Create Lasting First Impressions with Seamless Digital Onboarding

Finacle Digital Onboarding solution helps banks deliver seamless onboarding experiences across channels and devices. Its configurable workflows enable customer-centric, consistent, and fully digital journeys.

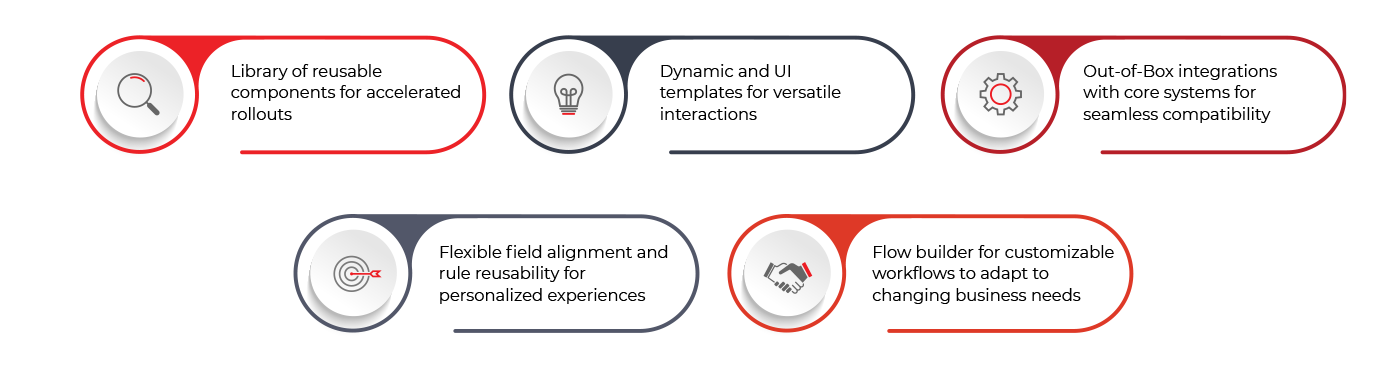

The solution is a cloud-native, multi-segment, and multi-product platform designed to transform customer experiences for retail, SME, and corporate clients. It features intuitive design tools and low-code capabilities, enabling seamless automation of end-to-end digital onboarding journeys. This solution integrates effortlessly with all related process capabilities, allowing financial institutions to customize workflows with ease.

Built on Finacle's fully composable and API-first platform, it empowers banks across 100+ countries to innovate swiftly and achieve exceptional customer engagement and operational efficiency.

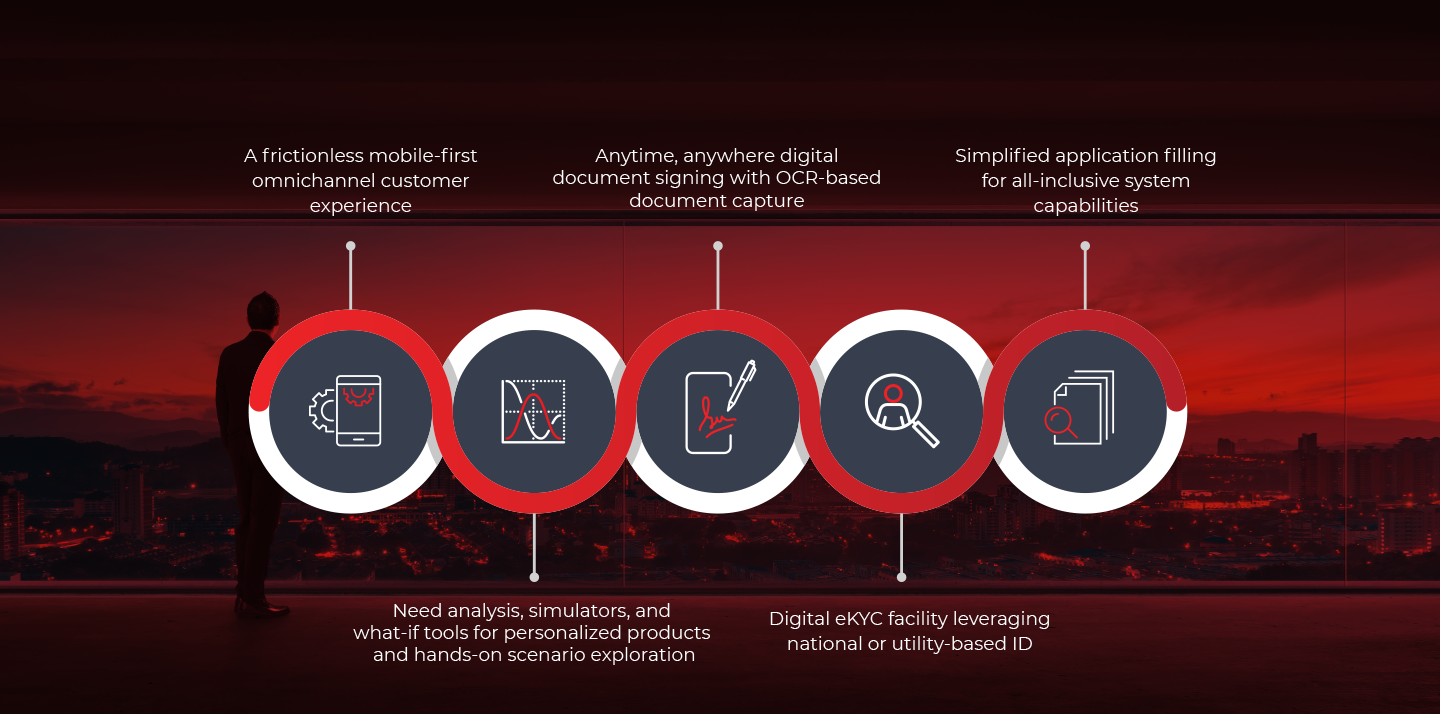

Crafting Exceptional Journeys for Lasting Customer Loyalty

Advanced Architecture

Discover how Rakbank enabled seamless Digital Onboarding for SMEs

Paperless online account opening in multiple currencies for both New to Bank and existing business entities via digital channels

Discover how Australian Military Bank revolutionized their customer onboarding process

Completing real-time identity, sanctions and fraud checks using Finacle APIs.

Empowering Banks with Enhanced Capabilities for Market Leadership

Learn how Pinang, Bank Rakyat fully automated loan processing

First bank in Indonesia licensed to offer Digital Lending as a service by the country’s Financial Service Authority

Offering fully automated loan processing, with eKYC and instant credit scoring

Unlocking Key Benefits for Superior Onboarding Experiences

- Maximizes customer satisfaction by offering a seamless, flexible onboarding journey that can be completed anytime, anywhere, on any device.

- Strengthens security and compliance with integrated digital KYC, biometrics, and automated decisioning for a streamlined yet secure process.

- Single, versatile platform supports diverse onboarding needs across retail, SME, and corporate segments, spanning products from deposits to loans.

- Boosts revenue potential by speeding up onboarding and minimizing drop-off points, ensuring customers move swiftly from application to activation.