, Group Chief Technology and Data Officer, RAKBANK

- Abhra Roy, Senior Industry Principal, Wealth Management, Infosys Finacle

As the wealth of affluent individuals grows worldwide, their expectations continue to evolve beyond basic investment products like mutual funds and insurance. They now seek access to a wide range of offerings, from structured products and private equity to precious metals, alternate funds, and held-away assets. Personalized advisory services and a unified platform for portfolio monitoring are also paramount in their pursuit of a better wealth management experience. Join us in this session to explore how banks are harnessing Finacle’s unified wealth management platform to seamlessly service, engage, and cater to their affluent customers. Discover how this comprehensive solution empowers banks to deliver personalized services, while simplifying and enhancing the wealth management journey for their valued clientele.

- Daniel Szmukler, Director, Euro Banking Association

- Kwabena Ayirebi, Director – Banking Operations, African Export-Import Bank

- Patricia Hines, Head of Banking and Payments, Celent

- Shekhar Bhandari, President – Global Transaction Banking, Kotak Mahindra Bank

- Vani Vangala, Product Business Manager, Infosys Finacle

In the challenging business environment of today, corporates encounter a myriad of obstacles spanning from increasing inflation and interest rates to geopolitical turbulence and supply chain uncertainties. Addressing these challenges requires a sophisticated digital strategy from banks, equipping corporates with the tools they need to adapt, innovate, and maintain resilience. Furthermore, the imperative for banks to grow interest-based income, elevate fee-based revenues, decrease expenses, and innovate with differentiated business models, makes scaling digital maturity equally indispensable. How will evolving along the digital continuum help banks differentiate? What does it take to scale digital success? Join this session to discuss the topics that matter most in the realm of corporate banking digitization.

- Rajesh Chandran Kaliyamveettil, SVP – Information Technology, Head – Core Banking, Axis Bank

- Prasad C, Head of Support and Maintenance, Infosys Finacle

Mergers and Acquisitions have emerged as a powerful catalyst for driving growth. To explore how organizations can unlock synergies for enhanced operating excellence, customer-centricity, and competitiveness, join us in this insightful session. Our panelists will share their valuable experiences and strategies, shedding light on the diverse transformation and technology integration options considered during M&A initiatives.

- Danijel Miletic, Chief Information Officer, HPB Croatia

- Funda Oney, Chief Information Officer, HSBC Turkiye

- Sunila Jaikumar, Head – Human Resources, Infosys Finacle

Today’s rapidly evolving banking landscape demands continuous transformation and relentless innovation. Prevailing hierarchies, monolithic structures and a siloed organization are ill-equipped to succeed in these demanding times. Join our panel discussion as we delve into the pivotal role of organisational culture in catalysing technology and business transformation. The session will feature real life examples of impact driven by organizational culture and stories of how banks have leveraged culture as the invisible competitive advantage for business.

- Goitsemang Morekisi, Board Chairperson for Botswana Savings Bank (BSB) and Permanent Secretary in the Ministry for State President

- Prerna W., Program Director, School of Ultimate Leadership

- Ravi Venkataratna, Senior Industry Principal, Business Consulting , Infosys Finacle

Banks are pivotal to building an ESG conscious world, given their influence on business, commerce and society. However, the challenge lies in making ESG consciousness a part of the bank’s organizational DNA, requiring internal and external change. This panel discussion will feature industry leaders, covering best practices to help your bank create profitable and future-proof value streams in an ESG-conscious manner. The session will feature examples of ESG-conscious measures within the bank and stories of how banks have achieved success in ESG-conscious lending and other products and services.

- Pruthviraj Patil, Global Alliance Director, Global Systems Integrators, Cisco AppDynamics

As digital transformation in Banking evolve to deliver exceptional and reliable customer service across hundreds of banking services while taking a proactive approach to application monitoring and performance, getting ahead of customer needs is imperative for the banking enterprises to scale-up. Customers aren’t aware of the backend challenges of keeping the various cogs moving smoothly; they only know how they feel interacting with the different facets of the business, from mobile apps to web applications to social pages, and they expect quality and consistency at every level. Learn how Cisco AppDynamics is partnering with Finacle FinAssure to empower best-in-class Digital Experience leveraging the power of Cisco’s full-stack observability.

