Taken the time to reflect, there’s indeed an interesting parallel between the very philosophy of banking and the cloud. Banks grant commoners the independence of managing their financial lifestyles from the iron vault security (both literal and figurative) of third-party custodians while the cloud gift entrepreneurs freedom to build their dreams while all ITOps foundations are managed virtually at no hassle.

Poetics apart, the latter now powers the modernized former. Today, digital banking is a common parley and one of the most impactful experience transformations across the world. This blog dives deep into the industry’s cloud world and how hybrid cloud, to be precise, is fueling the next-generation of banking.

The Present and Near-Future is Hybrid

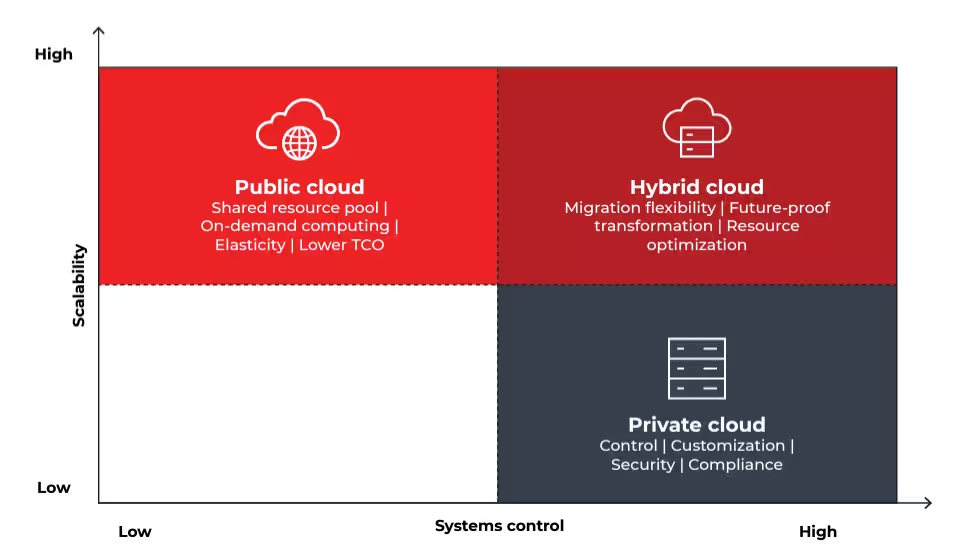

When one considers the various alternatives in cloud migration – risk versus return, public versus private cloud, scale versus security – hybrid cloud emerges as the most viable option. The only question is, what is the best configuration or mix? Traditionally, large and mid-sized financial institutions favored private cloud as it offered them more control; now, they are experimenting with public cloud for applications that are not mission critical. In our recent research* on cloud adoption, 41% of the banks covered had chosen private cloud, 28% had gone with a public cloud, and the remaining 31% were using a bit of both. As more organizations switch to hybrid cloud, the challenge for their technology leadership will be to strike the right balance between on-premise, private and public cloud options based on use cases. Contrary to popular perception, everything on public cloud is not always the best option; there are many situations where the limitations of public cloud, such as latency, governance, compliance issues and performance, rule it out, and private cloud is what works. The other reality is that banks still have many legacy applications that are not cloud-ready and therefore need to be maintained on the premises. Hybrid is the way forward, at least for the foreseeable future.

With the right approach, hybrid cloud can deliver the best of both worlds

Source: ‘Banking on Cloud: The next lap’, Infosys Finacle, 2022

The True Potential of Hybrid Cloud for Banks: More than ‘Best of Both Worlds’

