-

![]() ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More

ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More -

![Everest Group PEAK Matri Everest Group PEAK Matri]() Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More

Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More -

![]() Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

-

![]() Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More

Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More -

![]() Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More

Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More -

![]() Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

-

![]() Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More

Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More -

![]() Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More

Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More -

![]() Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

-

![]() Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More

Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More -

![]() Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

-

![]() Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More

Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More -

![]() A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More

A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More -

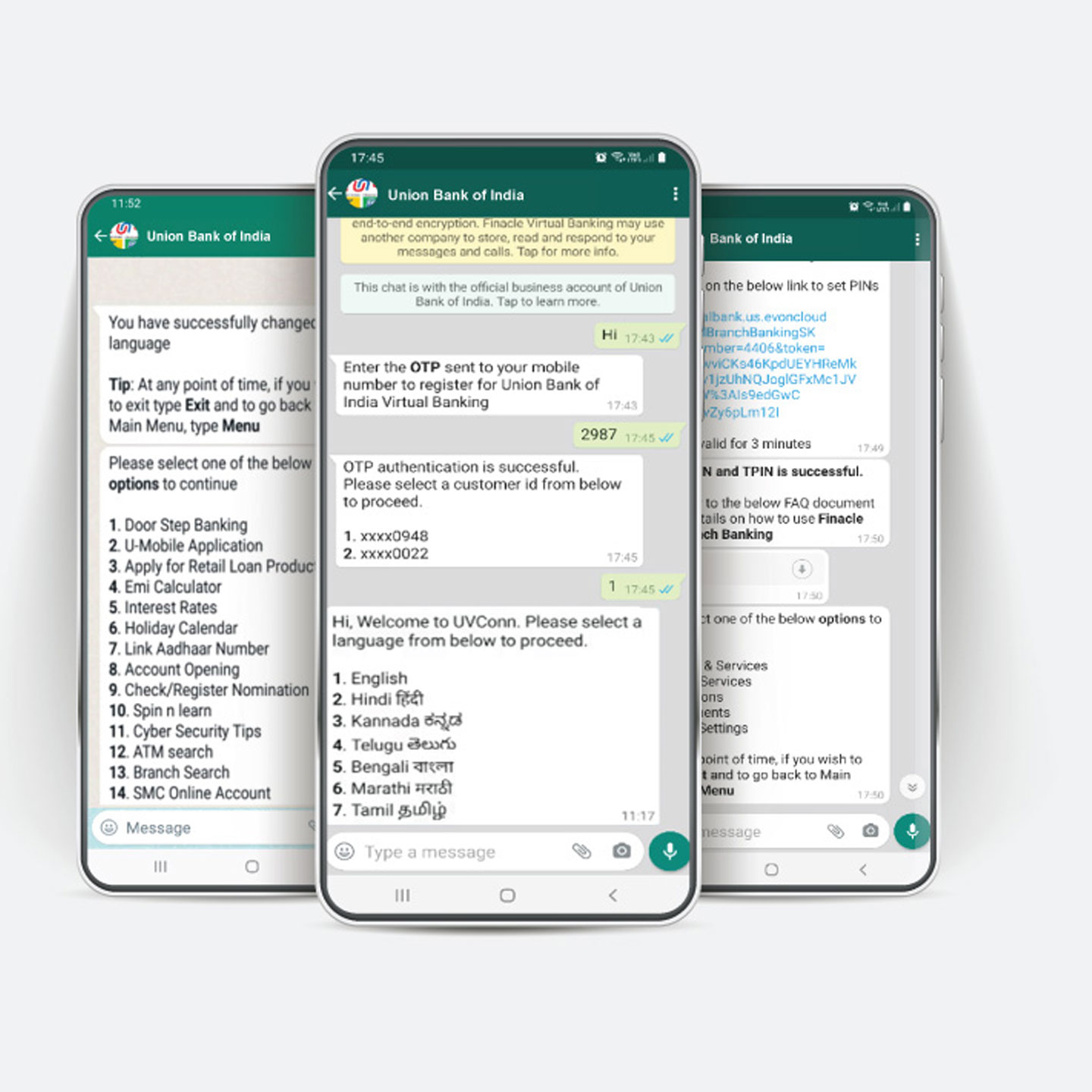

![]() Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of India

Integrates into Customers’ Primary Journey with Finacle Conversational Banking

About the Transformation

The bank leveraged the growth potential that a platform like WhatsApp offers by making its services available on it and responding to customer queries with Union Virtual Connect (UVConn). UVConn gives its retail customers personalized banking services, at their preferred time, place, and in seven languages. The bank made key services available to the users, including door-step banking, lending, deposits, and grievance redressal amongst others, and cater to customers’ inquiries related to accounts, cheque books, and lockers.

A Robust Technology for Increasing the Bank’s Digital Footprint

The bank opted for Finacle Conversational Banking and Remote Banker that allowed them to create, configure, and manage bots using GUI to create conversational flow for the users on any popular chat platform. The bank is now enabled with:

- Channel Agnostic Chat Interface – UVConn is currently integrated with Bank’s WhatsApp business number and can also be extended to other chat messengers such as Facebook Messenger, Signal, and Telegram.

- Self-service Transactions – The bot supports both non-financial service requests and query resolution.

Success Highlights

- Onboarded 5,17,901 customers and received 16,45,040 enquiries within 7 months of its launch

- With Conversational Banking, the bank offers 16 auxiliary services and 6 enquiries

- Customers can safely connect with the bank’s official number via the end-to-end encrypted WhatsApp messaging interface Union Bank of India with added levels of authentication like OTP, MPIN, and more

- Finacle Remote Banker is agnostic to any messenger interface and thus enables the bank to extend conversational banking experiences to other popular chat messenger platforms as well

A. Manimekhalai,

Managing Director & CEO, Union Bank of India

It has always been our endeavour to build lasting relationships with customers by offering simple, fast, and contextual banking solutions and experiences with improved convenience. In line with this vision, we have introduced this service on WhatsApp, one of the most popular instant messaging applications in the world. Our retail customers can execute a host of their banking requirements on their own, without visiting a branch, instantaneously and securely. With Finacle Conversational Banking and Remote Banker, we can now tap into the growing prominence of social media in everyday life. We expect this simple and convenient form of banking to add immense convenience to our customers and hope to see its rapid adoption in the months to come.

©2025 -Edgeverve Systems Limited | All rights reserved