-

![]() ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More

ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More -

![Everest Group PEAK Matri Everest Group PEAK Matri]() Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More

Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More -

![]() Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

-

![]() Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More

Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More -

![]() Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More

Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More -

![]() Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

-

![]() Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More

Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More -

![]() Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More

Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More -

![]() Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

-

![]() Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More

Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More -

![]() Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

-

![]() Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More

Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More -

![]() A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More

A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More -

![]() Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Overview

Leading global banks have leveraged Xelerate® to drive customer experience and thus increase the life time value of the customers. You can create innovative and personalized offerings in real-time, backed by intelligent insights from customer data. Pre-empting and managing risks will also lead to improved profitability. Our consistent R&D initiatives keep the product suite futuristic to match the needs of the changing industry landscape. You can stay agile and a step ahead of competition. Our customers will vouch for this.

Watch & Learn

SunTec Corporate Video

we work closely with enterprises across Financial Services, Digital Communication Services (DCS), & Travel in creating differentiated customer experience and to realize value for their stakeholders within the marketspace.

Watch & Learn

Xelerate's Pricing and Billing capabilities

Corporate banks today face immense challenges in improving their overall value proposition as a customer-centric organization. Xelerate relationship-based pricing and enterprise billing solution, by SunTec Business Solutions, has been designed for financial institutions who aspire to achieve customer centricity and sustainable growth but at the same time face complex bill cycles and fragmented invoice challenges leading to revenue leakages.

Watch & Learn

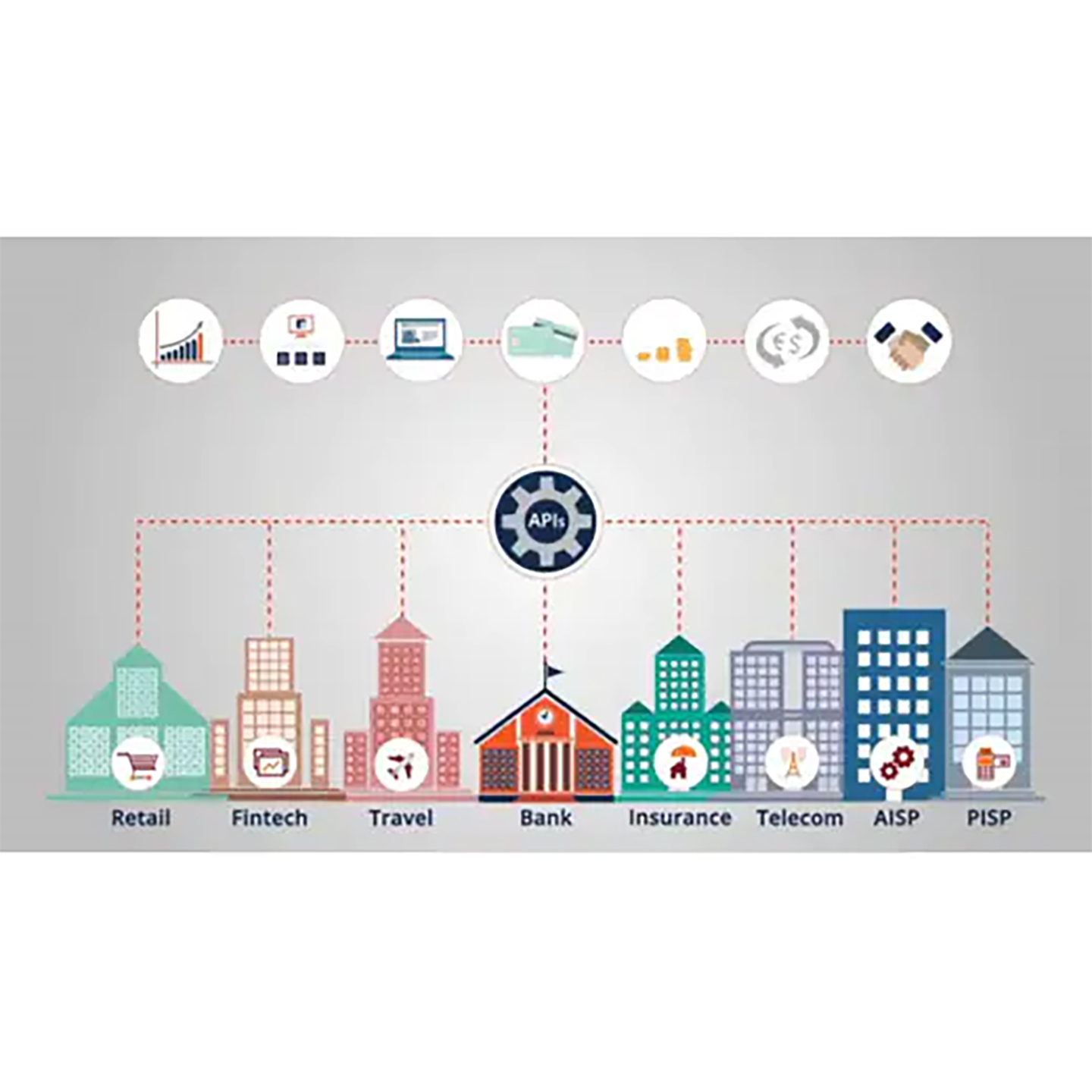

Embrace Open Banking - The Next Level of Customer Experience

Watch industry experts - Paul Rohan, author of "Open Banking Strategy Formation", and Gianluca Corradi from Simon-Kucher & Partners express their views on the Open Banking revolution. Know what it takes to transform and elevate to the next level of customer experience. SunTec Business Solutions provides proven solutions and is a trusted partner to global banks. Our flagship product, Xelerate®, empowers banks to embrace Open Banking, and get ahead of competition, by innovating rapidly on business models to aggregate...

Features

Centralized Information Management

Manage complex 360° customer, product & account views across multiple relationships & pricing schemes across the enterprise

Features

Real-Time Analytics

Monitor, track and simulate revenue generated across the enterprise and partner networks using intuitive dashboards

Features

Enterprise Billing

Simplify billing and operational efficiency with a granular-level tracking of transaction data and a robust billing engine

Benefits

SunTec helps clients increase the lifetime value of their customer relationships through real-time customer experience orchestration across the financial services and the digital and communications services industry.

- Real-time personalization of offers and pricing transparency with 360-degree customer and product view

- Omnichannel banking experience for clients across channels and geographies

- Interface to upstream and downstream channels with centralized product catalogue

- Streamlined and automated processes and reduced time to market for product and offers

- Increased customer wallet share with cross-selling, up-selling and cross-product pricing capabilities

- Catered to complex hierarchical structures across geographies

SunTec provided the ideal platform for the bank to design products suitable to the market demands in real-time. Xelerate enabled the bank to enhance customer experience with personalized offers and innovative pricing schemes and providing a unified view of customer. SunTec became the first solution provider to enable the bank with a multi-country implementation of their pricing needs.

Xelerate®, next generation product suite, enabled the client to overturn its legacy process and helped improve client relationships. Administration of complex fee computations were made easier and the computation time frame reduced from 8 days to 1 day.

Xelerate powered the client to place customers as their focal point enabling deliver customer centric and personalized offerings. The client was able to reduce the turn around time for the services provided, thus generating faster ROI and rapid growth in customer base

Related Solutions

©2025 -Edgeverve Systems Limited | All rights reserved