Hybrid cloud, in true sense, is the ultimate ‘customizable cloud’. Below are some instances:

| Enhancing Legacy Boundaries | A bank might want to host its networking and data assets on-prem while accessing a horde of SaaS applications to serve its customers |

| The Right Cloud Mix | A firm might want to migrate its CRM, HRMS modules to a public cloud to ensure fast office and end user operations while the financial management systems and core SAP applications could be hosted on a banking community cloud/private cloud delivered by hyperscale cloud providers/private-as-a-service infrastructure/traditional on-prem |

| Single but Significant Use Case | A company might just want to onboard a DaaS solution to collaborate and work across regions without disruption while the entire core banking ecosystem remains on its legacy foundations, the two interfaced together for maximum benefits |

| Risk-proofing End to End | A firm might just buy licenses to Azure Sentinel and wrap it over its multiple on-prem, cloud, third-party ecosystems to ensure end-to-end protection regardless of the location of the workload |

| Containerized Agility | A bank might just want to containerize and modernize its core banking systems, applications, workloads so that they work seamlessly regardless of the type of environment running underneath |

| Accelerating Product Pipelines | A firm might need to create a unified DevOps pipeline connecting product development lifecycles across all factions and regions for seamless, collaborative work and accelerated go-to-market timelines globally |

| The Compliant Cloud | A bank might hop into the sovereign cloud bandwagon and ask its partner to configure a public cloud-like environment with in-country hosted zones and infrastructure, meeting the country’s stringent IT guidelines |

| Brewing at the Edge | Think deeper about the vast edge possibilities; applications running on end mobile devices connected to the bank’s central cloud infrastructure, or a small stack of private servers running at local branches to deliver remote users ultra-low latency experiences while the former is connected via SD-WAN to a central hosted zone in metro city |

A Realm of Endless Business Possibilities: The Benefits of Hybrid Cloud

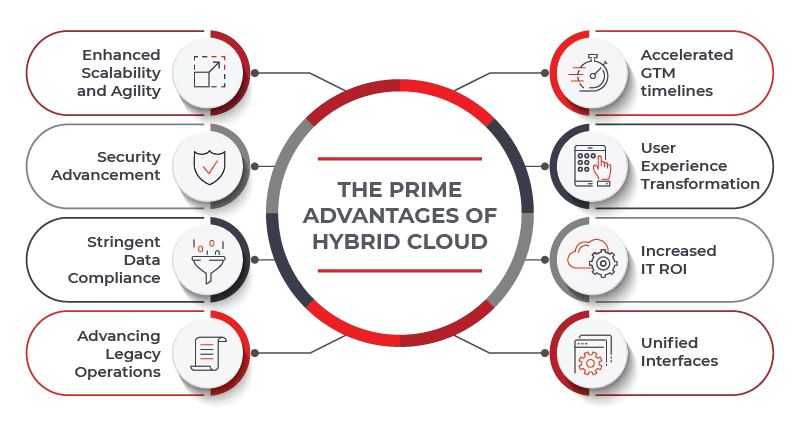

There are endless customizations in implementing cloud solutions that suffice a business objective. That’s where the hybrid cloud is game. Below are the prime advantages of hybrid cloud:

- Enhanced Scalability and Agility: Hybrid cloud, by being customized to combine the best of multiple private and public cloud counterparts, guarantees maximum availability, scalability, and agility of mission-critical workloads. Hybrid cloud partners often fine tune the architecture to ensure maximum performance and security end-to-end at the most optimal monthly costs. This helps banks, running with a gargantuan volume of daily workloads, to operate without hassle and maximize returns at the end.

- Security Advancement: Banks could host their mission-critical assets such as networks, databases, and core infrastructure on-prem or on the private cloud counterpart. Even if that’s not the case, IT leaders can also onboard third-party security solutions on their hybrid cloud landscape as the latter is quite flexible, customizable, and easily integrable. The entire security posture could be maintained from a single pane of glass view.

- Stringent Data Compliance: As the mission-critical assets can be hosted on-prem or on local regions, firms can seamlessly comply with central bank regulations and data guidelines. Automated governance tools and processes make it easy to compliance checks in real-time whenever there are data shifts or new solutions are onboarded to the existing ecosystem.

