AI in banking – A growing imperative

AI has transformed from a niche area of interest to a critical competitive differentiator in the banking industry. While financial institutions have been experimenting with AI technologies like machine learning, natural language processing, computer vision, and deep learning for some time, the focus has now shifted significantly towards value creation. Over the past few years, the adoption of AI has surged markedly, with more than 90%1 of banks now integrating AI in various forms. According to forecasts from the IMF2, AI spending by financial institutions is expected to double between 2023 and 2027, underscoring its escalating significance within the sector. In response, banks are not only accelerating their traditional, predictive AI initiatives but are also increasingly investing in exploratory generative AI pilots. Across the globe, the banking sector is abuzz with the potential of AI, recognizing that their future success depends on robust AI strategies, a forward-looking commitment, and the embrace of modern architectural principles.

A clear AI strategy is key to success

The path to successful implementation of AI use-cases requires a well-defined strategy. Banks must not only invest in cutting-edge technology but also align their AI initiatives with their overall business objectives. This involves careful planning around data governance, ethical AI usage, and integration with existing systems. Moreover, banks should focus on building AI literacy across their workforce to foster an environment where AI-driven solutions are effectively utilized and continuously improved. With a clear strategy, banks can navigate the complexities of AI adoption and harness its full potential to drive innovation, enhance customer experiences, and maintain a competitive edge in the rapidly evolving financial landscape.

The following guiding principles can help banks firm up their AI strategy:

Source: Infosys Finacle

Unlocking possibilities with the Finacle AI Platform

Finacle AI Platform is a comprehensive solution designed to help banks accelerate AI journeys. The unified, no-code platform simplifies AI development lifecycle, empowering both technical and business users to rapidly build, train, deploy, monitor and optimize explainable AI solutions with ease.

The platform offers a rich library of pre-built ML models and supports varied techniques like classification, regression, clustering, and forecasting. Banks can leverage these models to build custom ensembles or even import their own pre-trained models. Features such as model comparators, what-if simulations and pattern analysis are available to refine and elevate modeling sophistication.

The platform promotes responsible AI practices - comprehensive capabilities for detecting biases and drifts, along with a patent-pending synthetic data generation feature to safeguard data privacy during model build and training are all available natively.

Finacle AI Platform is built on the principles of transparency, interpretability, and explainability, fostering trust and accountability in AI models. The platform is based on open-source technologies and can be deployed on both cloud and on-premises infrastructure.

Finacle AI Platform - Key features

Source: Infosys Finacle

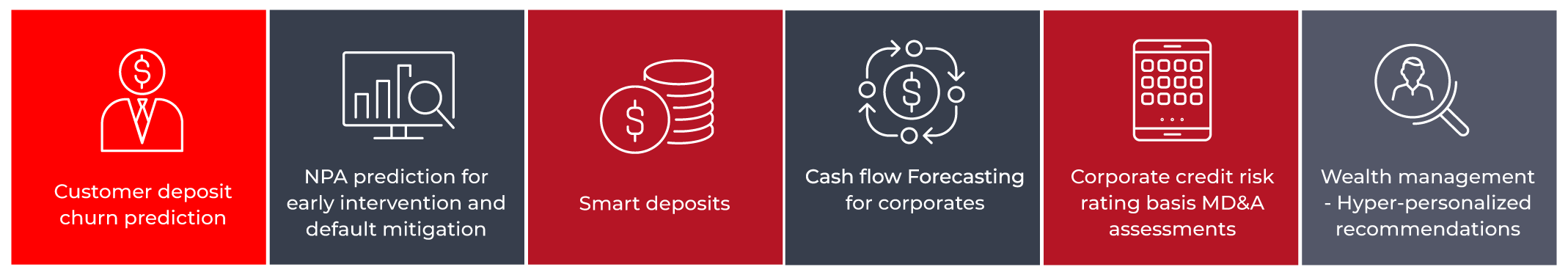

An array of embedded AI use-cases, available out of the box

With an extensive library of pre-built AI use cases, Finacle AI Platform enables banks to seamlessly integrate AI into various business processes and customer journeys, across banking segments. This empowers banks to accelerate value creation from their AI investments and drive innovation.

Finacle AI Platform on IBM Power

Infosys Finacle and IBM have a strong partnership spanning over two decades. This partnership has created compelling enterprise solutions that leverage the best of IBM Power and Finacle solutions that deliver significant value to our customers.

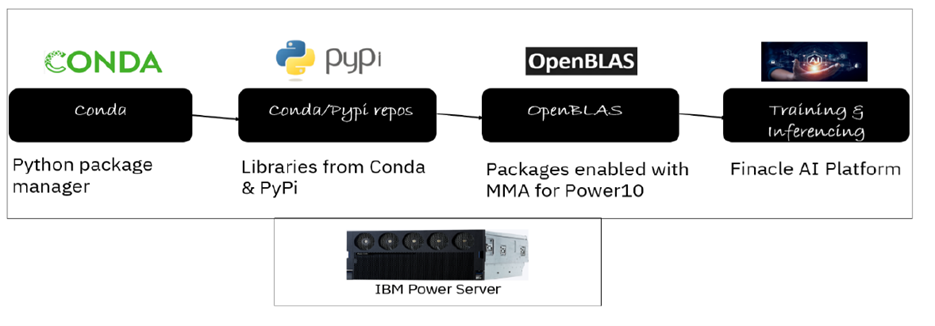

IBM Power is the secure, reliable and scalable infrastructure trusted to run mission critical workloads by global enterprise clients. The latest generation, IBM Power10 is built with on-chip acceleration (Matrix Math Accelerator, MMA) for enterprises to deploy AI at scale without requiring costly and energy intensive GPUs. IBM Power10 provides simplified, open, and flexible AI platform that enables price-performant and high throughput inferencing with full stack security.

The Finacle AI Platform can be successfully deployed on IBM Power 10 hardware. To validate the platform's capabilities on IBM Power 10, we selected the widely used classification use case which has an ensemble of 14 models. The scope encompassed uploading training data, training the models, deriving explanations for trained models, generating feature importance, automatically selecting the best model, and drawing inferences on unseen data. The validation covered the following - ability to train, build, deploy, and monitor.

During the porting process, we performed model training for our ensemble of models and inferenced on the trained model. All the models were executed successfully along with explanations. Python libraries were installed specifically for IBM Power 10 architecture. The time it took for each model to learn was also measured, along with its CPU and memory utilization. This data provides additional insights on the platform's efficiency and resource requirements on IBM Power 10 hardware.

Finacle AI Platform can be deployed on IBM Power infrastructure as an additional LPAR instance, enabling economies of scale. This allows customers to realize a fast time to value by scaling capacity on existing infrastructure while ensuring HW isolation between core data and AI with PowerVM. Enterprise clients will also be able to scale AI resources on-demand using standard IBM Power resource management capabilities.

Embrace AI with Finacle and IBM

The integration of AI in banking is an exciting journey that is just beginning. As AI continues to redefine the banking landscape, choosing the right technology platform and partner is crucial. Finacle AI Platform and IBM Power systems provide banks with AI solutions that are not only ready for today's challenges but also equipped for future advancements. Banks that adopt this powerful combination will be well-prepared to lead in a technology-driven era.

For more information or to set up a briefing for Finacle AI Platform on IBM Power, reach out to Prasant Saxena (prashant.saxena@ibm.com) or Ran Vijay Pandey (ran.vijay@edgeverve.com).

References

1. EY survey – AI adoption in Financial Services, 2023

2. IMF report – AI’s reverberations across finance, 2023