-

![]() ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More

ESG in bankingESG-conscious banking should create new and future-proof value streams to build a sustainable and resilient business.Read More -

![Everest Group PEAK Matri Everest Group PEAK Matri]() Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More

Everest Group PEAK MatrixA comprehensive solution delivering a full spectrum of wealth products as great experiences. It also improves the productivity of financial advisors and streamlRead More -

![]() Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

Subsidiary of an American Bank in IndonesiaFind out how a leading American bank adapts to a digitalized trade and supply chain finance operations as a part of its larger transformation by leveraging Finacle Trade Finance Solution Suite.Read More

-

![]() Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More

Recomposing Banking: Leading the Digital ContinuumReport gives you a glimpse of the major areas where recomposing banking will create significant impact and value, Infosys Finacle has put together a report on..Read More -

![]() Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More

Core Banking on Cloud: Navigating to the Fast LaneTake a deep dive into cloud-based core banking and explore the imperatives, opportunities and challenges, and the hallmarks of a robust solution.Read More -

![]() Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

Embracing Payments ComposabilityA step-by-step guide for maximizing Real Time Payment opportunities by embracing Payments Composability...Read More

-

![]() Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More

Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More -

![]() Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More

Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More -

![]() Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

-

![]() Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More

Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More -

![]() Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

-

![]() Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More

Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More -

![]() A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More

A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More -

![]() Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

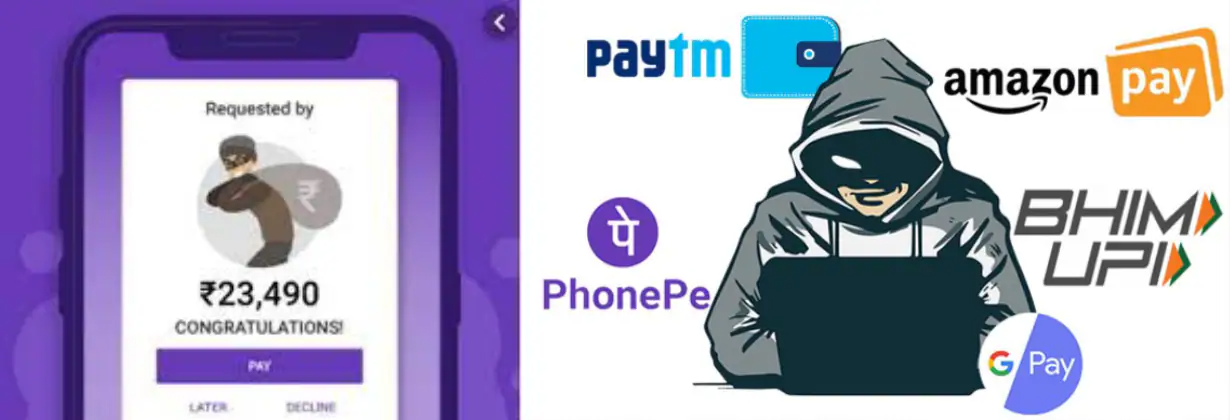

Are We Making Payments Faster at the Cost of Safety?

Blogs

UPI (Unified Payment Interface) was launched on 11th April 2016 and in the last two years it has been the most preferred mode for sending and receiving money. As per NPCI (National Payments Corporation of India), UPI reached 7.3 billion transactions this October 2022, surely this implies the phenomenal growth of UPI in India. RBI’s digital payment index indicates the extent of digitization of payments across country, it has risen from 207.94 in March 2020 to 349.30 in March 2022.

The extent of this payment revolution is so much that users have stopped carrying wallet/cash with them, by simply relying on UPI transactions. Moreover, it has resolved the most common issue of cash transaction i.e., ‘not having change’. Even after achieving this level of digitalization in payment space, NPCI continues to add more cherries on the cake. Recently, they launched 3 more products-

- UPI Lite- To make small ticket payments quickly without the need to enter UPI PIN.

- UPI 123 Pay- To make payments using feature phones (not smartphones)

- Credit on UPI- To make payment through Credit Card instead of bank account

While above seems very fancy and cool, the question we need to ask ourselves is the need of it? Do we still require payment to be faster? Indian payment system has already achieved a significant level of digitization through NEFT, RTGS, IMPS and UPI. While this has become boon to many (mostly digital savvy people), but a curse to others especially those who are negligent, unaware of this sophisticated technology.

More number of fraudsters have become active these days that in general all banks including RBI have launched campaigns to spread awareness on digital payments to be vigilant. Fraudsters are using fake QR codes to trick innocent people and perform online scams. Vishing (Voice Phishing) is another common way by online scamsters to dupe. This has generated distrust of many in digital payments, and all its features like speed, operability and convenience are conceived like “known devil is better than unknown angel”.

Though we have all sorts of fraud detection and alert systems, somewhere we have failed in building the trust for online payments that they are safe and secure. Can we change our approach to ‘finding a cure’ rather than ‘preventing it’ only?

We require faster payments but not at the cost of safety and security. Its high time that R&D in payment space should focus more on how to make payments more safe and secure. Also, in case of default, how it can be backtracked.

While the new-age fintech start-ups are focusing more on providing users on demand one-click banking service, Finacle as a banking backbone has all kind of resources, data, system integrations to solution the aforementioned.

©2025 -Edgeverve Systems Limited | All rights reserved