- Advancing Legacy Operations: In hindsight, perhaps one of the most important advantages, banks need not disrupt their existing legacy yet critical operations to embrace the hybrid cloud. A public cloud counterpart could be seamlessly linked with the existing on-prem landscape, and the former could be utilized to scale up workloads when necessary. This instantly provides the bank with undisrupted operations, anytime and every time irrespective of peak periods.

- Accelerated GTM timelines: Hybrid cloud makes it easy to unify DevOps pipelines across multiple landscapes and factions. Monitored and administered from a single pane of glass, this helps BFSI organizations to congregate their product development and innovation pipelines and help teams across regions to collaborate faster, go to market without risk. Hybrid cloud makes it easy to build, test, deploy, and go live with a unified automated DevOps pipeline regardless of the core platforms and infrastructure running underneath.

- User Experience Transformation: User-facing banking apps run smoothly and at full gear when there’s an agile, hybrid cloud core running at the backend. Seamless scalability, frictionless operations of the cloud core directly impact the experience of the end user. This is reflected in super-fast transactions, seamless app refresh rates, easy retrieval of financial data, zero lag insight representations in real-time, etc. The best part is the experience holds true even in remote areas enabling a digital banking transformation without risk.

- Increased IT ROI: Regardless of the architecture of the private and public cloud counterparts, there’s very little to no CapEx involved in setting up the hybrid cloud. All resources can be consumed on an OpEx or pay-as-you-go model for maximum gains. In addition, many cloud partners are now also willing to engage in a pay-as-you-grow model that helps a firm scale up and down on cloud bills as per their real-time business needs. This definitely is a harmonious engagement where the hybrid cloud acts as the foundation and catalysis for business growth.

- Unified Interfaces: Irrespective of the mix of clouds or IT environments constituting the hybrid cloud architecture, banking leaders can monitor, manage the landscape from a single pane of glass. The interface not only allows technical administration, but also delivers cutting-edge performance analytics, health insights, and more for effective, risk-proofed operations. If the bank has onboarded a FinOps solution, the same could also be integrated with this unified control panel to avail a bird eye’s view of the cost flows across the entire cloud operations, enhancing financial governance of the cloud.

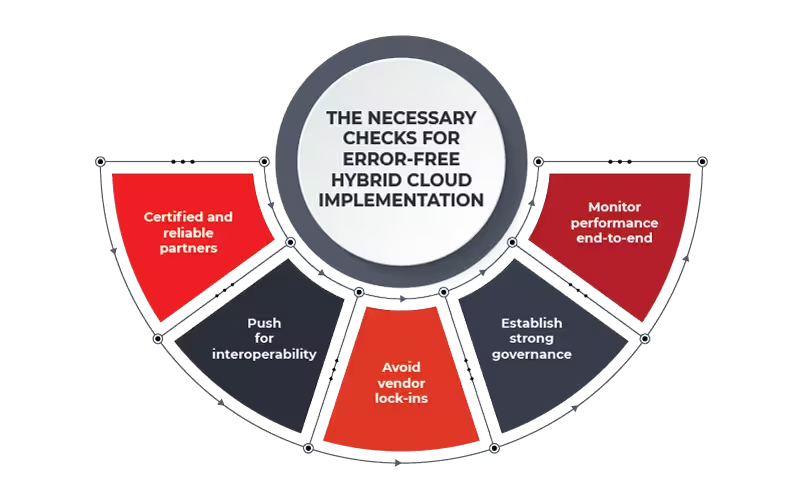

The Necessary Checks for Error-Free Hybrid Cloud Implementation

- Certified and reliable partners: Banking cloud partners should command migration, MSP, and if necessary specific solution competencies for the public cloud platform the bank is opting for. The vendors should also exhibit compliance with central bank guidelines for cloud banking practices in the particular region the firm operates in.

- Push for interoperability: Open banking is the new norm. These practices allow banks to combine their expertise, and solutions with other FSI innovators and deliver holistic experiences to end users. Think for a moment. Open banking allows fintech providers to deliver account-to-account hassle-free transaction experiences while the former avail behavioral insights on what serves the end customer best. The core banking systems and its infrastructure must facilitate interoperability; open APIs following interoperability standards, microservice-based modules, easily integrable platforms with third-party systems, etc without compromising on data security or compliance.

