-

![]() ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More

ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More -

![Everest Group PEAK Matri Everest Group PEAK Matri]() Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More

Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More -

![]() Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

-

![]() Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More

Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More -

![]() Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More

Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More -

![]() Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

-

![]() Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More

Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More -

![]() Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More

Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More -

![]() Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

-

![]() Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More

Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More -

![]() Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

-

![]() Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More

Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More -

![]() A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More

A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More -

![]() Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

DBS Bank Highlights:

Like Customers, Like Bank: Trulydigital

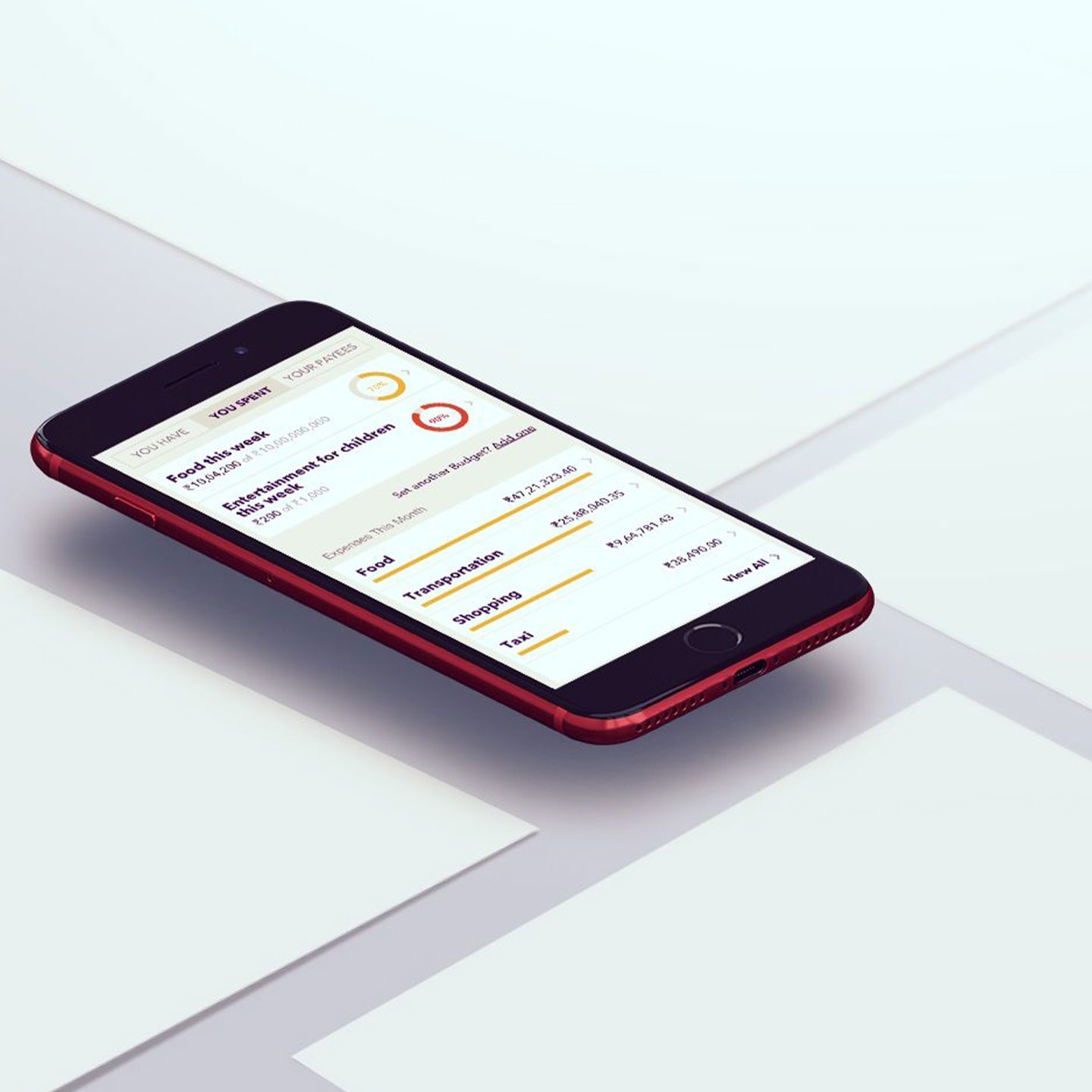

DBS serves some of the world’s fastest growing mobile markets and saw an opportunity to create a bank that was truly digital right down to its core. A bank to both impress the digital generation and simplify banking for millions of people. To achieve this, while ensuring easy scalability and empower growth, DBS adopted a three pronged strategy.

DBS envisioned a branchless, mobile-only bank that would offer all the functionalities of a physical bank, while making every process paperless and seamless. The result – digibank – a simple, convenient and secure way to bank on-the-go. To ensure such convenience along with robust security called for a flexible, scalable and resilient platform on which DBS could build their services and launch new features. And that’s why DBS chose Infosys Finacle.

Modern Platform, Designed for Agility

DBS required a partner who could help them transform digibank into a truly digital outfit with speed and efficiency, and the Infosys Finacle team delivered just that.

