-

![]() Quantum Computing: As the Future Awaits, The Strides Are DefinitiveQuantum computing is no longer confined to theory or the edges of experimental science - it is rapidly advancing toward practical impact.Read More

Quantum Computing: As the Future Awaits, The Strides Are DefinitiveQuantum computing is no longer confined to theory or the edges of experimental science - it is rapidly advancing toward practical impact.Read More -

![IDC IDC]() IDC MarketScape: Worldwide Integrated Bank PaymentFinacle Payments is an enterprise payments services system that manages end-to-end payments across instrument types, payment schemes, transaction types, customeRead More

IDC MarketScape: Worldwide Integrated Bank PaymentFinacle Payments is an enterprise payments services system that manages end-to-end payments across instrument types, payment schemes, transaction types, customeRead More -

![]() Supply Chain FinanceToday, as businesses seek to make their ecosystems more resilient, Supply Chain Finance (SCF) has emerged as a powerful lever for banks and financial institutions to support clients, while unlocking new revenue streams.Read More

Supply Chain FinanceToday, as businesses seek to make their ecosystems more resilient, Supply Chain Finance (SCF) has emerged as a powerful lever for banks and financial institutions to support clients, while unlocking new revenue streams.Read More

-

![]() The Future of Core Banking: Business and Technology EvolutionOur point of view paper, “The Future of Core Banking: Business and Technology Evolution”, serves as a candid and forward-looking benchmark of your institution’s readiness—and a strategic playbook for core modernization.Read More

The Future of Core Banking: Business and Technology EvolutionOur point of view paper, “The Future of Core Banking: Business and Technology Evolution”, serves as a candid and forward-looking benchmark of your institution’s readiness—and a strategic playbook for core modernization.Read More -

![The Forrester Wave The Forrester Wave]() Forrester Wave Digital Banking, Q4 2024Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support.Read More

Forrester Wave Digital Banking, Q4 2024Finacle is best suited for large retail, SMB, and corporate banks who seek a modern, comprehensive, innovative platform with superior support.Read More -

![]() Driving Comprehensive Revenue ManagementDiscover why revenue management must evolve into a comprehensive, strategic capability. Decode a blueprint to overcome challenges and unlock sustainable monetization.Read More

Driving Comprehensive Revenue ManagementDiscover why revenue management must evolve into a comprehensive, strategic capability. Decode a blueprint to overcome challenges and unlock sustainable monetization.Read More

-

![]() Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More

Shaping Banking’s Next: Banking Technology Trends for 2025 and BeyondThe banking industry has been balancing disruption and opportunity for several years now, and the pace of change shows no signs of slowing as we move into 2025 and beyond.Read More -

![]() Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More

Virtual Accounts 2.0: Surpass Conventional Cash Management and Unlock Next-Gen PossibilitiesVirtual Account Management was a groundbreaking shift in the banking landscape, revolutionising use cases like cash concentration, pooling, centralised treasury management, and in-house banking (POBO, ROBO, COBO)Read More -

![]() Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

Unlocking Hybrid CloudAs banks push forward with their digital transformation agenda, cloud serves as a pivotal enabler. Each bank, at varying stages of adoption, crafts its unique path, dictated by context, regulations, and risk appetite.Read More

-

![]() Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More

Banking on CloudThis report from Infosys Finacle delves into the need for accelerating cloud adoption, highlights the current state of the industry, and puts forth key recommenRead More -

![]() Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

Omdia Universe | Cloud-based Core BankingIn the report, Omdia highlights the following key capabilities of leading cloud-based core banking providers:Read more

-

![]() Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More

Emirates NBDEmirates NBD consolidates its operations on a single version for scalability, agility, and standardization.Read More -

![]() A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More

A Global Top 5 BankDiscover how a global top 5 bank headquartered in the US accelerated payments transformation.Read More -

![]() Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Union Bank of IndiaUnion Bank of India launches Union Virtual Connect (UVConn) by leveraging WhatsApp to provide customers personalized banking services.Read More