- Avoid vendor lock-ins: Often solution providers or vendors deliver closed ecosystems that cannot be integrated with other landscapes. Vendor lock-ins could be an extreme hassle and if the core banking systems and modules operate in closed doors, there would be little to no room left for quick advancement, integrations with new solutions. Often that would mean wholesome modernization of core assets which can prove costly at one go. Hence, it’s wise for banks to opt for solutions that are interoperable and integrable with external platforms.

- Establish strong governance: All digital banking processes, workloads, and operations must follow internal guidelines and local, regional, or national banking guidelines. Protection and storage of sensitive data and information processes is one of the key reasons to establish such acute governance. Often these governance checks are made by the cloud partners or managed service providers and there are automated governance tools too for end-to-end audits.

- Monitor performance end-to-end: Once the hybrid cloud ecosystem is in place, ensure there are proper monitoring tools and services to check health of infrastructure, systems, and applications running on top in real-time. Autonomous operations are also now gaining steam wherein AI, ML, automation algorithms continually check the current states of all IT components in action, identify errors, and self-patch functions at next to nil human intervention. These insights help shift a bank’s IT functions to being proactive in identifying probable risks and mitigating them rather than being reactive.

Inspiring the Future of Banking with Finacle on Cloud4C Hybrid Cloud

Infosys Finacle is the industry-leading digital banking suite trusted by banks across 100 countries. Apart from core banking solutions, the suite also covers wealth management, lending, treasury management, customer engagement, fintech, AI and blockchain solutions, SaaS modules to help banks transform operations, innovate, and engage better.

But, just like every modern digital ecosystem, the best possibilities of Finacle are unlocked on the cloud. Cloud4C, the world’s leading application-focused Cloud MSP and an Infosys Partner for Finacle, delivers a fully managed, highly available, hybrid cloud solution to run Finacle ecosystems at full steam without any disruption, data, or security risk. Organizations can host their Finacle workloads on a well-architected public, private cloud platforms of choice, expand into a seamless multi-cloud powered by Cloud4C Bank-in-a-Box framework, and integrate cloud-native services as fit.

All of this in a single SLA from infrastructure to application login layer.

- Fully modernized architecture with cloud-native capabilities

- Maximum availability till application login

- Certified cloud reference architecture for Finacle applications

- Fully managed hybrid and multi-cloud foundations

- Continuous performance optimization at maximum ROI

- Fully compliant with central bank regulations and international standards

- Everything-as-Code support for next-gen operational agility and flexibility

- Data-driven outcomes, AI-powered insights for informed decision-making

- Integrated Cybersecurity and DRaaS

- Platform-based administration, single pane of glass view end-to-end

Begin Your Hybrid Cloud Transformation at Zero Risk

It’s no secret that we are living in the experience economy where banks need to fine-tune their services for the end customer, hyper-personalized, and frictionless. Customers access all banking services from their mobile apps and make informed financial decisions with real-time analytics. For legacy banks or even their modern incumbents, achieving this is only possible when they operate with a next-gen banking platform running on an equally agile cloud core.

The Finacle and Cloud4C hybrid cloud solution duo promises exactly that with fully risk-proofed mission-critical transformations. Over the years, our banking customers have witnessed up to 33% higher returns, 20% boost in innovations at up to 50% cost savings on their IT investments. Almost 100% of these engagements have witnessed next to nil disruptions during their cloud evolution journeys. Jumpstart your future with Infosys Finacle on Cloud4C’s risk-proofed hybrid cloud tailored for banking use cases. Connect with our experts today to explore further.

References:

1. https://epaper.timesgroup.com/article-share?article=19_04_2023_017_010_toim_TOI

2. https://www.ibm.com/downloads/cas/74KLAO6J

3. https://www.alliedmarketresearch.com/hybrid-cloud-in-bfsi-market-A14267