- Advanced Solution Suite

for core and wealth products to design personalised customers journeys and enable continous innovation - Agile Delivery

to break down the delivery requirements into sets of work items to be completed in sprint cycles - Design Thinking Principles

for the requirement gathering and design stage

digibank uses one-fifth of the resources required in a traditional bank set-up.

Reaching 1.8 Million People in 18 Months

A unique and incredibly forward-looking service, digibank gained over 1.8 million customers in India, within just 18 months of its launch. Here’s how digibank achieved its vision of reimagining and simplifying the banking experience.

Convenience

Customers can open an account right from the mobile app, requiring minimal data and zero paperwork, in just 90 seconds

Wallet to Savings Account

Customers can open a wallet account and can convert into a savings account anytime to enjoy greater returns

Open Banking

Leveraging UPI, DBS empowers its customers to manage

all their external bank accounts through its app. They can see real time bbalances and send or receive payments.

Invest in a Flash

Customer can open a wealth account in a jiffy, create a personalized risk profile, and purchase, track and redeem mutual fund on the go

Manage Finances Wisely

With budget optimizers, customer can track expenses, analyze purchase patterns and get actionable advise.

Frictionless Payments

Customers can make payments using their digibank app at all QR-enabled stores and website

Invested in the Future

With its hassle-free functionality and innovative feature-set, digibank is providing a delightful experience to customers in India and Indonesia, as well as rapidly increasing their presence in the two markets.

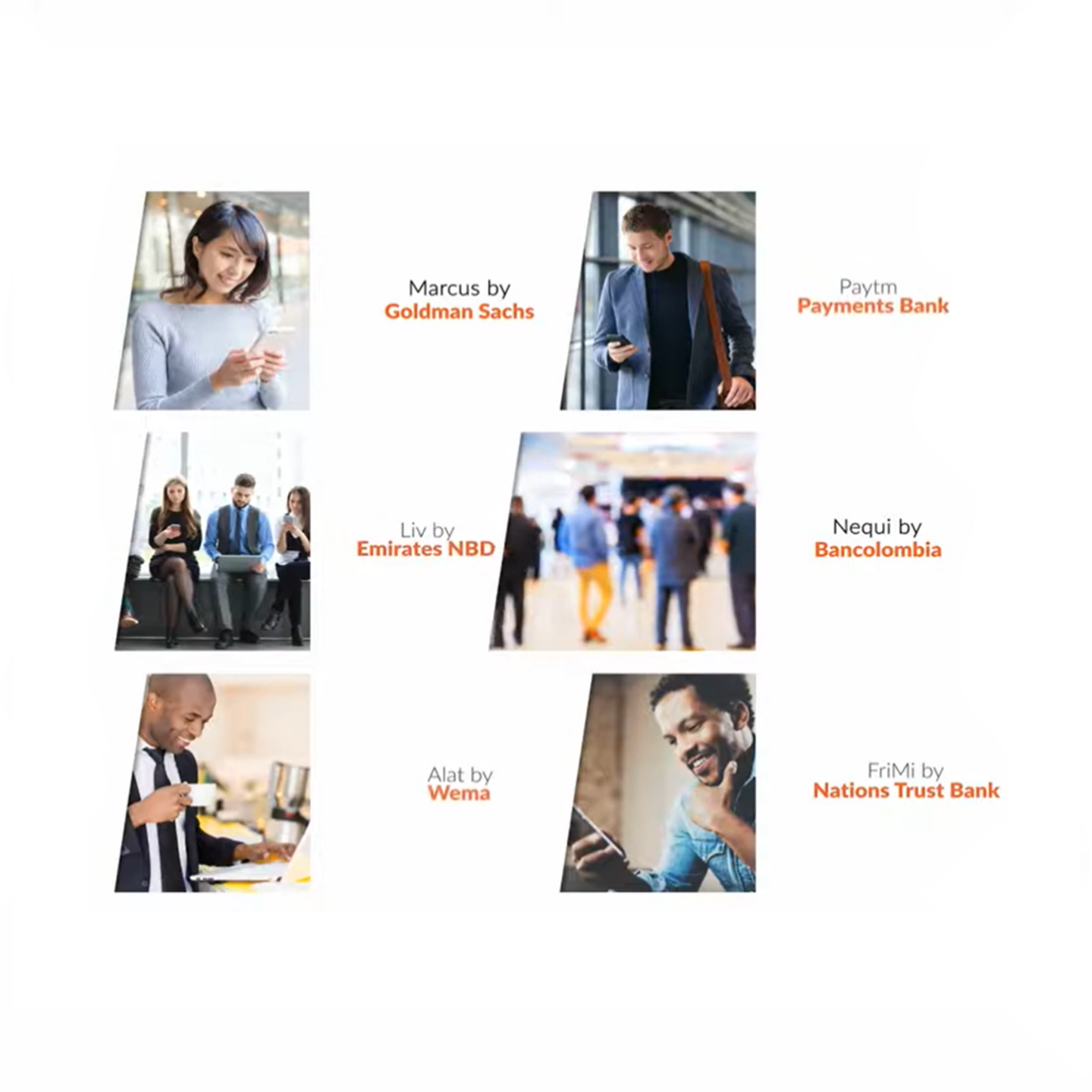

Learn How Leading Digital Banks Rely on Finacle

©2025 -Edgeverve Systems Limited | All rights reserved