-

![]() Quantum Computing: As the Future Awaits, The Strides Are DefinitiveQuantum computing is no longer confined to theory or the edges of experimental science - it is rapidly advancing toward practical impact.Read More

Quantum Computing: As the Future Awaits, The Strides Are DefinitiveQuantum computing is no longer confined to theory or the edges of experimental science - it is rapidly advancing toward practical impact.Read More -

![IDC IDC]() IDC MarketScape: Worldwide Integrated Bank PaymentFinacle Payments is an enterprise payments services system that manages end-to-end payments across instrument types, payment schemes, transaction types, customeRead More

IDC MarketScape: Worldwide Integrated Bank PaymentFinacle Payments is an enterprise payments services system that manages end-to-end payments across instrument types, payment schemes, transaction types, customeRead More -

![]() Supply Chain FinanceToday, as businesses seek to make their ecosystems more resilient, Supply Chain Finance (SCF) has emerged as a powerful lever for banks and financial institutions to support clients, while unlocking new revenue streams.Read More

Supply Chain FinanceToday, as businesses seek to make their ecosystems more resilient, Supply Chain Finance (SCF) has emerged as a powerful lever for banks and financial institutions to support clients, while unlocking new revenue streams.Read More

-

![]() The Future of Core Banking: Business and Technology EvolutionOur point of view paper, “The Future of Core Banking: Business and Technology Evolution”, serves as a candid and forward-looking benchmark of your institution’s readiness—and a strategic playbook for core modernization.Read More

The Future of Core Banking: Business and Technology EvolutionOur point of view paper, “The Future of Core Banking: Business and Technology Evolution”, serves as a candid and forward-looking benchmark of your institution’s readiness—and a strategic playbook for core modernization.Read More -

![The Forrester Wave The Forrester Wave]() Forrester Wave Digital Banking, Q4 2024Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support.Read More

Forrester Wave Digital Banking, Q4 2024Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support.Read More -

![]() Driving Comprehensive Revenue ManagementDiscover why revenue management must evolve into a comprehensive, strategic capability. Decode a blueprint to overcome challenges and unlock sustainable monetization.Read More

Driving Comprehensive Revenue ManagementDiscover why revenue management must evolve into a comprehensive, strategic capability. Decode a blueprint to overcome challenges and unlock sustainable monetization.Read More

-

![]() Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More

Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More -

![]() Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More

Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More -

![]() Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

-

![]() Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More

Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More -

![]() Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

-

![]() Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More

Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More -

![]() A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More

A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More -

![]() Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

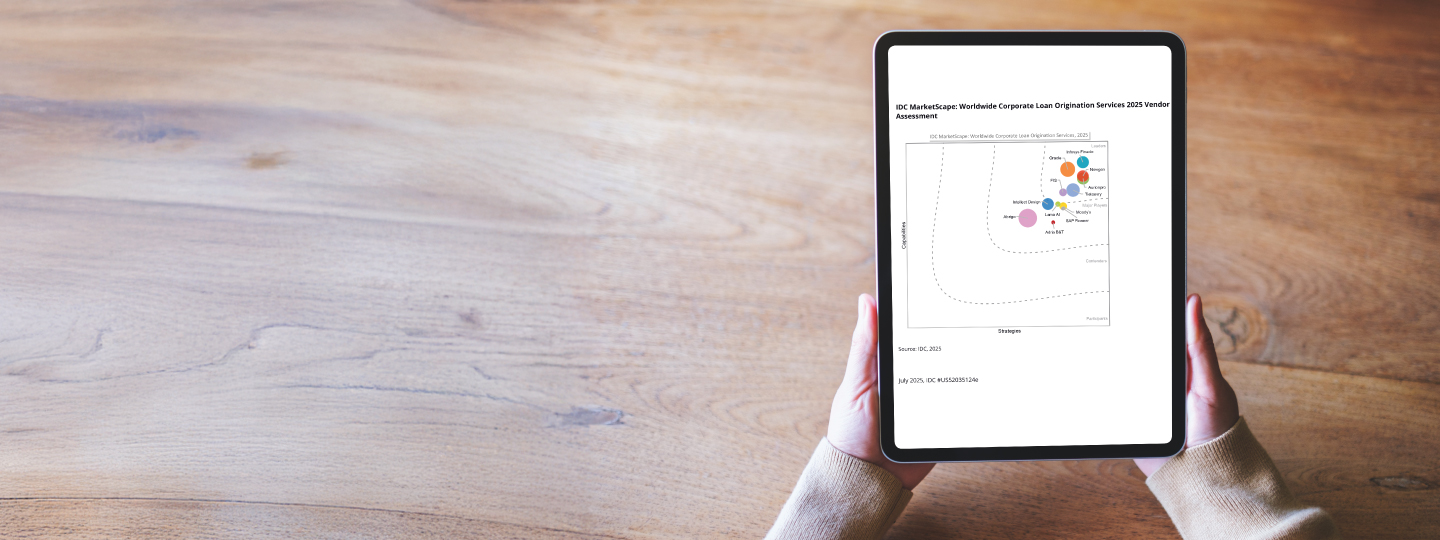

IDC MarketScape: Worldwide Corporate Loan Origination Systems 2025 Vendor Assessment

Infosys Finacle positioned as a Leader

Here’s what IDC MarketScape mentions about Infosys Finacle and Finacle Origination Solution in the report:

- Finacle’s onboarding solution offers extensive configuration capabilities to design customer-centric, end-to-end digital onboarding processes. The platform enables the origination of different types of loans using a rules engine, intuitive workflows, and automated decisioning

- Finacle’s portfolio coverage is wide, and the composable architecture enables Finacle to tailor its solution to meet the customer's needs

- Finacle has adopted all innovative technologies, including AI and GenAI, and confirms its willingness to stay at the forefront of innovation

- AI and ML are widely adopted in the Finacle Origination Solution. It leverages the Finacle AI Platform, a unified, no-code platform that simplifies the AI development life cycle, empowering both technical and business users to rapidly build, train, deploy, monitor, and optimize explainable AI solutions with ease

* Source: "IDC MarketScape: Worldwide Corporate Loan Origination Systems 2025 Vendor Assessment", Jul 2025, IDC # US52035124

IDC MarketScape vendor analysis model is designed to provide an overview of the competitive fitness of technology and service suppliers in a given market. The research methodology utilizes a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each vendor’s position within a given market. The Capabilities score measures vendor product, go-to-market and business execution in the short-term. The Strategy score measures alignment of vendor strategies with customer requirements in a 3-5-year timeframe. Vendor market share is represented by the size of the circles. Vendor year-over-year growth rate relative to the given market is indicated by a plus, neutral or minus next to the vendor’s name.

Streamline Your Loan and Account Origination with Finacle

Accelerate Your Journey Towards a Truly Digital Origination

The Finacle Origination Suite is an enterprise class, multi-segment solution designed to help banks and other FIs seamlessly onboard customers across various segments and products, digitally. The unified solution digitizes the entire application lifecycle from initiation to processing, customer onboarding and monitoring across asset and liability products.

Finacle has helped banks and financial institutions around the world to reimagine their customer onboarding journeys with digital technologies to launch tailored products, drive operational excellence, innovate with agility, and enhance customer propositions.

©2026 -Edgeverve Systems Limited | All rights reserved