- Puneet Shukla, AVP & Regional Head – EMEA, EdgeVerve

In the current business environment, effectively addressing the diverse needs of millions of banking customers while positioning your enterprise for the future hinges on your ability to harness AI-powered solutions across all facets of your organization, scaling them swiftly. For Banks and financial institutions, the objective of leveraging recent developments in AI should be threefold – drive Straight through Processing; deepen Customer engagement and empower Knowledge workers. Join this session to learn about EdgeVerve’s suite of capabilities powering Finacle, including debt collection, branch banking, and retail and corporate loan origination, which are designed to foster seamless collaboration between people, AI, and automation.

- Sanjay Kupae, Head – Partnerships and Channels, MoEngage

Unlock AI’s Banking Revolution: Explore MoEngage’s digital enablement stack, delve into case studies, and key use cases – seamless onboarding, digital adoption, upselling, cross-selling, web personalization and AI driven customer engagement. Witness AI’s power in simplifying banking and elevating experiences. Stay ahead in banking’s dynamic world. Join us on this session for a journey where AI shapes our financial future.

- Abhishek Sinha, Partner, Financial Services Consulting, EY

- Christophe Parent, Partner, Technology Consulting, EY

- Vivek Patil, Partner, Financial Services Advisory, PwC

- Kimberly Payton, Head of Alliances & Ecosystem Partnerships, Infosys Finacle

In an era marked by increasing uncertainties, from economic shifts to technological disruptions, the banking sector continues to evolve rapidly. Modern banking leaders recognize that resilience is not a mere defensive posture, but a strategic edge. As we dive into future-forward approaches encompassing agile crisis-response strategies, scenario planning, and proactive monitoring of potential disruptions, this session aims to elevate the discourse from managing risks to harnessing them. Join a panel of experts as they unpack the blueprint for banks to not just navigate challenges, but to thrive in their midst, transitioning from mere survival to strategic resilience.

- Devika Nayyar, Country Manager- BFSI, HPE

Join us for the session to understand how you can complete your hybrid cloud strategy and transform with the cloud that comes to you. The question is no longer “What apps should move to cloud and what should stay on prem?” but, “How can I become more data-first and bring a consistent, modern cloud operating model across all your workloads and data?” The answer is HPE GreenLake. Power-up your portfolio and accelerate your digital transformation with insights, secure data and business-critical apps on the edge, innovate faster and modernize IT environments for the new digital norm.

- Druvinda Vaidyakularatne – CIO, Hatton National Bank

- Padmini Nagarajan, Industry Principal – Treasury, Infosys Finacle

Amidst an environment of increasing market volatility and recent events of bank failures, the strategic importance of bank treasury and asset liability management has never been so profound. The expectations are sky high – be it delivering financial prudence, mitigating risks across trading and banking books, ensuring capital adequacy and optimizing profitability through astute investment and balance-sheet strategies. Leading banks are driving the charge with digital operations across their front-to-back treasury technology stack. Join this discussion to hear more about a leading bank’s treasury transformation journey and learn how Finacle is powering the same.

- Abdulla Qassem, Group Chief Operating Officer, Emirates NBD

- Arturo Rivera, Chief Information Officer, Banca Mifel

- Greg Berry, Chief Technology Officer, Nave Bank, Puerto Rico

- Sajit Vijayakumar, Chief Operating Officer, Infosys Finacle

- John Barber, Head of Business – Europe, Infosys Finacle

For some time now, banks have been navigating their digital transformation journey across various business dimensions. However, a recent study revealed that only 11% of executives believe their bank has deployed digital transformation at scale and it was delivering to expectations. This highlights the dynamic nature of digital transformations in an evolving landscape, which, in turn, is constantly shifting the goalposts. In such a situation, how should banks adapt and tune their strategies? What are the best and next practices for success? How can banks define success and measure progress when the goalpost keeps shifting? And how can leaders build an organization that succeeds repeatedly in this digital transformation marathon?

