One Platform. Endless Digital Possibilities.

Finacle Digital Engagement Suite enables banks to unlock Next-Gen Engagement with a unified, cloud-native platform, built for agility, scalability, and innovation.

A single platform to deliver hyper-personalized experiences across channels - mobile, web, branch, and beyond - for retail, wealth, business, and corporate banking customers.

With the industry’s first GenAI-powered UX Experience Studio, your bank can convert designs into live journeys within hours, using agentic AI. Backed by composable, headless architecture, LCNC tools, and a rich library of pre-configured journeys, the platform accelerates innovation with minimal friction.

Trusted by over 285 financial institutions, in 85+ countries, Finacle offers proven performance at scale in enhancing customer satisfaction, driving operational efficiency, and unlocking new revenue streams. From digital onboarding to digital self-service to intelligent lifecycle-based engagement, Finacle equips banks to stay ahead in a hyper-competitive, experience-driven world.

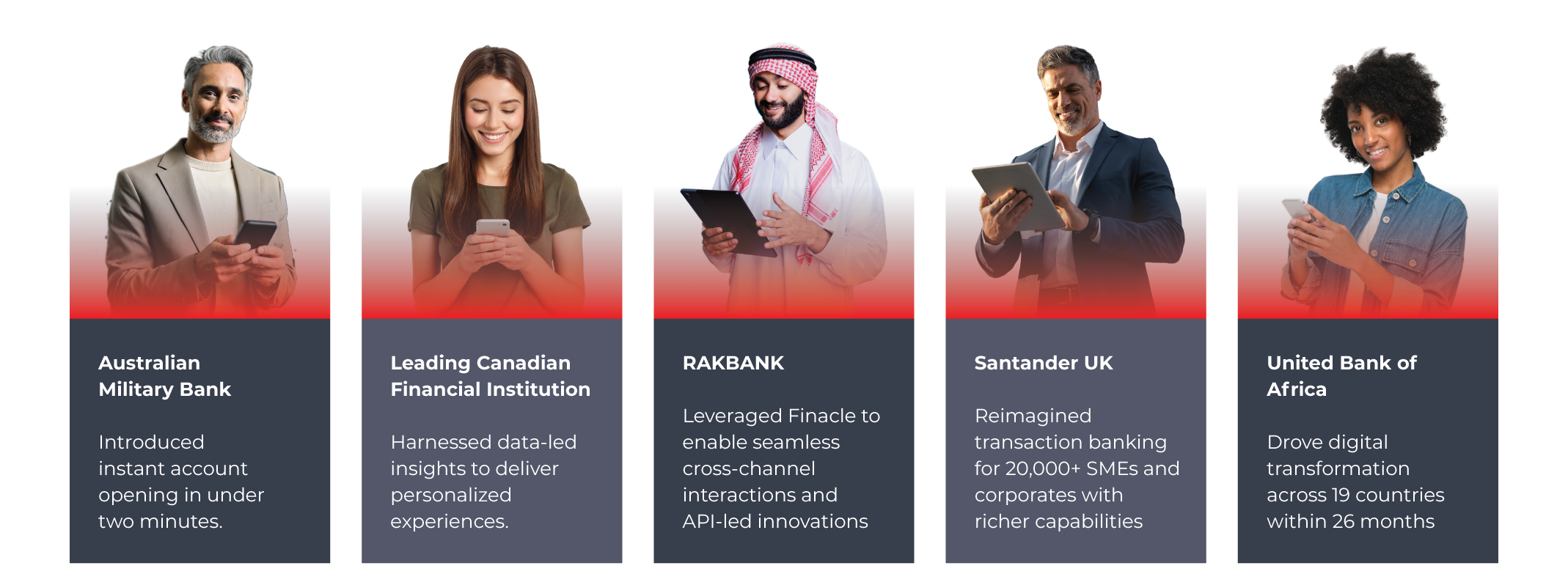

The world’s most innovative financial institutions choose Finacle

Experience the New Standard in Digital Banking

What Makes us Unique

5 pillars of the Finacle Advantage

Industry's first AI-First Experience Studio

- Unparalleled UX Flexibility

Deliver fully customized journeys with a headless, composable architecture and pre-built app experiences.

- Intelligent, Lifecycle-Driven Engagement

Use real-time insights and embedded AI to drive contextual nudges across acquisition, growth, and retention stages.

- Speed of Innovation at scale

Fast-track innovation LCNC tools - supported by continuous feedback loops from live usage.

"’....Through our Digital Banking Transformation, we have sought to fundamentally improve the Customer Experience of our digital everyday banking offerings for existing and future customers. Our partnership with Infosys Finacle has enabled us to leverage their leading digital capabilities to build an exciting digital banking experience for our customers.”

- Greg O’Leary,

Program Director, Digital Banking, Permanent TSB

Omnichannel Journeys for all Segments on One Unified Platform

- Unique Omnichannel Hub

Orchestrate journeys across customers, employees, and partners with seamless integration via APIs

- Build for Every Segment

Access 4,500+ pre-configured features across Retail, SME, Wealth, and Corporate banking

- Device-independent, Consistent Experiences

Powered by BFF architecture to ensure design flexibility with zero compromise

"...Finacle Conversational Banking and Remote Banker, we can now tap into the growing prominence of social media in everyday life. We expect this simple and convenient form of banking to add immense convenience to our customers and hope to see its rapid adoption in the months to come."

- A. Manimekhalai,

Managing Director & CEO, Union Bank of India

A Next-gen / Future-Ready Architecture

A future-ready foundation to power digital transformation

With the persistent support of the Infosys management and the robust Infosys Finacle digital banking suite, BRI’s vision of accelerating Indonesia’s financial inclusion is one step closer.

- Kaspar Situmorang,

EVP Digital Center of Excellence | Bank Rakyat Indonesia

Ecosystem Advantage

- Accelerate Innovation

Launch new solutions in days using the intuitive LCNC tools and the Finacle App Center

- Leapfrog with Embedded Finance

Effortlessly integrate fintech innovations and partner services using RESTful APIs to unlock new revenue models

- End-to-End Trusted Expertise

Leverage deep transformation capabilities, with robust post-implementation support, consulting services and Finacle's global SI ecosystem

"...Our partnership with Infosys Finacle exemplifies our dedication to continuous improvement and our relentless pursuit of innovation.. Together, we are poised to revolutionize the way our customers interact with our bank, providing them with greater convenience, flexibility, and efficiency.

- Peter Robert,

Chief Operating Officer, RAKBANK

Client Success

Recognized as a Leader

The Forrester Wave™: Digital Banking Engagement Platforms, Q3 2021

"EdgeVerve stands out with a rich application architecture and delivery options… In addition to a host of rich functional, technology, and architecture enhancements, the solution’s well-defined roadmap also features many differentiators, such as hyperscalable APIs and machine learning and deep learning for security purposes… The solutions offer very broad and rich retail, business, and corporate banking capabilities… solution’s application architecture is well defined, offers banks a variety of delivery options in the cloud, and continues to stand out for its preventive maintenance service… EdgeVerve is a strong fit for banks that seek an advanced solution without any significant gaps and a product roadmap promising a similarly advanced solution in the future…"

- Jost Hoppermann, VP and Principal Analyst, Forrester