Digitization of Core Banking

Blogs

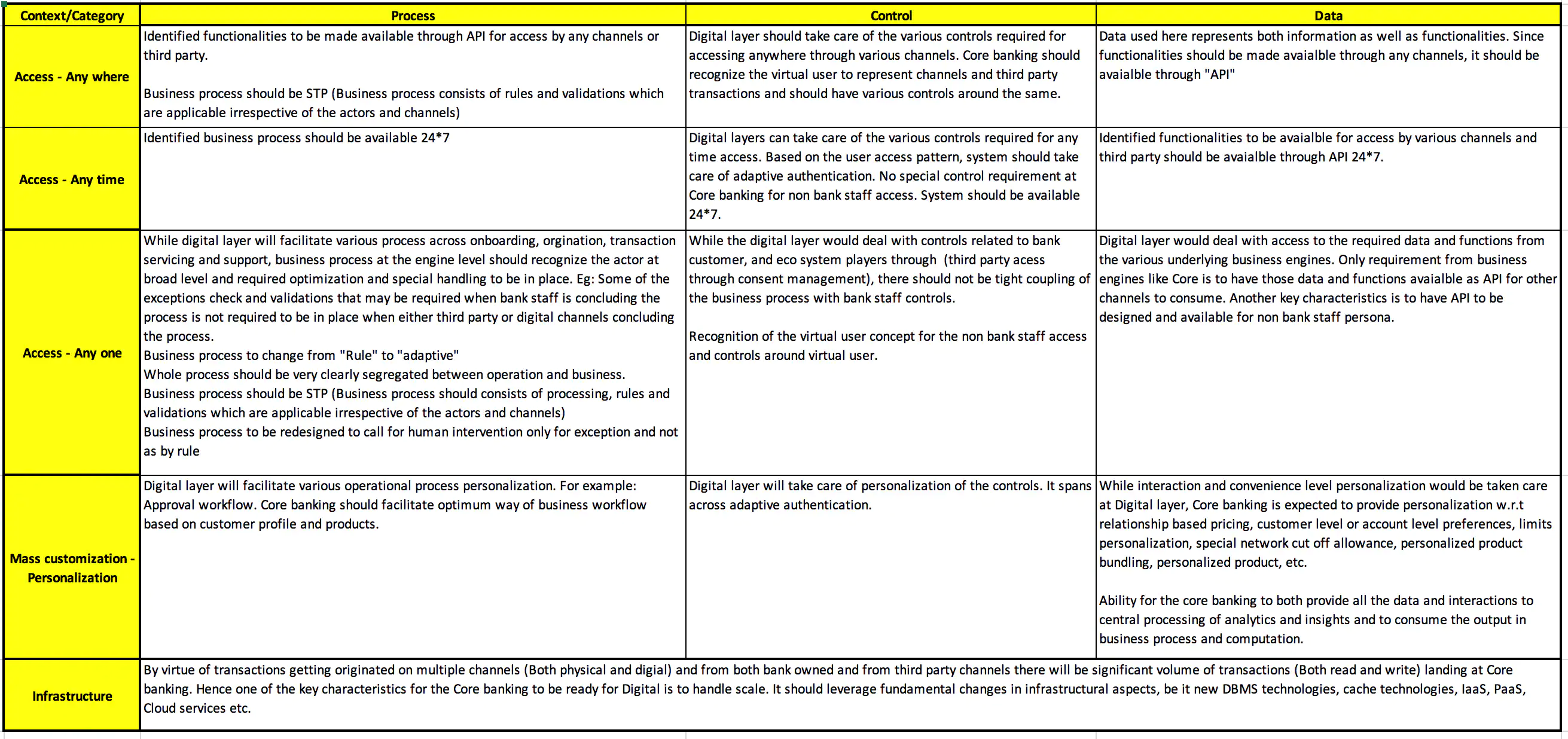

Truly digital is all about transformation spanning experience, engagement and business engine layers. Focusing only on enabling new channels or touch points is not enough. There are a set of basic characteristics that a Core banking solution must demonstrate to enable banks to achieve the intended results:

- Creating compelling customer experience

- Exploiting the power of core operations and

- Reinventing business models

This article describes some of the most critical basic characteristics across three dimensions for core transformation.

Before getting into the details, let us look at the change of context w.r.t

- Accessing banking services – (A)

- Infrastructure – (I)

- Mass production to mass customization – (M)

In short, it can be referred to as “A.I.M”. (Access, Infrastructure and Mass customization)

Accessing Banking Services

In the first phase of automation banking services were accessed

- At designated places like Branches

- At designated time like branch operation time and

- By designated people like bank staff (Teller, RM, Agent..)

In the next phase, which can be referred to as the “Access” phase, banking services were made available as

- Anywhere through various digital channels

- Any time through various Digital channels at user convenience

- Any one – Not only bank staff but also various bank customer persona like Retail and Corporate and third party through open banking. Literally “access” was provided to any one and of course with required controls and consent

| Phase | Where | When | Who | ||||

|---|---|---|---|---|---|---|---|

| Automation | Designated Places | Designated Time | Designated People | ||||

| Access | Any where | Any time | Any one |

Hence there is a fundamental shift of context from “Designated*” to “Any*”. This clearly carves out the path for the digital engagement layer to take care of personalized data, control and engagement and at the same time clearly emphasizes the significance of core banking.

Infrastructure

There is a considerable change in infrastructural aspects for computing power, storage, network, monitoring, IaaS, PaaS etc. Considering that transaction volumes are growing exponentially (both read and write), solutions like Core banking should leverage such infrastructures.

Mass Customization

Due to various factors and predominantly change in customer expectation, there is a shift from mass production to mass customization. From the bank’s perspective, this can also be referred to as “What I have” to “What you need”. It is a well-known fact that personalization is the key to achieving mass customization. Let’s have a look at how it plays out:

- Interaction: Favorites menus, frequently and recently used, themes, profile photo, etc.

- Content: inbox, date format, amount format, language preference etc.

- Convenience: Personalized reports, query template, favorite accounts, primary account etc.

- Functionality and control: Payment template, personalized limits, VAM etc.

- Product level: Personalized product offer based on real KYC, tailoring of the product, etc.

While personalization for interaction, convenience, control can be dealt with at the digital engagement layer, product, services and functionality-level personalization should be dealt with at the business engine level as well.

Based on these changing paradigms, business engines like core banking should have some critical attributes that are mapped below to the three dimensions of (A.I.M):

Conclusion

To realize the benefits of digital transformation, digitization is required across experience, engagement and business engine layers. For supporting digitization of core, it should exhibit a set of characteristics across three dimensions (A.I.M). To mention a few:

- APIs for required functions

- Rules for adaptive business process

- Business processes demanding human intervention only on exception

- Ability to consume relationship-based pricing

- 24*7 availability

- Ability to deal with volumes

- Core business process to be independent of actors and channels. Any specific handling required for actors to be dealt with separately

- Leverage various infrastructural aspects like new DBMS technologies, cache technologies, cloud services etc.

Is your core banking ready for Digital age? Does it exhibit these characteristics? Do share your views in the comments section below.

©2026 -Edgeverve Systems Limited | All rights reserved