Gain valuable insights and learnings from this panel of visionary leaders who have successfully guided their organizations through transformative journeys. Join us to discover the strategies that will help your bank thrive in the ever-changing digital landscape.

- Fredrik Haren, Author and Keynote Speaker, Business Creativity

As technological advancements continue to reshape societies, banks must adapt and innovate quickly. This places immense pressure on bank executives to enhance their adaptability, amplify their creative capabilities, and cultivate their innovation skills. The leaders who accomplish this will be the ones who emerge at the forefront. An inspiring talk on an important topic concludes the conference on a high note.

Proudly Carbon Neutral

We are delighted to share that Finacle Conclave 2023 was once again a fully carbon neutral conference. The carbon footprint of all delegates travel, stay and participation in the conference, is effectively zero.

#1 The total emissions for the event have been meticulously calculated as per global standards. This includes air travel, hotel stay, food, commutes, energy usage, materials, fuel and much more.

#2 All avoidable emissions have been offset using sustainable methods and materials, including recycled, biodegradable and recyclable materials, largely local sourcing, cleaner energy, waste reduction etc.

#3 Any unavoidable emissions are being offset by carbon credits accrued from Infosys owned, internationally certified Gold Standard carbon offset projects, making the event carbon neutral across all 3 Emission Scopes.

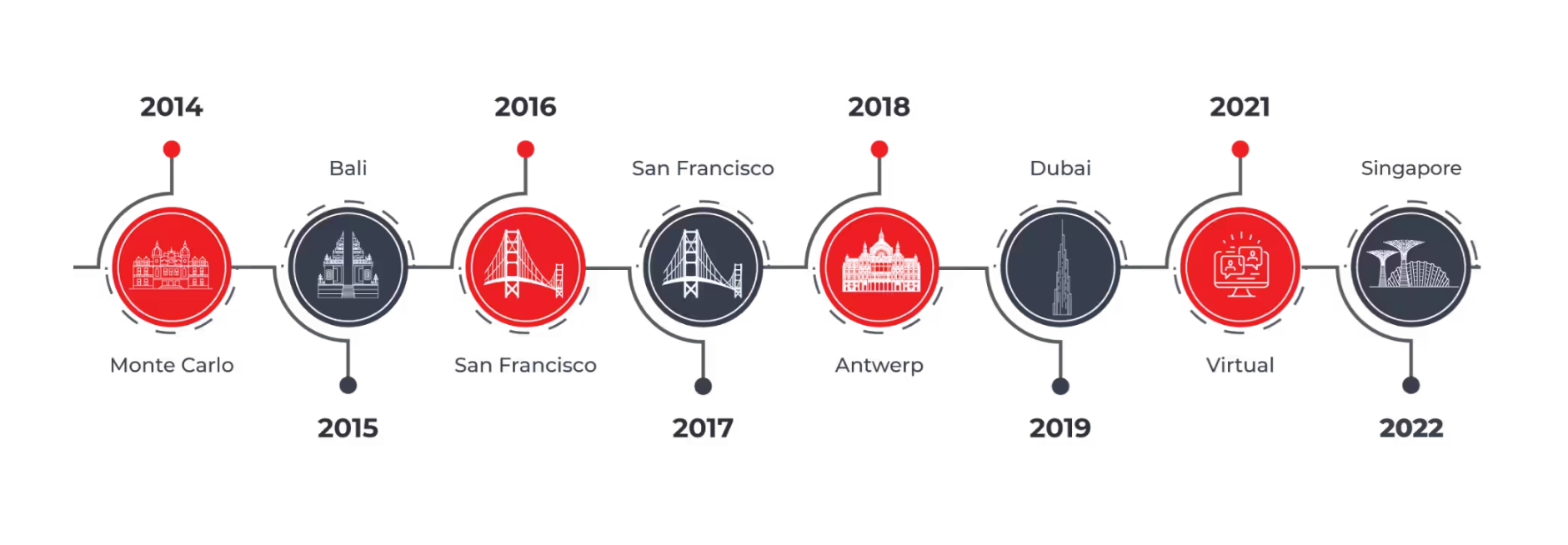

Past Finacle Conclave Venues